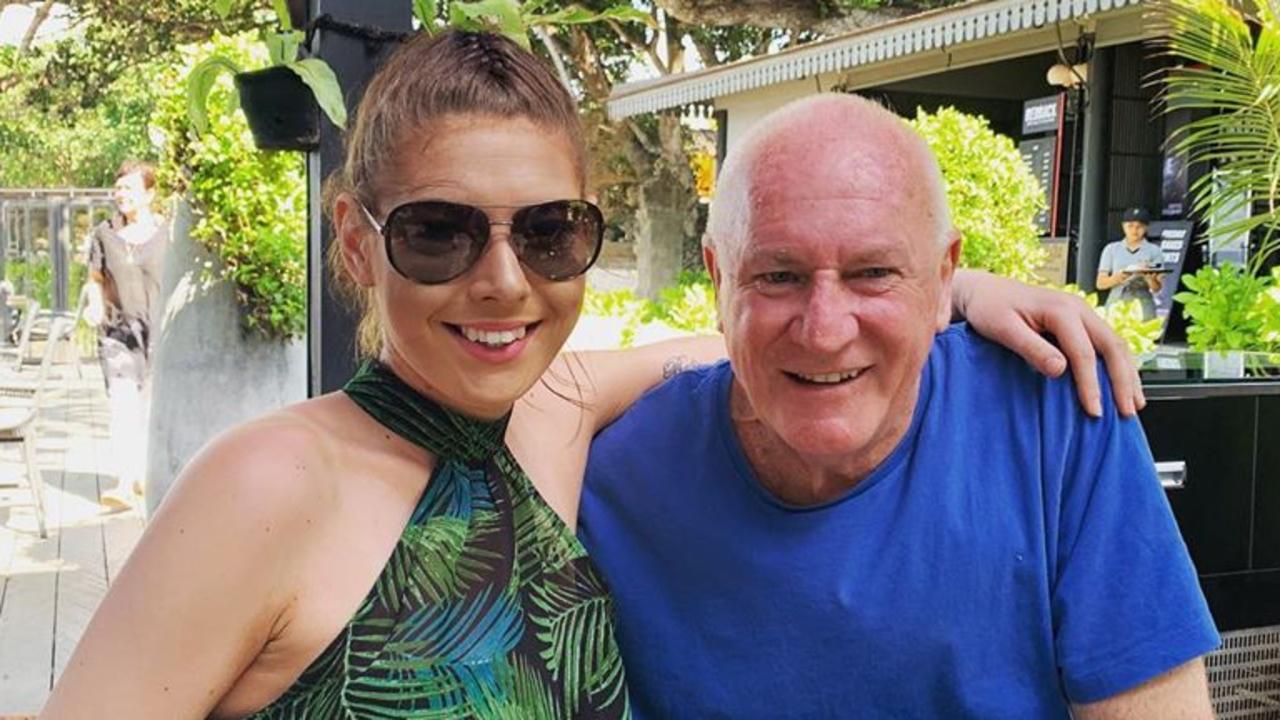

Magistrate Rodney Higgins wins late fiancee Ashleigh Petrie’s super death benefit

A magistrate who made headlines over his relationship with a law clerk 45 years his junior has claimed her $180,000 super death payout.

A magistrate who was involved in a scandal-ridden relationship with a significantly younger court clerk who tragically died shortly after their engagement, has won her $180,000 super benefit.

The Herald Sun reported this week that Victorian magistrate Rodney Higgins had successfully claimed his late fiancee Ashleigh Petrie’s super death benefit despite the 23-year-old’s mother being the nominated beneficiary.

The couple made headlines in 2019 over their unconventional romance, with Ms Petrie, a court clerk who was 45 years Mr Higgins’ junior, tragically being killed after being hit by a car in October that year.

The pair had only recently become engaged during a trip to Fiji, with magistrates across Victorian courts being warned over inappropriate relationships with judicial officers.

Ms Petrie’s mother is now fighting to receive her late daughter’s death benefit from her superannuation fund after Mr Higgins secured the payout from Rest Super as her de facto partner.

The decision is currently the subject of an appeal before the Australian Financial Complaints Authority and the funds have not yet been paid.

A spokesman for Rest super said that while they could not comment on the specifics of Ms Petrie’s case due to privacy, super funds were bound by laws which govern how death benefits are paid.

“Rest has every sympathy for Ms Petrie’s loved ones and all those grieving her tragic passing,” spokesman Michael Mills said.

“In general terms, when a member dies, super funds are required by law to pay the member’s death benefit to a dependent or a legal representative, such as an estate.

“A super fund can only consider paying someone else if they can’t locate either a dependent or estate.

“The process of paying a death benefit can involve contested claims and disputes between potential dependants.

“Rest always endeavours to handle situations like these with the utmost sensitivity and sympathy.”

The revelation has sparked outrage on social media and shone a spotlight on the often confusing area of superannuation law.

Wills and estates specialist Emma Blay, with Barry Nilsson Lawyers, said she often advises in succession planning who were in the dark about how super death benefits were paid out.

Under superannuation law, if a member of a super fund creates a death benefit nomination in favour of a person who does not fit the definition of a ‘dependent’, the super fund trustee has the discretion to determine who will receive the payout.

“I’ve seen situations where clients have made nominated a parent, friend or a niece or a nephew, as the beneficiary of their superannuation, without knowing that those people do not fall within the definition of a dependent, and the nomination is, in fact, invalid. Often the super fund will not inform the person that this is the case,” Ms Blay said.

According to superannuation law, a dependent is the spouse of the person, any child of the person and any person with whom the person has an interdependency relationship.

Ms Blay said in cases where a person did not have any dependants, superannuation can be paid to their legal representative, with the recipient of the payment being determined by the terms of their will.

“There seems to be real tendency for super funds to pay superannuation to a dependent rather than a person’s legal personal representative (their estate). So it is more likely than not, in circumstances where there is no valid nomination and a dependent exists, the super fund trustee is going to pay the superannuation to that dependent. This is why it is so important to a valid binding nomination and Will,” she said.

She said clients were often not aware that nominations usually lapse after three years and therefore become invalid.

“Again, in those cases, the trustee of the super fund has the discretion as to who to pay it to. Often this can have inequitable consequences, and sometimes it may be the case that someone the deceased did not intend to receive the superannuation, but fits the definition of a dependent, receives the payout,” she said.

What can you do?

Ms Blay advised super fund members to consider their superannuation at the same time as they prepare their Will. It is also wise to consider relationship status and whether specialist advice is necessary to ensure assets, like superannuation, end up where intended upon death.

Additionally, if a person does not have any dependants (under superannuation law) or a number of dependants who would seek to claim their superannuation, a person should consider nominating their estate as the beneficiary under the binding nomination, so as to have certainty as to who would receive the funds in accordance with their will.

Talking to an estate planning expert can also help in identifying if a person’s nomination is invalid.

Time for change?

Ms Blay said changes in policy and possible reform could take away of the overwhelming control super funds currently hold over distribution of superannuation benefits.

“I think there needs to be an obligation on super funds to require members to put a binding nomination in place and alert them when they have completed a nomination which is invalid. In some cases, superannuation (and insurance) are a person’s most significant asset,” she said.

“If super funds were obliged to require members to put valid nominations in place and had a policy to alert members when their nominations had lapsed (or were invalid), the trustee would not have such unilateral decision-making power.”