How much superannuation you need at age 30 to be better off in the future

There’s an amount you need in superannuation to lead a “comfortable” life in retirement and many need to save a lot more to get there.

When you’re young and have a heap of time until retirement, it’s easy to fall into the trap of thinking super is tomorrow’s problem and something not worthy of much of your attention today.

But the reality is, give your superannuation a little bit of love through some small tweaks today, and you can be better off by hundreds of thousands in the future.

How much should you have in your super?

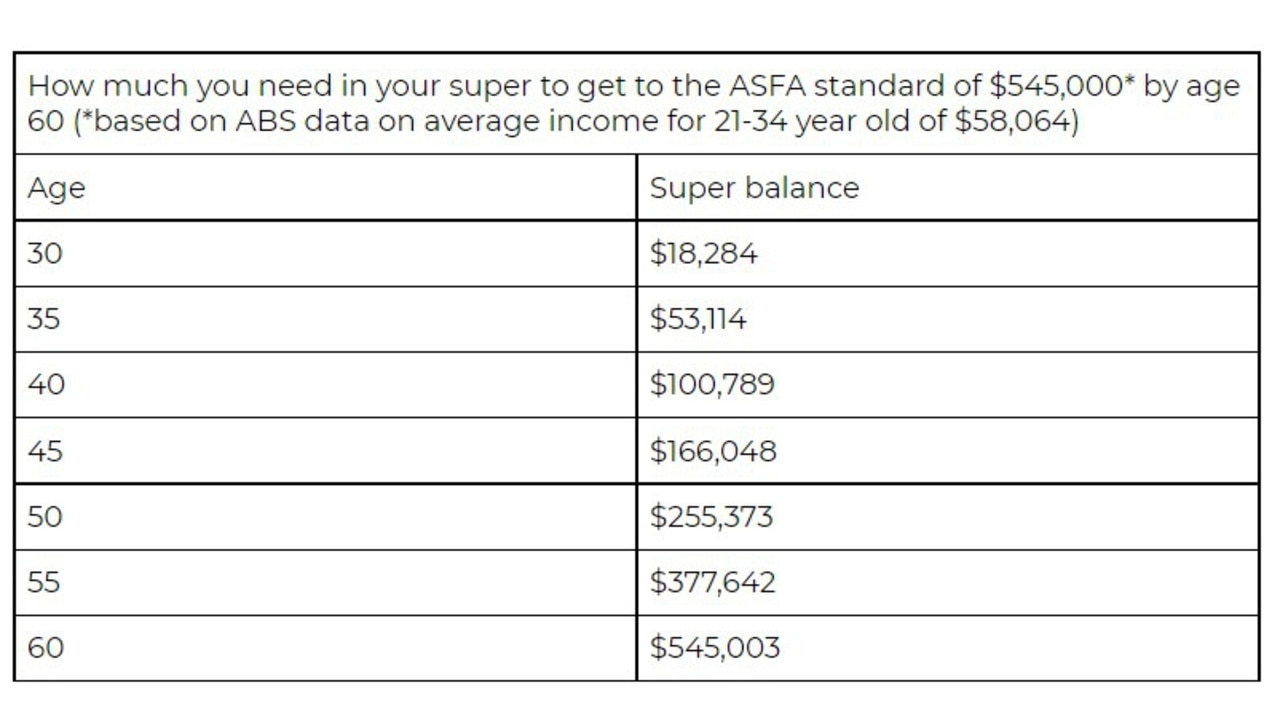

Based on the super fund statistics from the Association of Superannuation Funds of Australia (ASFA), an individual needs to have $545,000 in their super at age 65 ($640,000 if they’re a couple) to provide an annual income of $44,818, a figure they say will allow you to live a ‘comfortable’ standard of living in retirement.

Recent statistics from ASFA show that the average super fund balance for people aged 30-34 is $58,035 for males and $45,968 for females.

If you want to build your super from this level to $545,000 (or even if you have a bigger target in mind), you need to save a certain amount today to get there.

With lots of time on your side it’s all possible, but if you wait a month, a year, five years, or longer to get started, you’ll need to save more and more to get there.

Get Cashed Up

Created by financial advisor Ben Nash, Cashed Up is a free six-week course to help Aussies get their finances in check. Those who sign up to the budget bootcamp get weekly, step-by-step challenges to improve their financial fitness.

By the end of the six weeks, participants will have set a budget, created a savings plan, learned how to invest, and sorted their superannuation. The interactive course can be started at any time and aims to empower participants to make more informed financial decisions.

How to build up your super fund

No matter what your number is, the sooner you start the easier the path to get there will be. The implication is that making the right moves with your super today will make your life easier in the future.

In addition to pumping your super savings strategy, there are a few hacks and strategies you can use to accelerate your super progress if you know how to use the rules to your advantage.

Consolidate your super

It’s pretty common to have more than one super fund, often collected from multiple employers over time. If you have more than one super account, you could be doubling up on fees and insurance premiums, both of which will drag down your super fund growth.

It’s important to note that you probably shouldn’t rush out and make changes to your super before doing your research, you don’t want to lose out on benefits like insurance or create tax implications without being across the details.

But, for most people choosing one super fund that’s aligned with how they want to invest, making sure your super fees are reasonable and value for money, and then using that as the primary (or only) account to grow your super wealth can make a lot of sense.

Salary sacrifice and tax deductible super contributions

The government wants you to have a good super nest egg (partly because it reduces your reliance on government benefits like the age pension) so they have some perks that incentivise you to contribute to your super.

One of these is ‘salary sacrifice’ where you can ask your employer to put part of your pay cheque into super, which because of the rules they’re able to take this money out before they deduct your income tax, then you only pay tax on your income after the super contribution is factored in. With marginal tax rates of at least 32.5 per cent for anyone earning more than $45,000, this means that you only feel around two thirds of any amount you choose to salary sacrifice to super.

Ask your employer if this is something available to you, and if not don’t stress – the government has recently changed the rules to allow you to make super contributions directly from your bank account and then claim a tax deduction.

Contributing part of future pay rises to super

If salary sacrifice isn’t something you think you can manage in your budget today, think about directing a proportion of future pay increases to your super. If you increase your super contributions as your income increases, you won’t even really feel the cost of these because you’re only doing this when you start getting paid more money.

Using a low cost super fund and value for money fees

Low fees aren’t the only important thing when it comes to choosing a super fund, but fees are a big driver of your returns over time. These days the super fund market is very competitive, meaning there are a stack of good quality, low cost super options that might make sense for you.

Take the time to do your research on how your super fund compares to the market, making sure you’re getting good value for the fees you are paying. If not, look at what other funds out there have good investments and charge low fees – just make sure you know what you’re looking at so you compare apples with apples.

The wrap

Superannuation can seem like something that’s complicated and confusing, and something you only need to worry about in the future. But given your super is likely to become one of your biggest assets over time, it’s worth taking the time to get this right. Your future self will thank you for it.

Written by Ben Nash, finance expert commentator, podcaster, financial advisor and founder of Pivot Wealth, author of the Amazon best-selling book Get Unstuck: Your Guide To Creating A Life Not Limited By Money.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.