Aussies who withdrew $20,000 super have lost $100,000 towards retirement

It may have seemed like a good idea at the time, but a $20,000 government scheme could cost hardworking Aussies $100,000 in the long run.

When Prime Minister Scott Morrison announced that Australians could withdraw up to $20,000 from their superannuation accounts at the height of the Covid pandemic last year, millions quickly took advantage of the scheme.

In theory, the super withdrawals scheme was intended to be another form of a safety net for pandemic-impacted workers. Working alongside a boosted rate of JobSeeker payments and the Government’s then newly minted JobKeeper program, it was meant to provide support for Australians who fell through the cracks or required greater levels of assistance.

In some cases the withdrawals were used for their intended purpose, but data from analytics firms Alpha Beta and Illion suggest that this was the exception, rather than the rule.

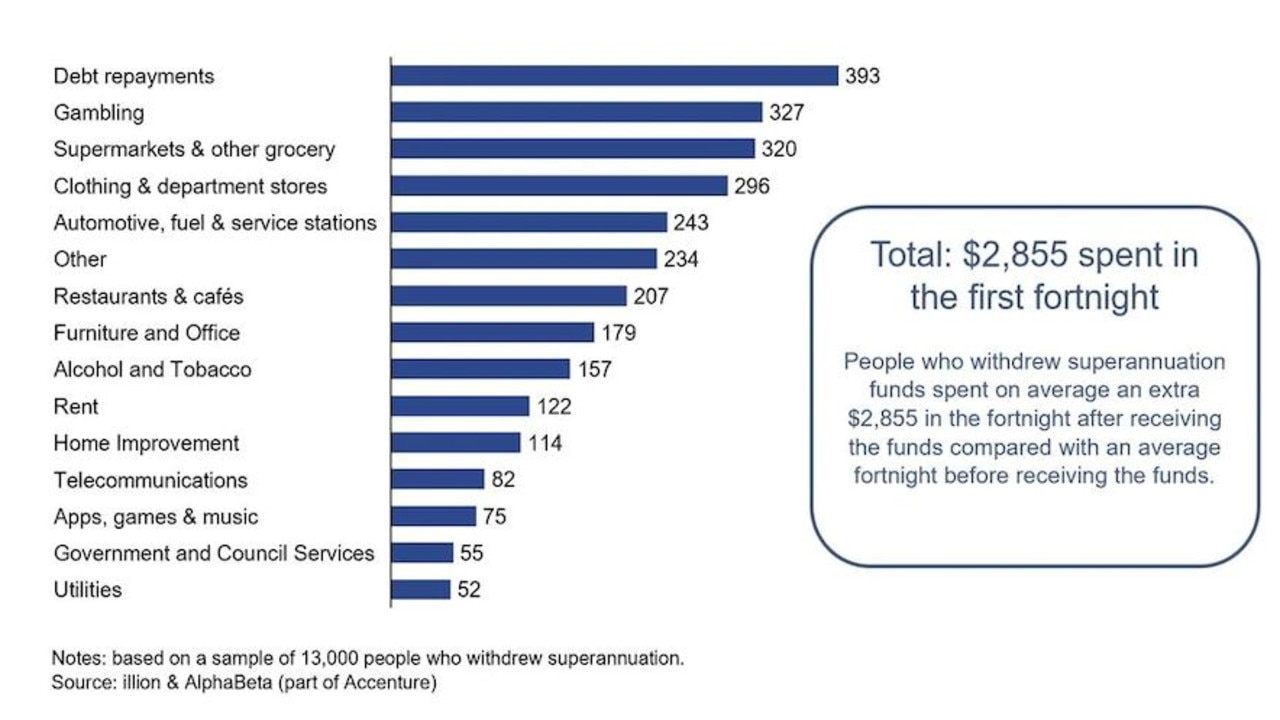

On average of the additional $2855 in fortnightly spending made by those who withdrew funds from their super in the early months of the program, less than 20 per cent was directed towards utility bills, rent or debt repayments.

Instead much of the withdrawals were directed toward discretionary spending, with gambling the second largest recipient for super withdrawal funds after debt repayments.

RELATED: ‘No idea’: Sign Aussie economy is doomed

RELATED: How Aussies flushed $3000 down the toilet

It’s not just the local Dan Murphy’s and TAB that have benefited from the more than $36 billion that Australians have cumulatively withdrawn from their super.

According to figures from research firm Digital Finance Analytics (DFA), 22 per cent of first homebuyers who have purchased a property in the last six months did so with a deposit at least partially made up by withdrawals from their superannuation. A further half of those withdrew the maximum $20,000 from their super over the course of the policy’s two rounds.

According to an analysis from the Australian Institute of Superannuation Trustees, it is estimated one million workers under the age of 35 had either closed their super accounts or had less than $1000 left.

Unfortunately for many of the Australians who withdrew super in the first round of withdrawals in the 2019-20 financial year, it came at the worst possible time.

At that moment financial markets were still reeling from the market crash of February and March, which had seen stock prices and the balances of super accounts plummet.

Now as super funds survey their results for the 2020-21 financial year, the near-record median returns of 18 per cent across growth funds may be proving quite stinging for those who withdrew a sizeable sum from their retirement savings.

Some may regret withdrawing super in long run

For those who withdrew their super for its originally intended purpose of providing a much-needed safety net, this decision no doubt remains money well spent.

But for others who spent a sizeable chunk on discretionary spending such as alcohol, gambling and clothing, the decision may not be so well regarded in hindsight.

As for how much withdrawals ended up costing Australians in their retirement, it depends on what age the withdrawal occurred and who you ask.

According to figures provided by Shadow Assistant Treasurer Stephen Jones, “a 25-year-old who withdrew $20,000 will be between $80,000 and $100,000 worse off in retirement”.

“A 35-year-old who withdraws $20,000 will be at least $65,000 worse off,” Mr Jones said.

An analysis by Industry Super Australia concluded that a $20,000 withdrawal could cost a 30-year-old $100,000 at retirement, and a 40-year-old $63,000.

RELATED: Terrifying prediction for mortgage payers

Important to plan for retirement years

While it’s important to keep in mind that these numbers are estimates and there is a list of variables as long as your arm, the fact remains that super withdrawals may prove to be a sizeable blow to the retirement prospects of Australian workers, particularly those on lower incomes.

According to a report from the Federal Government’s Retirement Income Review panel, the median age for paying off a mortgage has risen from 52 in 1981 to 62 in 2016.

With 12 per cent of homeowners over the age of 65 still holding mortgage debt as of 2015, there is a growing need for retirees to look to their superannuation to ensure they enter their golden years debt-free.

As housing prices continue to rise, a healthy super balance is becoming more important ever for the retirement of first homebuyers who are not entering the market until an average age of 36.

With lockdowns in Victoria, NSW and South Australia further clouding the already uncertain future that lies ahead, it’s challenging to quantify exactly how much the Morrison Government’s super withdrawal program will cost those who took part in the long run.

For some Australians, super withdrawals were a much-needed lifeline, for others a tool to further goals of home ownership and for some, a lotto-like windfall that was spent accordingly.

In the short-term the cost may have seemed like it was one worth paying, but in the decades-long path to a secure retirement, things may look quite differently.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator