Sign Aussie interest rate hike could happen sooner

Our economy hinges on interest rates not rising for 18 months but there’s increasing worry no one has a clue what will actually happen.

As the RBA continues to insist that rate hikes are not coming “for at least three years”, the reality is arguably quite different.

In the words of New Daily columnist and economic commentator Alan Kohler: “The RBA has absolutely no idea what’s going to happen. Nobody does.”

We are in entirely uncharted waters, with a highly distorted financial system and economy. All supported by $4 billion a week in RBA bond purchases and a predicted federal deficit of almost $2 billion per week.

It’s possible we could see inflation rocket higher than the RBA forecasts, forcing rate hikes years earlier than anticipated due to supply chain driven inflation and a much tighter labour market than expected.

However, it is also possible that the global economy could struggle badly as the Chinese economy slows and the last of government stimulus feeds through the system toward the end of the year. That may even see the RBA cut the cash rate to 0 per cent or perhaps even to negative interest rates.

The truth is we don’t know and it may pay to expect the unexpected.

What does transitory inflation actually mean?

From Australia’s own Martin Place, to halls of the United States Congress, there is one word central bankers are overwhelmingly using to describe the ongoing rise in inflation — “transitory”.

The almost universal consensus among central bankers of the Western world is the current inflationary pressures are transitory – temporary and will pass – therefore justify not raising interest rates for years to come.

Broadly speaking, economists generally agree it will be at least 18 months before we begin to see rate hikes. But there is rather large elephant in the room.

Does it mean six more months of rapidly rising prices well above central bank inflation targets? Nine months? Or even longer than that?

So far it’s a question that central bankers have generally remained tight lipped on, allowing themselves quite a lot of scope to shift their commentary, due to the ambiguity of how they define the word “transitory”.

RELATED: Looming disaster in Aussie housing market

But central banks aren’t the only players in setting interest rates for credit markets and mortgage borrowers. If down the road, global bond markets run out of patience with promises that inflation is temporary, they could then force up borrowing costs for banks and mortgage holders all on their own.

And there are a number of forces that may keep higher inflation around for longer than central bankers expect.

Supply chain issues for longer

In decades gone by, companies once had vast warehouses filled with stock to ensure that their commitments to retailers or suppliers could be met.

But in an age of global trade defined by the “just in time” business model, all of a sudden many companies have found themselves without the raw materials and finished products required to meet demand.

After tens of trillions of dollars were pumped into the global economy over the past year, it is perhaps unsurprising that manufacturers, logistics companies and the maritime freight industry are buckling under the strain.

The current global manufacturing and logistics network is simply unable to cope with the current demand and there are no quick or easy fixes.

In the Pearl River Delta anchorage located south of Hong Kong and the Chinese megacity of Shenzhen, there are currently more container ships waiting to dock than during the height of the impact of the pandemic on China back in February last year.

RELATED: China photo reveals impending disaster

As a result of these factors and an outbreak of the Delta coronavirus variant in Southern China, the cost of shipping has skyrocketed to all time record highs.

For example, in mid-2020 it cost under $2,600 to ship a 40ft container from Shanghai to Rotterdam, today it costs more than $16,300.

It’s a similar story for shipping from China to the western United States, with a 40ft container from Shanghai to Los Angeles rising from around $2,600 in Q3 2020, to $15,820 today.

According to reports some companies are being charged as much as $26,800 for container loads booked from China to the western United States at the last minute.

Immigration, inflation and rate hikes

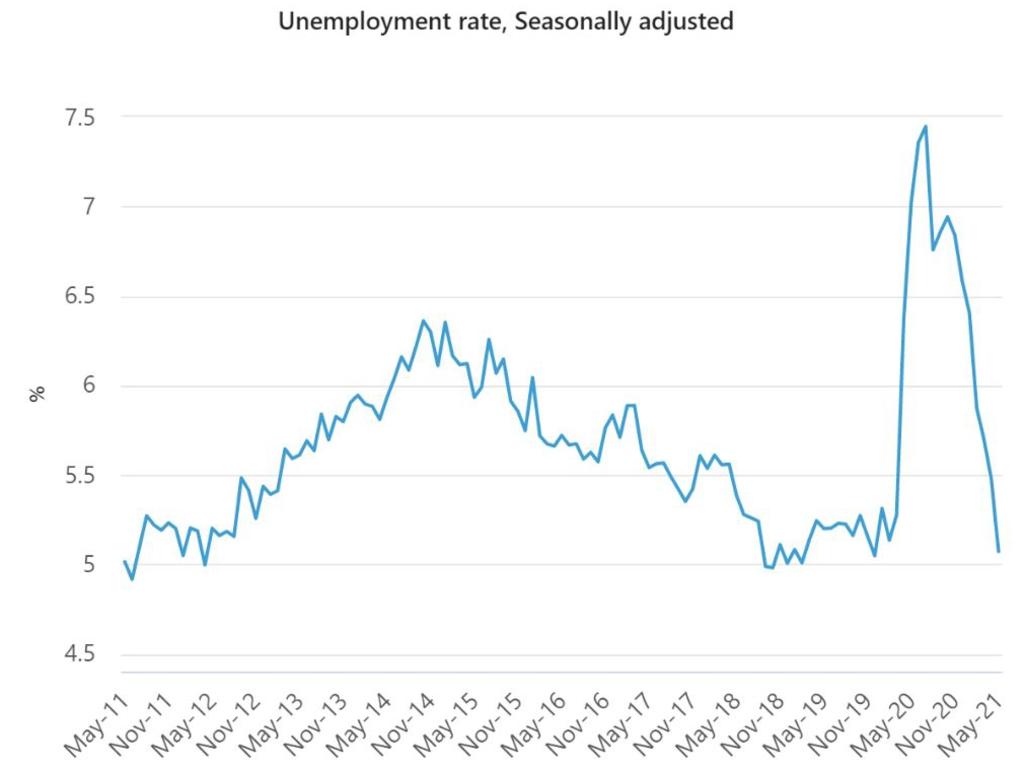

When Treasurer Josh Frydenberg handed down the federal budget back in May, it included a forecast that unemployment would remain at 5 per cent at the end of the 2021-22 financial year.

However, when the ABS released the May unemployment figures a few weeks ago, Australians were given a pleasant shock. The nation’s unemployment rate came down by 0.4 per cent in just a single month, to sit at 5.1 per cent, almost achieving Treasury’s forecasts before the 2021-22 financial year had even begun.

RELATED: Sign Australia is heading for disaster

While there are a number of different factors that have contributed to the labour market recovery, such as government stimulus and ironically closed borders, there is one other major factor that could push the nation’s unemployment rate head toward historic lows – low immigration.

With the international borders now closed for more than 15 months, Australia’s pool of available labour has shrunk significantly. Between Australians and temporary visa holders leaving the country permanently, and reversing net international migration, there are more than one million fewer people in Australia than there would have been without the pandemic.

Even after removing those who are not of working age, not allowed to work or not in the labour force, the reduction in the size of the nation’s labour pool remains a defining driver behind the strong labour market recovery.

If the unemployment rate continues on its trend toward a rapid decline, we may see upward pressure build on wages before international borders reopen sometime in mid-2022.

With the RBA forecasting relatively weak wage growth for at least the next few years, the shock of wage growth above their estimates could place upward pressure on interest rates.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator