How Australia’s border closures have impacted house prices

House prices are rising by $1266 a day in places like Sydney but there’s on huge factor that could see the Aussie housing bubble burst.

When Prime Minister Scott Morrison ordered the effective closure of Australia’s borders on March 19 last year, concerns swiftly began to build about how the property market would fare as a result.

Looking at the numbers, it’s easy to understand why some forecasters were expecting home prices to fall up to 32 per cent.

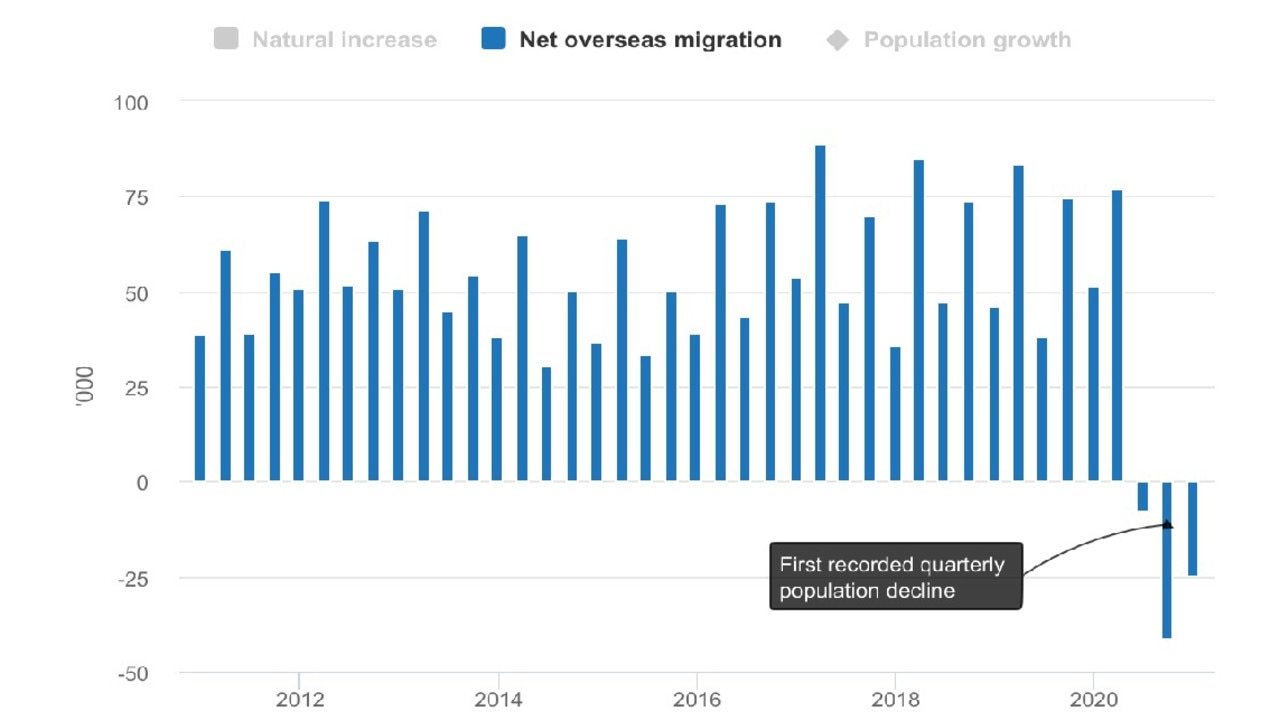

Over the past decade in any given year, Australia welcomed an average of more than 200,000 new migrants to our shores, many of whom would go on to become homeowners. But since the pandemic arrived in Australia, migration has not only flat lined, but outright reversed.

RELATED: Terrifying prediction for mortgage payers

RELATED: Sign Australia is heading for disaster

Between April 1, 2020 and December 31, 2020, net migration was -73,900, as far more Australians left permanently than migrants arrived.

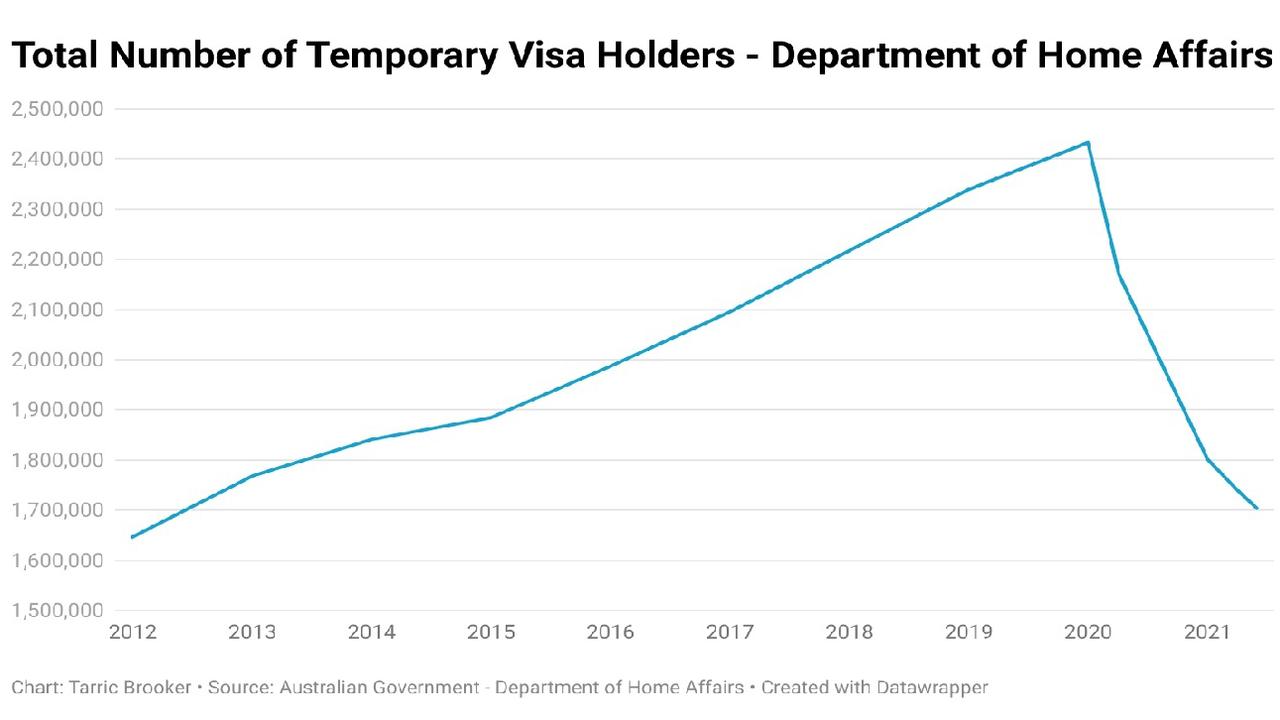

Meanwhile, the number of temporary visa holders (international students, skilled workers, etc) currently in Australia has plummeted by over 700,000 since reaching its seasonal peak in December 2019.

Based on the average household size of 2.6 persons, the combination of reversing net migration and a mass exodus of temporary visa holders reduced total housing demand by around 375,000 homes, compared with where it would have been without the pandemic.

While it could certainly be argued that migrants generally live in larger than average households, the fact remains that their collective absence has reduced demand for homes significantly.

However, despite this drop off in overall market participants, housing prices relatively swiftly arrested their pandemic-induced falls and really began to take off nationally at the start of this year.

Drivers of the boom

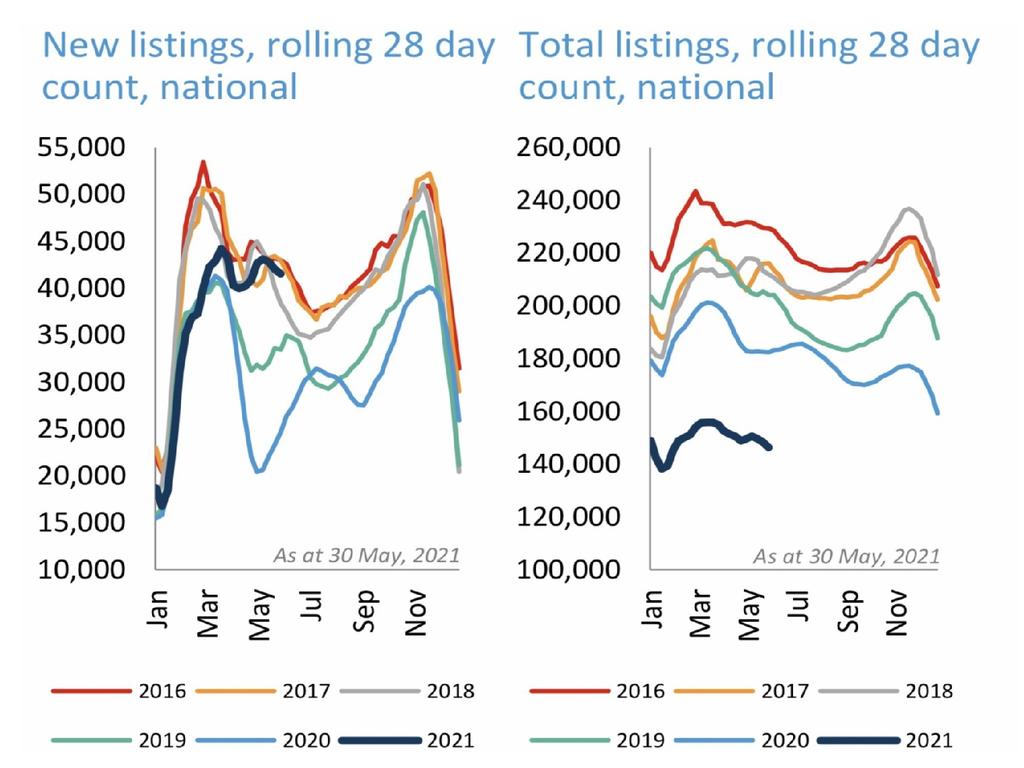

Through a combination of low levels of housing stock on the market, low interest rates and pandemic-driven demand, the issues of a lack of temporary migrants and new Australians coming to our shores rapidly found itself in the rear view mirror.

RELATED: ‘56 per cent increase’: Scary mortgage prediction

However, quantifying how much each of those respective factors is driving the currently booming housing market is far more challenging.

And this arguably matters quite a lot.

If low rates are the overwhelming driver of the current demand for housing, then the boom may have quite a while still yet to run. After all, despite the prospect of rising rates on the horizon, they are not going back to 2019 levels in the immediate future.

But if the current demand is driven by a temporary rush of buyers due to pandemic driven factors such as working from home, wanting space away from family or housemates or an exodus from the city, then the boom may have a significantly weaker future in the long term.

That’s not to say that these factors won’t continue to play a major role in the decision making of prospective home buyers, they certainly will. But we are arguably at or near the peak of the impact of these market forces, as those with the means to buy a home are doing so now.

Less market participants long term = lower demand?

With the recent announcement by Prime Minister Scott Morrison that the total capped number of arrivals to Australia would be cut by half, it was made abundantly clear the government is set to continue its ‘Fortress Australia’ strategy for the foreseeable future.

This move was also backed by multiple state premiers and federal Opposition leader Anthony Albanese, signalling bipartisan support for Australia remaining relatively closed off from the rest of the world.

With the housing market already down more than 1 million participants since March 31 last year and the nation’s international borders to remain closed until around mid-2022, that figure will only continue to grow relative to where it would be without the pandemic.

Meanwhile, according to the ABS building approval figures, the number of houses being built is at all-time record highs and overall dwelling construction is a stone’s throw from its late 2017 peaks.

However, unlike late 2017, we won’t be welcoming more than 238,000 new Australians to our nation in the coming year. The recent federal budget is instead forecasting that net migration will again reverse during 2021-22, with a net number of 77,400 Australians expected to leave.

For AMP chief economist Shane Oliver, there is rising concern that weak population growth due to low immigration could drive a slowdown in the housing market.

In a recent market update, Mr Oliver forecast that housing price growth would slow down to around 5 per cent in 2022, ahead of a roughly 5 per cent decline in prices for 2023.

Not all cities are equal

As the uncertainty of the long term future of the housing market continues to build, not all cities or regions will experience the same impact from lower immigration.

With the pandemic fresh in the minds of many Australians, both Victoria and New South Wales have seen an exodus of residents to other states. During 2020, in net terms Victoria lost 12,737 residents and NSW around 19,000.

Meanwhile, the ‘Sunshine State’ of Queensland gained 30,000 new residents from interstate.

Given Victoria’s reliance on population growth for both economic growth and demand for housing, another year of closed international borders and Victorian’s leaving for sunnier skies, Melbourne would in theory be the capital city the hardest hit by the ‘Fortress Australia’ strategy.

Where to from here

For now at least, it appears that the lack of more than 1 million housing market participants compared with a scenario without the pandemic is not having a major impact. Prices continue to rocket on strong demand and rising levels of investor activity in the market.

But how the market will fare in the long run, the outlook is far more cloudy.

With prices rising rapidly and prospective home buyers unable to keep up with housing prices rising by $1266 a day in places like Sydney, how the balance of supply and demand will look for the market in a year is anyone’s guess.

While it’s possible that we could see lower immigration starting to impact the housing boom in the next 12 months, if the borders reopen more quickly than expected, we could see a rush of foreign buyers looking to enjoy our relatively trouble free shores.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator