Interest rates rise will trigger skyrocketing mortgages in Australia

It’s a scenario many homeowners can’t imagine but if interest rates rise it could push average Aussies into mortgage stress.

In the past five decades the conditions underpinning Australian mortgages and the property market more broadly have been extremely varied.

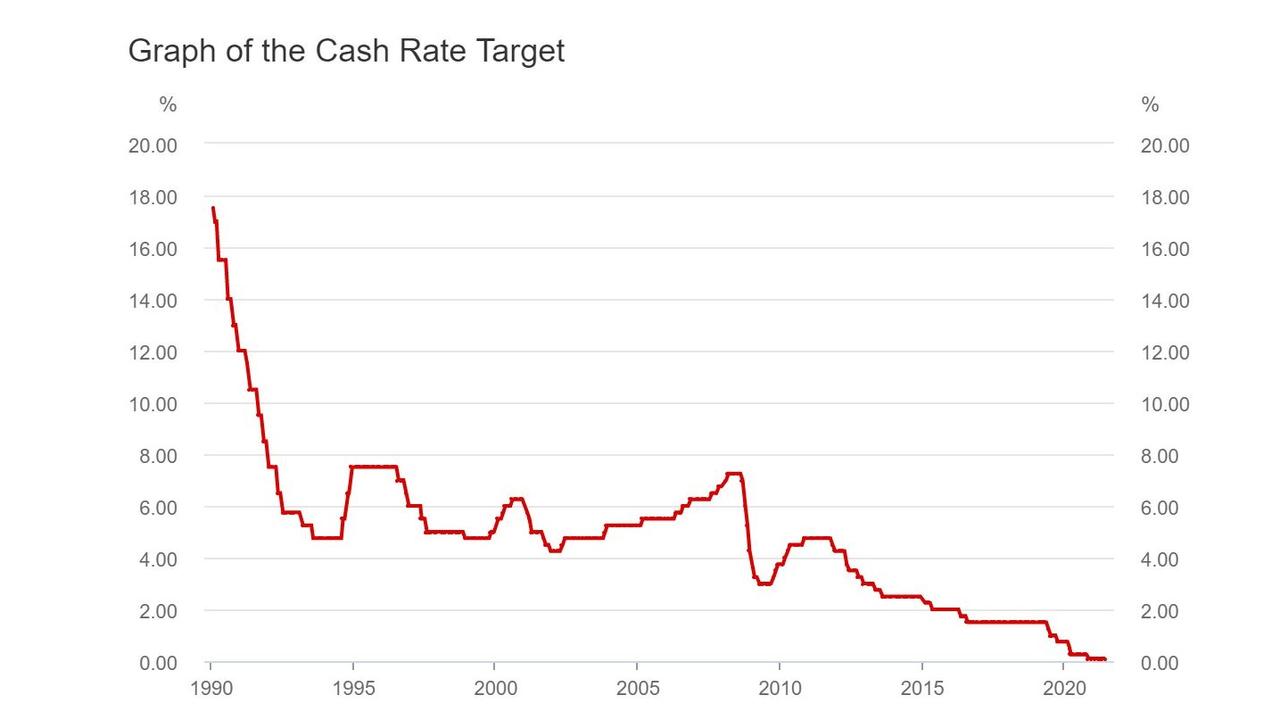

Between 1970 and 1990 interest rate rises were an ever present threat to household budgets, with mortgage rates almost tripling from around 6 per cent to a peak of more than 17 per cent in 1990.

The next thirty years would bring almost the exact opposite.

Between 1990 and 2020, the RBA slashed interest rates time and time again, with rates falling from 17.5 per cent in January 1990 to sit at just 0.1 per cent today.

RELATED: Why property price madness won’t end

RELATED: Sign Australia is heading for disaster

Rather than lying awake at night like their parents’ generation wondering if a rate rise would make their financial future all the more challenging, the atmosphere for the current generation of mortgage holders has been far more relaxed.

Instead of the threat of the RBA raising interest rates and forcing households to tighten their belts, in the past three decades the RBA has slashed interest rates every five months on average.

Mortgages and interest rates today

With the RBA cash rate now sitting at a record low 0.1 per cent, there is simply no more room for the Reserve Bank to cut rates further without taking the cash rate to 0 per cent or below.

But as mortgage holders ponder the possibility of never again enjoying another rate cut at this level, there is another temporary factor that has been supporting new mortgage holders and those refinancing.

The RBA’s intervention in the bond and bank funding markets.

At the height of concerns about the pandemic in March last year, the RBA announced its Term Funding Facility (TFF) to provide capital to the banks.

Over the months that followed, the RBA eventually committed up to $200 billion in funding for the banks at an interest rate of just 0.1 per cent. This ultimately allowed the banks to reduce their funding costs and offer cheaper mortgages while still maintaining a very healthy profit margin.

RELATED: Huge clue about Aussie house prices

At the same time, the RBA also put into place yield curve control targeted at three-year Australian government bonds, which are one of the key benchmarks for long term bank funding costs.

Under the policy the RBA attempted to ensure the three-year bond yield did not rise above 0.25 per cent, until the policy was tweaked to target a figure of just 0.1 per cent.

Put together the RBA’s yield curve control and TFF have provided banks with ample scope to lend at extremely low interest rates on selected fixed terms.

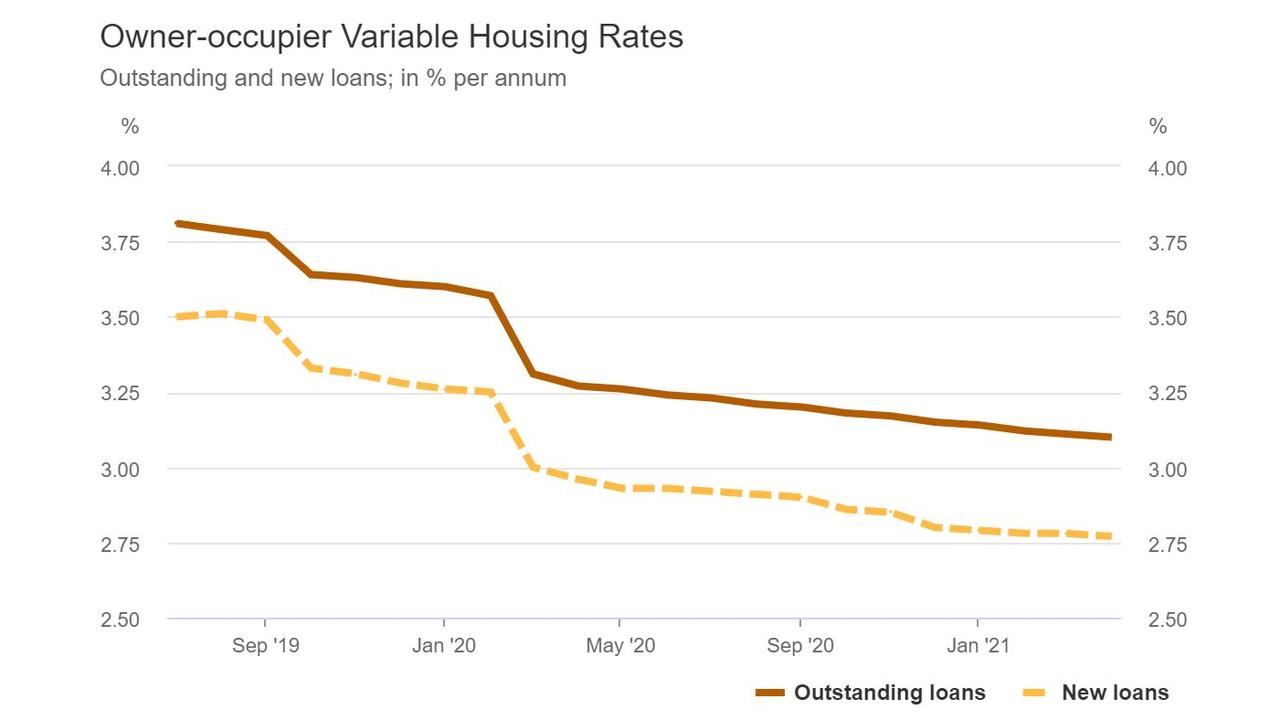

For example, according to the RBA the average variable rate currently being paid on existing mortgages is around 3.1 per cent. But there are three-year fixed term loans available from some of the major banks for as little as 1.69 per cent.

Rising interest rates don't have to deter you from saving for a house deposit. Read Compare Money's tips >

But with the TFF now concluded and announcements of adjustments to the RBA’s yield curve control program expected in the coming months, the current record low fixed mortgage rates are not going to last forever.

Markets and what lies ahead

As for when interest rates will rise, it depends entirely on who you ask.

In late June, the Commonwealth Bank (CBA) moved up its forecast for the first RBA rate increase in more than a decade to November of next year. CBA is expecting a 0.15 per cent increase in November 2022, followed by a 0.25 per cent increase in December.

On the other hand the RBA continues to insist that it will not be raising rates until “at least” 2024.

Interest rate futures markets appear to align far more closely with CBA’s forecasts, than the RBA.

A recent analysis by US investment J.P Morgan revealed the interest rate futures market expected around 0.4 per cent worth of rate rises over the next two years, 1 per cent over the next three years and roughly 1.5 per cent over the next four years.

It’s important to keep in mind that this is a snapshot of how the market sees things now and not a concrete confirmation of what is to come.

Given the uncertainty that defines the current situation we collectively find ourselves in, it’s possible rates could rise by more, less or we could even see the cash rate go negative like it has in several nations such as Switzerland, Japan and Sweden.

The future for mortgage holders

With record numbers of households taking advantage of low interest rates and fixed term mortgages, if rates were to rise as interest rate markets are expecting, things could get more challenging for these households in a couple of years’ time.

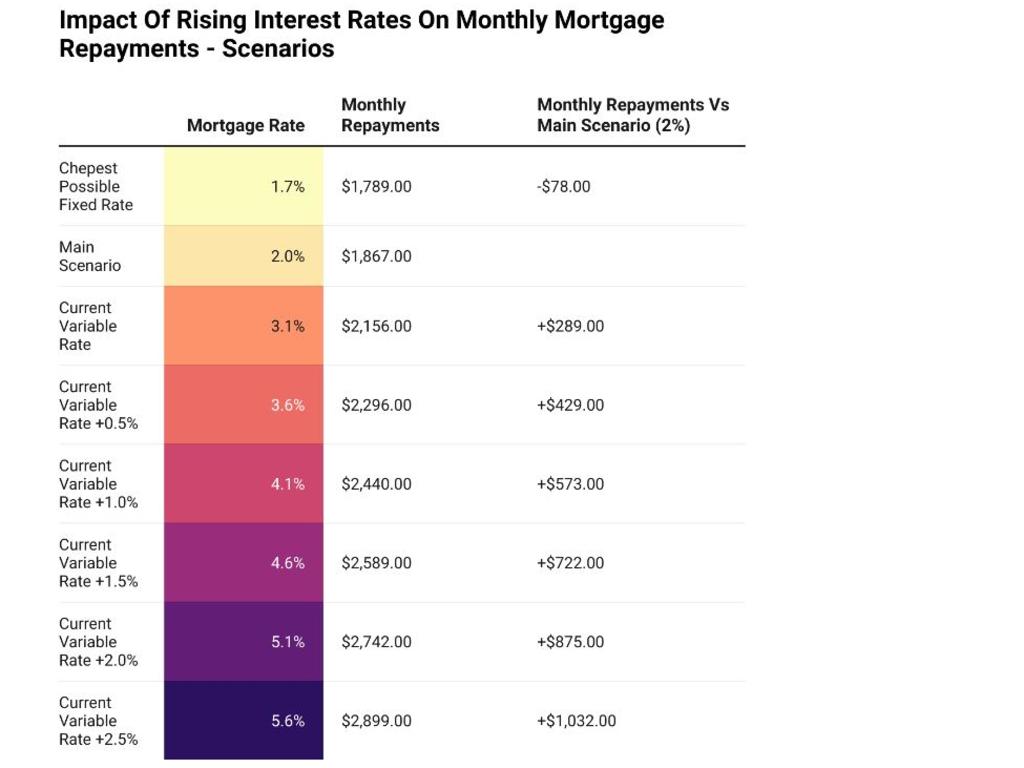

If 1.5 per cent worth of interest rate hikes was to be priced into the current average variable rate, the average interest rate on a variable rate mortgage would rise to 4.6 per cent per annum.

For an average buyer who recently purchased a home with the average mortgage of $504,000 who got a good deal of 2 per cent rate on a fixed term mortgage, the reversion to a variable rate loan amid rising interest rates could mean interest repayments more than double in an instant.

As a result, monthly repayments would rise by $722 per month (38.6 per cent) and the household could find themselves in financial stress if they did not swiftly adjust their spending to their new mortgage servicing costs.

With property prices currently rocketing higher and markets increasingly seeing an inflationary future defined by rising interest rates, these two forces appear to be on a long term collision course.

While it could be years before rates rise and impact the market, it’s also true that rising rates once kept a generation of Australians awake at night for decades and if the pundits are right, we may be going back to that future.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator