Negative gearing will save investors from high interest rates, meaning the price boom won’t end anytime soon

Interest rates look set to rise but it’s unlikely the heat will come out of the property market and there’s a crazy reason why.

When the Reserve Bank of Australia last raised interest rates in November 2010, it marked the end of an era for Aussie mortgage holders.

In the decade that followed, the once ever present threat of rising interest rates consuming a greater portion of household budgets all but disappeared, as the RBA cash rate fell from 4.75 per cent to just 0.1 per cent.

But now, after almost 11 years of rate cuts leaving mortgage holders better off, the hazard of rising global inflation is threatening to force the RBA to raise interest rates long before it’s scheduled to.

As a result, bank funding futures markets are now pricing in four interest rate increases in the RBA cash rate by June 2024. With concerns about inflation continuing to mount, further pressure may build for even greater rate rises, as bank funding markets price in a more inflationary future.

RELATED: Rising house prices an economic ‘time bomb’

What would happen if interest rates rose?

Based on the average new mortgage size for an owner occupier of $478,822 and the RBA average rate payable on new loans, if rates rose by 1 per cent monthly mortgage repayments would rise by $264 per month.

For most borrowers a 1 per cent increase in interest rates can be taken in their stride relatively easily. But the big question is, what if the analysts predicting higher inflation for longer, are right and this is just the beginning of a multi-decade inflationary cycle?

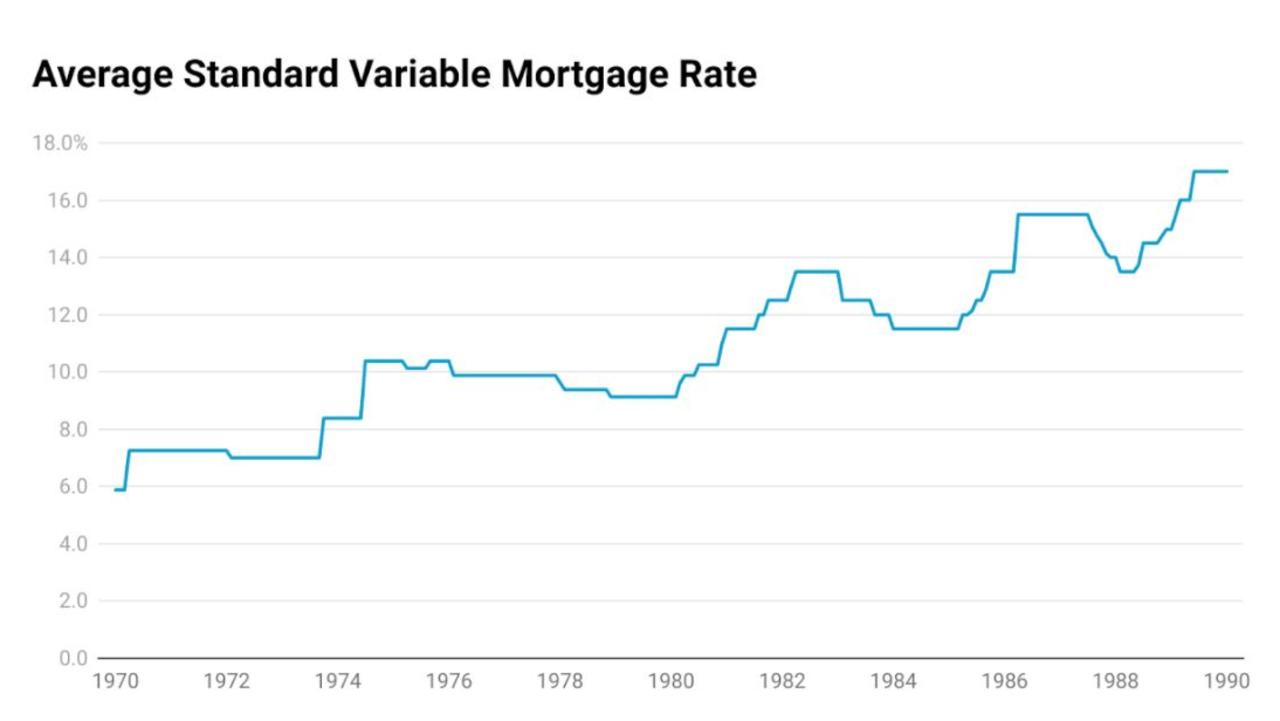

In late 1970, Australian home loan rates sat just under 6 per cent after decades of being relatively low following the Second World War. Over the coming 20 years, mortgage rates would ebb and flow, before finally peaking at 17 per cent in 1990.

RELATED: Map shows how insane house prices are

While it’s extremely unlikely rates would get even close to double digits, let alone 17 per cent, it’s easy to see why many analysts are seeing a strong chance of history once again repeating itself.

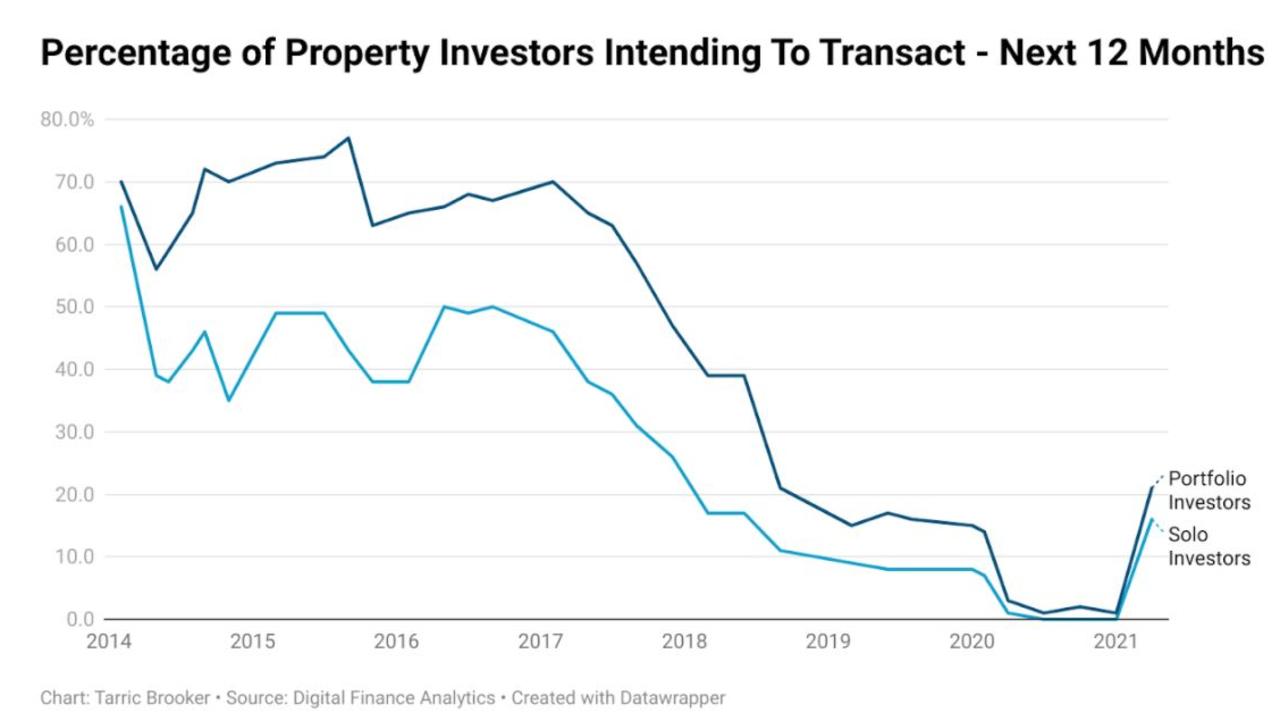

Despite growing concerns about a potential rise in interest rates, the nation’s property investors are increasingly keen on getting into the market.

According to figures from research firm Digital Finance Analytics, the number of investors looking to buy a property in the next 12 months has rocketed from its pandemic lows to the highest levels since 2018.

RELATED: Huge clue houses will skyrocket further

While first home buyers are increasingly dropping out of the market in droves, the same rocketing prices forcing them out are enticing investors to throw the dice on entering the market, to chase the outsized capital gains currently on offer.

With the near certainty of housing prices continuing to rise in the short term, there is still plenty of scope for more investors to enter the fray before getting close to approaching the record levels of interest that defined 2014 and 2015.

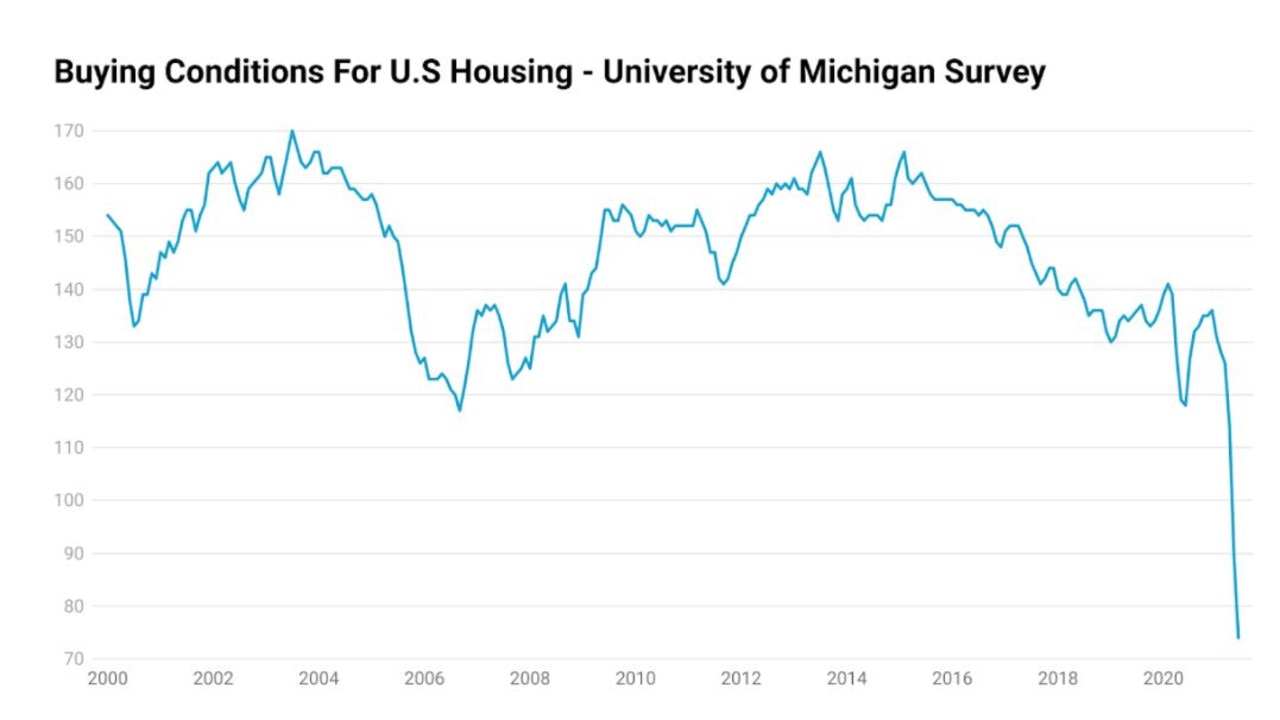

In other parts of the world property investors may now be thinking twice about diving into a hot property market, amid the prospect of multiple rate hikes and a new cycle of higher interest rates.

In the United States, consumer perceived conditions for buying a home have plummeted to the lowest levels in 37 years, as rising interest rates and rocketing prices begin to significantly impact American households.

The elephant in the room

But there is a uniquely Australian element that significantly alters the calculations that define property investment decision making, negative gearing.

If interest rates were to rise significantly, resulting in more investors finding themselves staring down the barrel of losing money on their property, the federal government will effectively foot part of the additional cost through negative gearing tax deductions.

According to the latest figures from the Australian Taxation Office (ATO), out of the 2.2 million taxpayers that own at least one investment property 1.3 million declared a net rental loss in the 2018-19 financial year.

The 58.6 per cent of landlords claiming a net loss is actually the lowest proportion of investors to be losing money since records began back in the 2003-04 financial year.

Consistently losing money week in, week out may seem like the exact opposite of what an investor would want from an asset. But for Australian property investors, losing money in the hope of strong housing price growth has become a way of life.

While owner occupiers would likely find a rising interest rate environment much more challenging, through negative gearing the federal government effectively provides a safety net for property investors, should net rental losses increase significantly.

The psychology of the Australian property market is arguably one of the most nuanced and complicated in the world. With various cultural, political and financial factors all combining to make Australians relationships with the property market a complex one.

But what isn’t complex is what is likely to happen next.

As housing prices continue to rocket higher, investor interest in the market is likely to continue to grow, as the allure of strong capital growth draws in more buyers.

While higher interest rates are likely a factor in the back of the minds of many investors looking to potentially buy in this market, negative gearing provides them with a strong incentive to pull the trigger anyway.

But perhaps the bigger question is, what will it take to stop the current runaway growth in property prices? Especially when investors supported by favourable government policies may have only just started dipping their toes in the market.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator