Crazy Sydney real estate prices will hurt all Aussies trying to buy

A common issue with the real estate market exposes a huge problem that will impact house prices across the whole of Australia.

OPINION

Like many first-time buyers, when I dipped my toe into the Sydney housing market in March 2021, I was realistic but optimistic.

My partner and I didn’t need anything fancy – just a two-bed apartment with a parking space and maybe a small balcony. Having spent over five years saving up a healthy six-figure deposit, we were easily approved for a mortgage but equally knew we couldn’t stray above our limit.

Three months on and we’ve all but given up.

It turns out Sydney’s property market is almost impossible for anyone who isn’t a rich investor or being bank rolled by Mum and Dad.

Guide prices are complete BS

One of the most frustrating things about trying to buy in Sydney is that guide prices set by real estate agents seem to be a thing of fantasy.

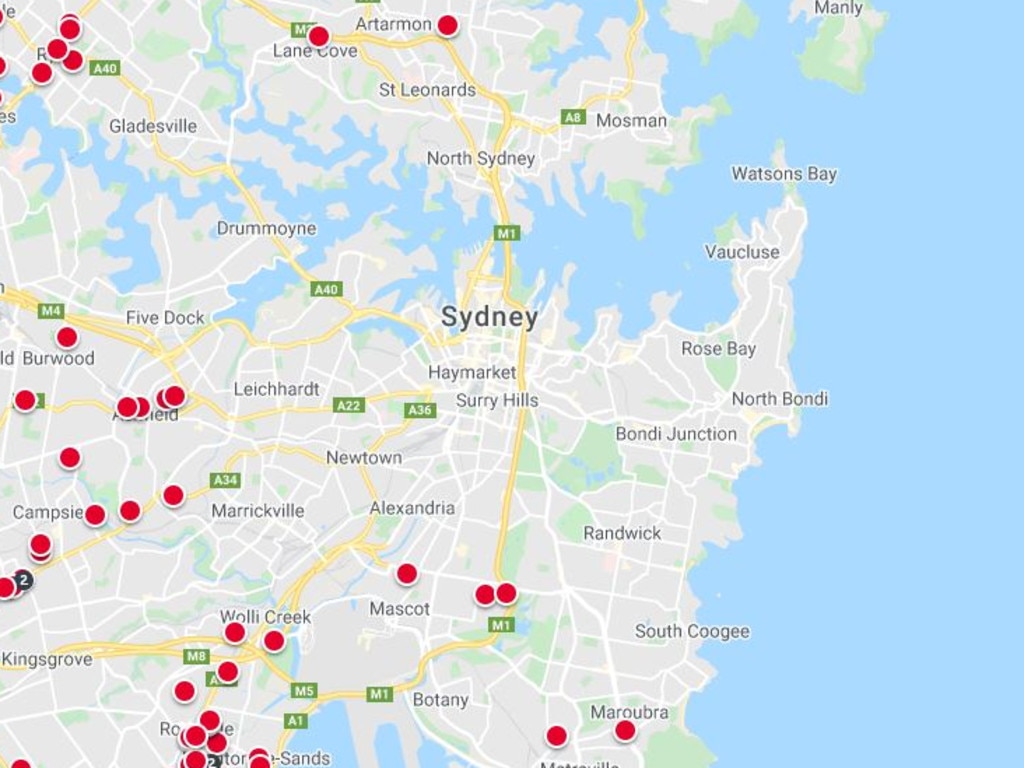

As an example, in April a two-bedroom apartment in Randwick was listed with a guide price of $850,000. The open home was full of optimistic wannabe first-time buyers hoping this would be their step on the ladder. But when the auction came around on May 15 it sold for over $1 million – $185,000 over the guide price.

RELATED: Rising house prices an ‘economic time bomb’

Even in the traditionally cheaper suburb of Maroubra, a two-bedroom apartment had a guide price of $790,000 but recently sold for a huge $922,000 – $132,000 over the guide. Price guides in NSW are meant to be based on recent comparable sales guides evidence and should be assessed weekly and revised if necessary.

The problem is, agents know that if they put down a low guide price they’ll get more people interested in the property, creating a buzz.

The practice known as ‘underquoting’ is unlawful in NSW but in my experience is rife.

RELATED: Insane price paid for Sydney parking space

While many guide prices set by estate agents are low, it’s becoming clear that Sydney sellers know exactly what they want.

In late March, a Randwick unit which had a guide price of $900,000, went to auction. As two buyers battled it out, the price got to $970,000 but the vendor still didn’t accept it. The property is now for sale for between $1-$1.1 million.

If that’s what the vendor wanted then why did it have a lower guide price? This practice is wasting so many people’s time. And when you consider it can cost $250 to get a strata report, it’s also wasting a lot of people’s money.

RELATED: What average home price actually buys you

You can’t afford where you want to live

Once you’ve accepted that you can’t actually afford anything a real estate agent says is in your guide price, it’s time to be more realistic.

For example, if you have been approved for a mortgage of $900,000 then you probably need to be looking at properties with a guide price of $750,000, that way they may sell for what you can afford.

A quick browse of realestate.com.au for two-bed apartments with a parking space and balcony for $750,000 (which remember is probably more like $900,000), you aren’t living anywhere near the CBD and definitely not the water.

Not only will you have to buy an apartment you don’t like in an area you don’t want to live in, but your commute is about to get a lot longer too.

The quality of what you can afford is also dismal too. This house at in Darlinghurst is currently on the market for $1.68 million (and will no doubt sell for more) but it is falling down. The real estate agents describe is as a “labour of love” but you’d need a lot more than love to make this home habitable.

Moving interstate won’t help

Many people priced out of buying in Sydney and Melbourne are buying investment properties in cheaper areas like the Gold Coast, rural Victoria or Hobart. Indeed, a quick browse of realestate.com.au shows you can get a pretty schmick three-bed, two-bath house in Cannon Hill near Brisbane for $750,000.

While this is a great solution for people who have saved for a hefty deposit in Sydney or Melbourne and are happy to relocate or invest elsewhere, the long-term impact on smaller cities and rural towns could be devastating for people who already live there.

As prices continue to climb across Australia, people in places like Darwin, Hobart and Brisbane are at risk of being priced out of their own areas.

This is definitely not just a “Sydney problem” or a “Melbourne Problem”, the knock-on effect will impact all Aussies.

CoreLogic figures show home values in Hobart have surged by 60 per cent in five years, which is not only making it hard for first-time buyers to get on the market but also causing rental prices to go up.

Research from NHFIC found that potential first home buyers face the biggest challenge in Sydney and Hobart. The bottom 60 per cent of income earners of potential first home buyers can afford just 10–20 per cent of properties in these markets.

While Tenants Queensland says Queensland is already experiencing a rental crisis as demand skyrockets in the state.

“Renting is becoming less secure, buying a first home continues to grow further out of reach and the Federal Government is all but missing on the issue of housing,” said Penny Carr, CEO of Tenants Queensland.

Foregoing avocado on toast won’t help

When Aussie millionaire Tim Gurner said the now famous quote, “When I was trying to buy my first home, I wasn’t buying smashed avocados for $19 and four coffees at $4 each”, it implied all we needed to do was skip a few brunches and then we could buy a house.

If my partner and I had brunch every Saturday for the next year, dropping $19 on avocado on toast and $4 on a coffee each, we’d spend $2496 in total. Do you know how much difference $2496 would make in the Sydney housing market? Absolutely none.

Riah Matthews is the commissioning editor for news.com.au.