US high inflation rate could leave Australia struggling like the 1970s and ‘80s

Australia seems to be riding high with a strong economy but a sign in the US could leave us facing a ‘wildcard’ not seen for decades.

When US President Joe Biden defeated Donald Trump back in November, there was a swift consensus in the media and among pundits that the ‘Trump era’, defined by populism and rising frustration with the political class, was drawing to a close.

Articles and ‘hot takes’ on how Biden’s grandfatherly persona and sterling political reputation would help heal a divided America, began spreading like wildfire throughout much of the US media.

RELATED: Huge clue houses will sky rocket further

RELATED: Global economy sitting in a time bomb

Now as Biden’s Presidency nears the halfway point of its first year, on paper things look pretty good for the President.

With a 53.3 per cent aggregate approval rating, Biden is roughly on par with his contemporary predecessors. He is well ahead of Donald Trump at this point in his presidency, although still significantly behind his former running mate Barack Obama.

But behind the scenes of a relatively satisfied electorate and positive media coverage of his leadership, Biden’s long term political fortunes look far shakier.

RELATED: Real reason behind ScoMo’s fat budget

Despite $2.8 trillion US dollars in stimulus flowing into the US economy since the end of last year, some economic indicators are showing some concerning signs that have proven to be Kryptonite to US presidents’ careers in the past.

These signs, if realised, could also have a devastating impact on the Australian economy.

High inflation and a weaker than expected labour market

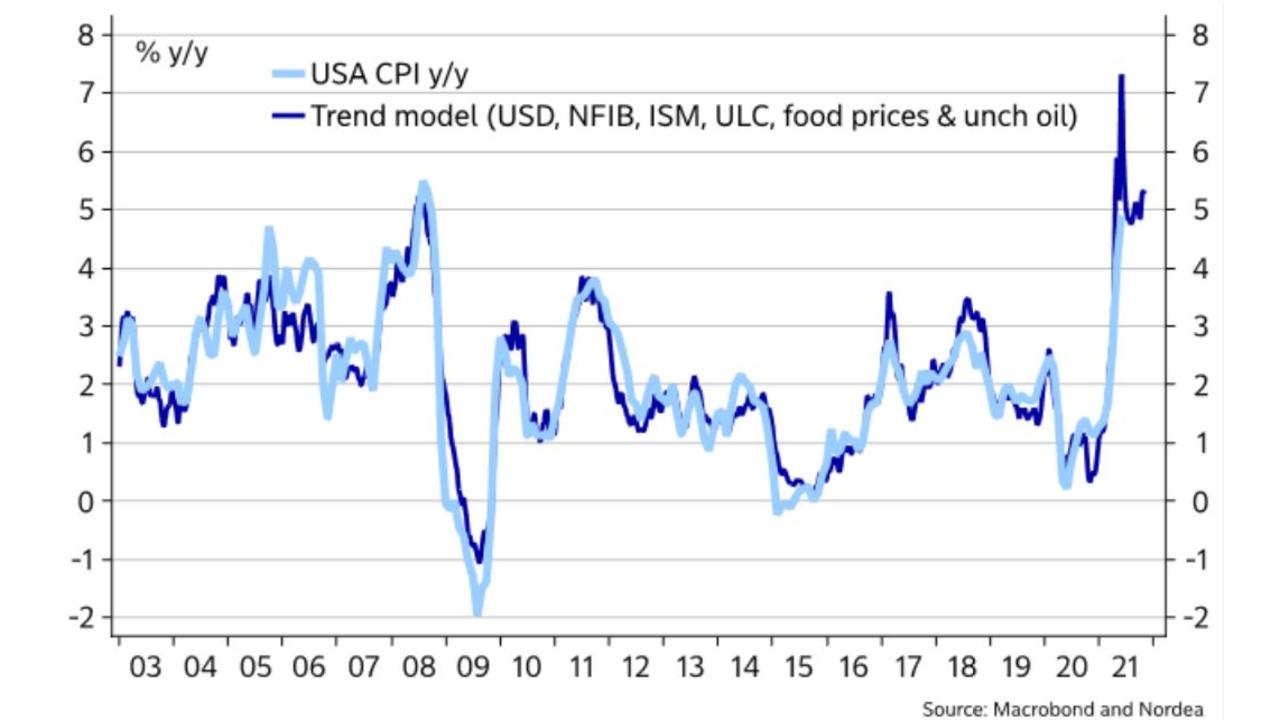

The US inflation rate recently hit 4.2 per cent, its highest level since 2008. One of the key drivers of the current inflationary pressures is struggling global supply chains, which find themselves often completely overwhelmed by pandemic and stimulus driven demand.

Despite moves by manufacturers and logistics companies to attempt to meet this demand, there is currently little sign the supply chain issues plaguing global trade will be resolved in short order.

As the American public’s concerns about inflation and a rapidly rising cost of living continue to build, consumer confidence has already taken a significant hit. A recent University of Michigan household confidence survey shocked analysts by plummeting, despite expectations of continued strong levels of confidence amid the reopening of the US economy.

At the same time, consumer confidence for a major purchase such as a home, car or large durable goods also dropped to near multi-decade lows and American households are now seeing the worst conditions to buy a house since 1983, a time when interest rates were over 13 per cent.

Meanwhile there are signs that US inflation could head as high as 7 per cent as supply chain issues and a reopening US economy drive consumer prices higher.

The US jobs market has also begun to show some concerning signs, with 851,000 fewer jobs created in April and May than initially predicted by analysts.

Despite some big numbers for jobs growth figures since the worst of the pandemic, the labour market recovery being experienced by lower income Americans stalled in November last year and jobs growth has been much weaker than anticipated.

High inflation can be terminal for a presidency

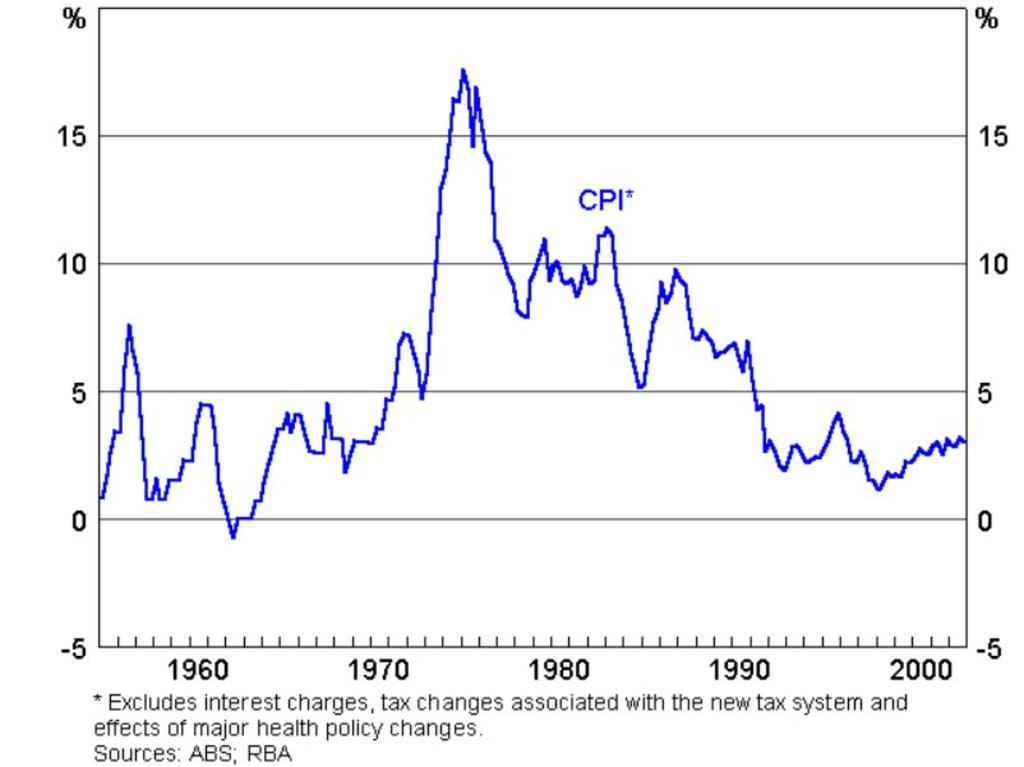

In the 1970s Biden’s predecessor and fellow Democrat, President Jimmy Carter found out the hard way how damaging high inflation can be to a political career.

After spending the last years of his presidency battling inflation, the 1980 election against Ronald Reagan was a disaster for the Carter administration.

Carter won just six states, compared with Ronald Reagan’s 44 and Carter became the only Democrat President of the 20th century to spend only one full term in office.

Former President Donald Trump has wasted no time in attempting to capitalise on concerns about rising inflation.

In a recent interview with Fox News, Trump warned of “massive inflation” and shared his concerns about the future of the US economy.

Despite only being out of office for less than five months, it’s clear that Trump is already plotting a White House comeback.

What does it mean for Australia?

As concerns about inflation continue to mount around the world, Australia’s interest rate futures market are now pricing in four 0.25 per cent rate hikes by June 2024.

Despite bank funding markets pricing in significantly higher interest rates in the coming years, the RBA remains resolutely committed to its position that rates are “unlikely” to rise until 2024 at the absolute earliest.

James Gorman, the CEO of investment bank Morgan Stanley has quite a different view on rising rates. Gorman sees the US Federal Reserve (the Fed) being forced to raise interest rates in early 2022, much sooner than most anticipate.

While there is a large degree of differences between the interest rate decision making criteria’s for the Fed and the RBA, if the Fed is forced to raise interest rates years ahead of their current schedule, the RBA may not be too far behind.

As any Australian who paid bills during the 1970s and 1980s will tell you, high inflation can be extremely challenging.

If a high inflation scenario was to be realised, prices for our supermarket shops and utility bills would rise far faster than they have at any time during the past 25 years.

Except unlike the 1970s and 1980s which were also at times defined by extremely strong wages growth, its possible wages growth could remain relatively stagnant, severely impacting household budgets.

Where to from here?

As we head into an uncertain future, the coming years will be defined by whether or not inflation proves to be “transitory” or far more long lived.

If inflation remains high, then it’s a whole new world.

President Joe Biden’s Presidency could crumble in the face of high inflation and voters frustrated at the out of control cost of living. Former President Trump could even ride that wave of anger back into the White House in 2024.

High inflation could be the wildcard that ripples around the globe for years to come, as the world struggles to recover from the pandemic and cope with the more than $374 trillion in debt it currently finds itself in.

For Australians, after over a decade since the last interest rate hike and 25 years without very strong inflationary pressures, a permanent shift to an inflationary future could prove quite the shock to our psyches and our wallets.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator