Superannuation: Super-Rewards online shopping platform puts cashback direct into fund

Many Aussies are set to sink into poverty when it comes to retirement. Find out how something you do every day could boost your superannuation.

Aussies are headed towards a “world of pain”, with millions of women in particular, expected to retire in poverty because they don’t have enough money in their superannuation fund.

Now one Sydney woman is working to stop this with an easy way for people to contribute to their super fund, even if they aren’t currently working.

Pascale Helyar-Moray has worked in finance for over 20 years and is also the communications director at the Australian Gender Equality Council. It’s there she realised how disadvantaged women were when it came to the super system.

She discovered that 40 per cent of Aussie women are not in the workforce and a further 36 per cent are employed part-time or casually.

“The often repeated industry and government message is that women should top up their super but when we have such a high portion of women not earning an income or without access to spare money the question becomes how do they top up their superannuation?” she told news.com.au.

“Women don’t have spare money but have all these responsibilities. They are looking after the next generation and running the household, so we have to find a way to reward women and low-income men. There needs to be a way to reward people for contributing into their super for things they are doing every day, whether it’s buying pet food or booking holidays or buying school shoes for their kids.”

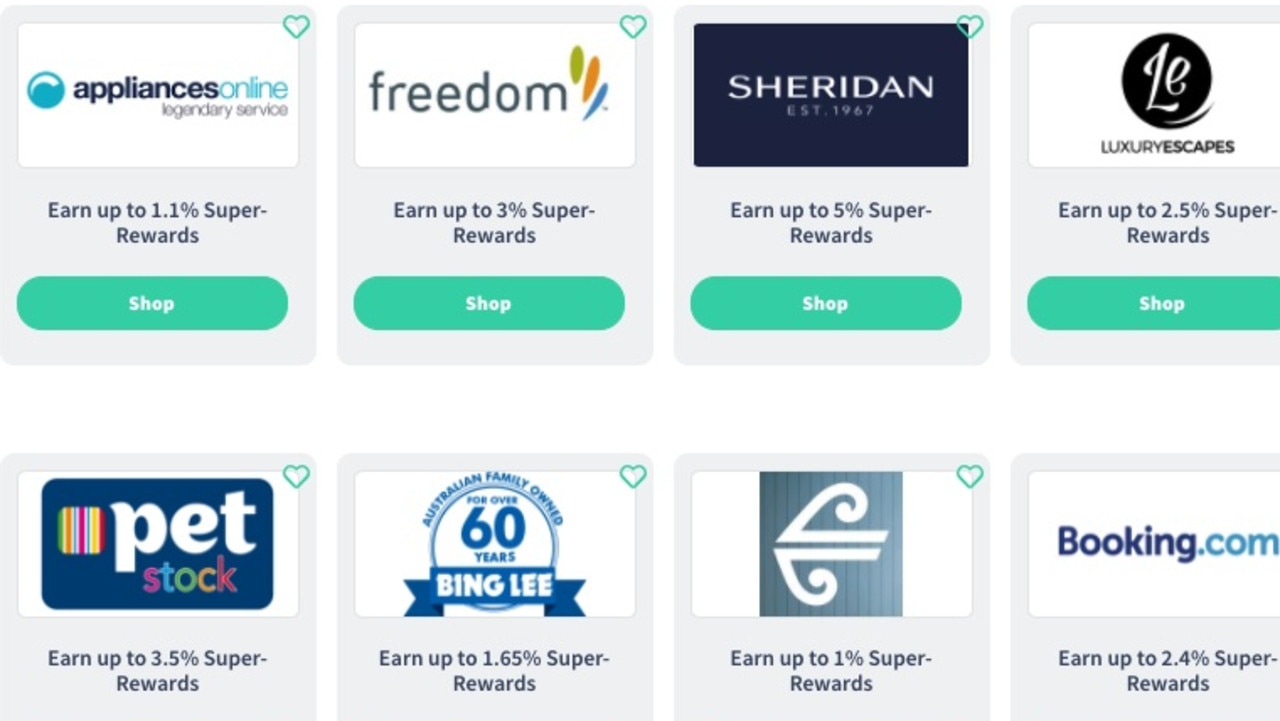

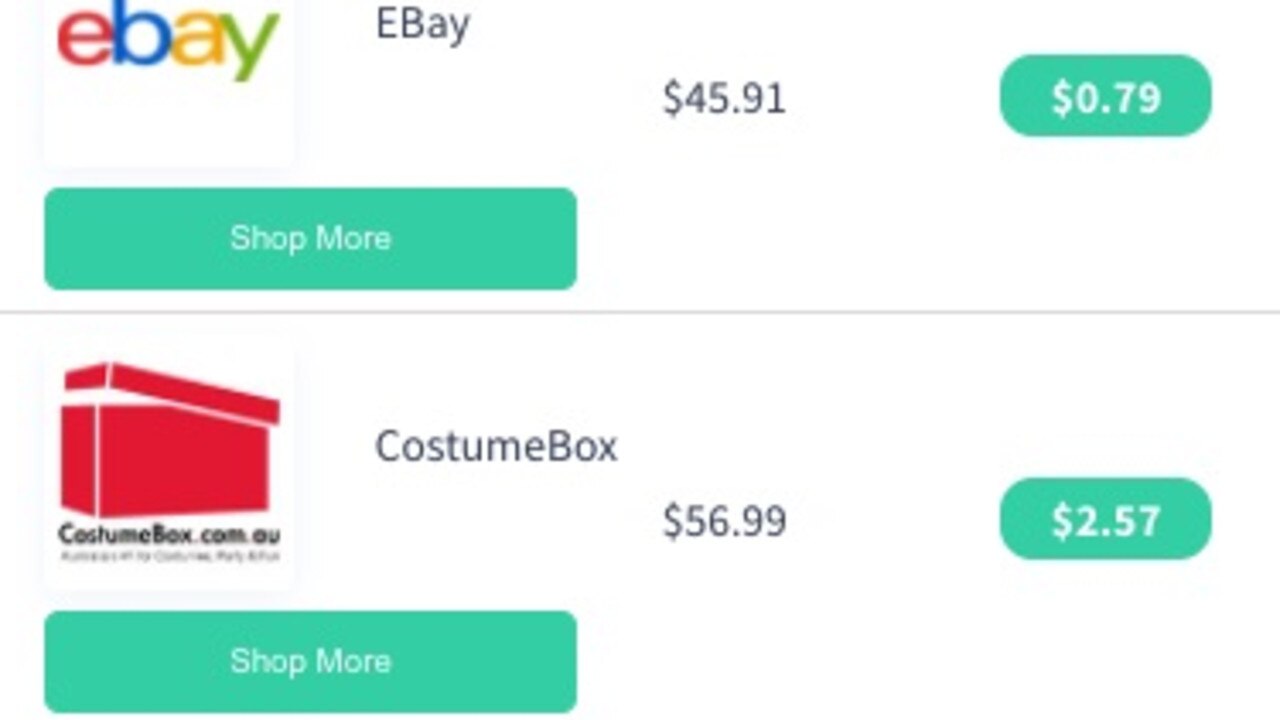

This gave Ms Helyar-Moray the idea for Super-Rewards, an online shopping platform with over 400 major retailers such as Apple, eBay, The Good Guys, Catch and Adore Beauty, which offer cashback paid directly into super.

RELATED: Aussie companies paying workers less

Membership is free and retailers pay cash back into over 180 super funds that accept voluntary contributions – which is 99 per cent of those in Australia – as well as any self-managed super funds.

The user links their superannuation account to the system so the money is directly deposited into their fund.

“Think of it as a power charger for your super,” added Ms Helyar-Moray, who said she has earned almost $900 in just 18 months by co-ordinating birthday presents for her three kids, buying school supplies, booking flights and organising Christmas time.

She said on average members would earn just under $6 a week in cashback rewards, but it really depends on how much shopping they are doing and where.

Dire need to replenish super

Women and low-income earners are already short-changed by the system, according to Ms Helyar-Moray, and are in dire need of replenishing their super, especially post-Covid.

“There’s a world of pain coming towards us and it’s only be exacerbated by Covid. In Australia, the fastest growing demographic of homeless people is the older woman as she has no super,” she said.

“One in six women in Australia retires into poverty and those numbers are pre-Covid and if we think about Covid’s impact, obviously there were a number of industries where people lost their jobs. Some of those industries were heavily female-dominated, for example hospitality and retail.”

RELATED: Controversial move nabs $700,000 unit

As a result many women accessed the early withdrawal super scheme at the maximum amount of $20,000, while men tended to return unused money back into their funds, Ms Helyar-Moray said.

Australians who dipped into their superannuation during the height of the pandemic are up to $3644 worse off today, recent research revealed.

More than three million Aussies withdrew a total of $36.4 billion from their super accounts last year as part of the scheme.

“Women are already retiring with about 58 per cent less super as men and now they have less in the pension or super pot, so we are really going to see the long-term effects of Covid on women from 10 to 20 years from now,” she said.

Government and industry need to move faster

Ms Helyar-Moray urged the Government and super funds to take on initiatives like Super-Rewards from fintechs like hers at a quicker pace and to inform their members about it.

“Typically, it takes over one year for funds to adopt innovative solutions and a further year for implementation,” she said.

“Not using Super-Rewards for two years can translate to individuals missing out on as much as $56,000 at retirement. That’s two years’ worth of pension the Government will have to fund.

“When a super fund lets its members know about Super-Rewards, user uptake is over 15 times higher than self-directed sign-up. These results demonstrate clearly that users do engage with their super and their fund, overcoming one of the industry’s greatest challenges.”

Super-Rewards launched in October 2019 and so far 20,000 users have signed up.

“Our goal is to really help everyone have a better retirement outcome and someone else described this as a no-brainer as people are doing these things anyway,” she said.

“The thing about other ways people can top up their super, they are through mechanisms like spousal splitting and very few know about that and even fewer implement it. Super-Rewards is quick, easy, actionable, practical and you don’t have to fill in forms or see an accountant – it’s something anyone can do straight away, so its incredibly useful.

“Every month or year you don’t take action ends up costing you in your retirement.”