The Project’s superannuation experiment shocks millennial retirement plans

An experiment conducted on The Project has left some millennials “petrified” and “emotional for their future after what they discovered.

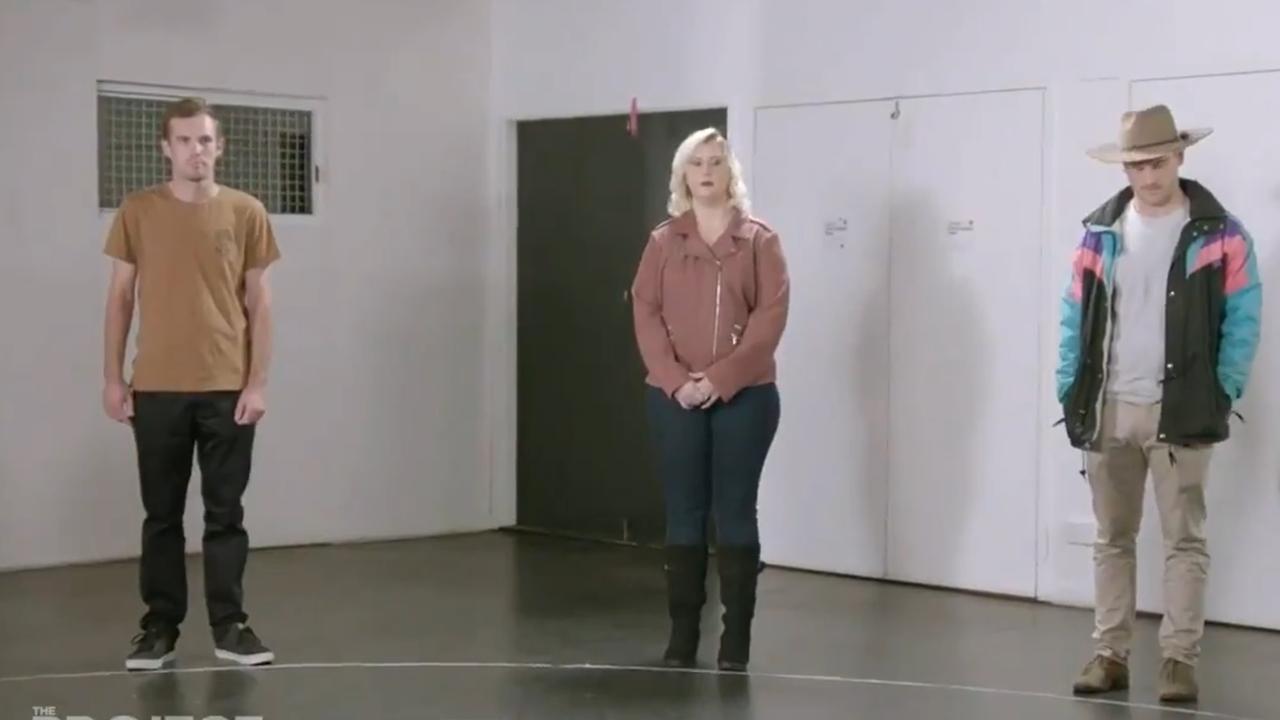

Eight millennials who were put through a superannuation experiment for The Project were “emotional” and “petrified” by what they discovered.

The young Aussies, aged between 26 and 35, were asked about their ideal retirement.

“I want to retire at age 40. I want to make sure basically I can book a first class ticket to anywhere in the world and not have to look at the price,” 26-year-old Logan said.

Beth, 29, wanted it to be stress-free, relaxed and a bit of adventure, while 34-year-old Nikki had a goal to rely on her own money rather then receiving the aged care pension.

For the experiment, the millennials stood in front of a series of circles that led to a red line, and they had to step forward if a question regarding their financial affairs applied to them.

The closer they got to the red line the higher chances they had of experiencing financial stress in retirement.

RELATED: Easy way to boost super by $56k

But there was one piece of advice that floored the participants.

“If you’re single you’re going to need close to $1 million in retirement assets to live without any debt and a house that’s fully paid off to be not reliant on the aged pension,” explained Ellie Fordham, financial advisor at Dozzi, a Brisbane-based financial planning firm, who helped conduct the experiment.

“I feel a bit emotional to be honest I think it’s a bit of a wake up call,” said 27-year-old Joshua in response to the $1 million figure.

Ben, 31, said he was not sure he would achieve that “even working full time in a stable job for 30 years”.

Mum Beth was most alarmed. “If Ben is terrified than I’m petrified because I think I out of everyone here I am closest to the line,” she said.

RELATED: Massive money trap for people under 35

Ms Fordham told the millennials that to retire comfortably individuals will need $545,000 and for couples $640,000 in their super pot, but there was a catch. It would only apply if they weren’t paying rent and even with that amount of money they would still need to rely on the aged pension.

“My current super balance is just over $100,000 and being 29 I feel like I’m getting pretty close to that $500,000 I’ve got to have,” said Eva.

But it was a different story for Joshua. “I don’t feel financially set yet, I don’t have much super so that’s why I’m here,” he explained. “That’s real scary, I’m 27 and I’m probably sitting at $20,000.”

At one stage in the experiment, all the women in the room were asked to take a step forward.

“How does it make you feel to already be at a disadvantage because of your sex?” asked Ms Fordham.

She revealed that women’s super balances are typically 40 per cent lower than men.

“I have been a single parent, stay at home (for) six, seven years so that’s a big chunk out of the workforce and out of my super so I have a lot of catching up to do,” said Beth.

If participants were renting and still trying to break into the home ownership, they were also asked to come forward.

“All the house prices jumped right up and that sort of scared me off,” said Eric, 26.

“I’m living at home but I would like to buy my own home (but) trying to afford a house right now is crazy,” added Joshua.

Home ownership is a huge factor for young people’s retirements, explained Ms Fordham.

“The number of homeowners aged under 35 has halved since 1995 and most of the properties are now concentrated in the hands of 65 year olds and older and this is concerning considering how important it is to own your home to have a comfortable retirement,” she said.

The millennials were also asked to take a step forward were if they earned less than $62,500, had withdrawn super money early or are likely to take more than six months out of the workforce.

The rise of the gig economy was also likely to have a big impact on millennials retirement, Ms Fordham said.

“Less than half of all Australians are currently in permanently full time work and by 2025, 75 per cent of the workforce is going to be made up by millennials,” she said. “And with the gig economy on the rise this is really concerning that more and more millennials are not going to have contributions going into their super fund.”

Participants were also asked to step forward if they didn’t make extra contributions to their super – with Ms Fordham recommending that this was a good first step for millennials to get ahead with their super.

At the end of the experiment Logan was the only one confident about his retirement.

“I’m 100 per cent on a good trajectory, I’m stoked with where I’m sitting today, it goes to show everything mum has taught me has paid off,” he said.

After the segment aired, host Carrie Bickmore said she was shocked by one thing in particular.

“I’m so naive I honestly thought we had come further than women having 40 per cent less super than men,” she remarked.