New superannuation laws could cost Aussie workers $230k

Controversial new laws being debated in the Senate this week could see some Aussie workers up to $230,000 worse off.

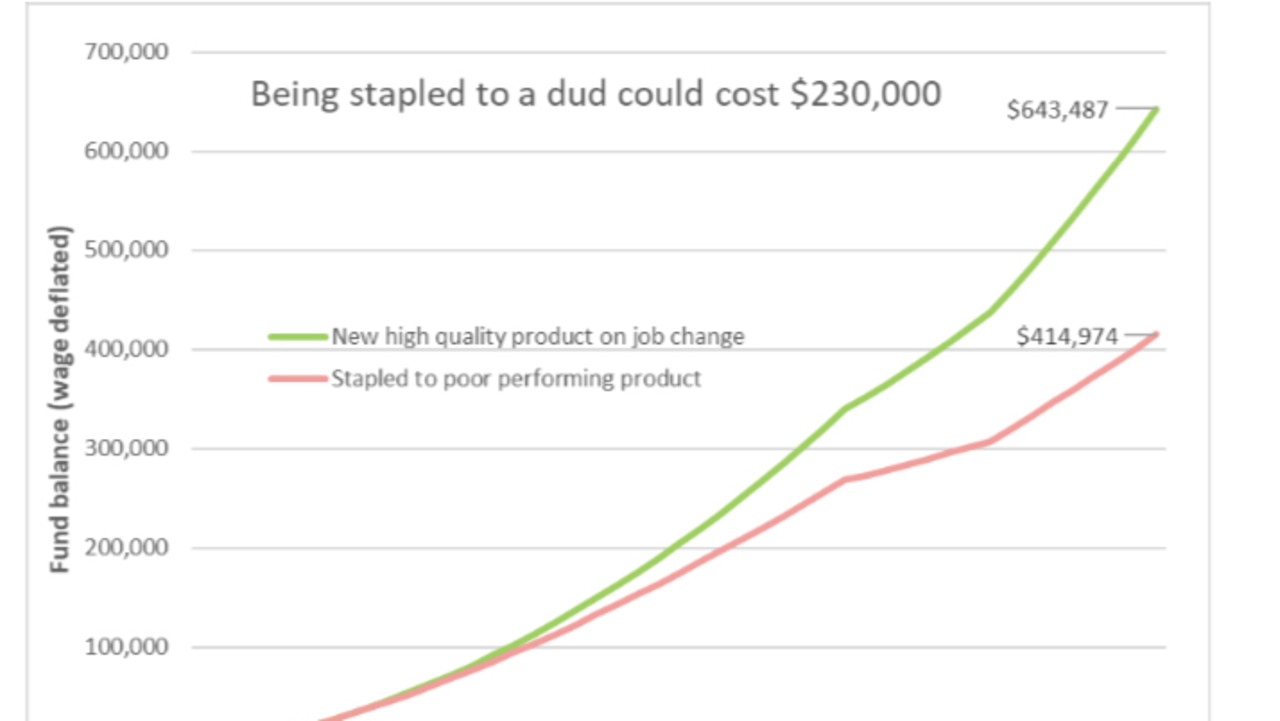

Super funds claim new laws that would “staple” workers to a single fund could cost workers up to $230,000 over the course of their working lives.

The new laws, to be debated in the Senate this week, are designed to address the issue of Australians accruing multiple super accounts as they change jobs by “stapling” a member’s account to them as they move between employers.

But Industry Super Australia claims that if the Your Future Your Super legislation staples members into dud products it could leave thousands of workers worse off.

The super funds’ analysis shows that a member who is stapled to a dud product would be almost $230,000 worse off compared to requiring stapled funds to pass the performance test.

For example, a 20-year-old stuck with a bad fund would end up with $414,740 in super while the same worker allowed to stick to a high quality product would end up with $643,487.

“We’ll work with Senators of all persuasions to get the best outcome for members, but we won’t support a bill that shields the worst performing funds from scrutiny or staples workers to dud products,” Industry Super Australia chief executive Bernie Dean said.

RELATED: Massive money trap for people under 35

“Most people don’t spend a lot of time thinking about super and so they deserve to be protected from ending up chained to a dud fund and finding out only when it’s too late.

“The Senate can boost members’ savings by stopping them ending up with too many super accounts or stuck in a dud fund- they can do both by mandating workers can only be stapled to the best performing funds.”

The changes have already passed the House of Representatives and are now heading back to the Senate.

The House of Representatives passed the laws after the government agreed to dump the controversial “kill switch” from its superannuation reforms that would have allowed it to veto certain types of investment decisions by super funds.

Former Nationals MP Barnaby Joyce had argued the “kill switch” could be used by a future Labor government to ban investment in coal, gas, fracking and the live cattle trade.

RELATED: Blunt message for Aussies facing pay cut

Labor is opposing the legislation arguing the “stapling” provisions could leave workers worse off.

“Everyone agrees that workers being in multiple funds is a bad thing, and everyone wants to fix it,” Shadow Assistant Treasurer and Shadow Minister for Financial Services and Superannuation, Stephen Jones, said.

“But you don’t do that by putting workers in poorly performing funds for life.”

Industry Super Australia wants the bill amended so that workers can only be stapled to funds that pass the performance test – arguing anything less will leave workers worse off.

But ISA says it supports the Bill’s intention to remove unintended multiple accounts from the system as long as it doesn’t leave workers worse off.

The super fund is also concerned that $500 billion of members’ savings will also be shielded from performance tests – including products that were savaged during the Banking Royal Commission.

Under the rules funds that fail the test are forced to write to members informing them of their underperformance, the consequence for consecutive failure is new members are barred from joining.