Aussies who will get a pay cut on July 1

A sneaky trick some bosses are trying to pull will see some Aussies paid less from next month. But a government minister says it’s just tough luck.

Superannuation Minister Jane Hume has delivered a blunt message to unions complaining that some bosses will force workers to pay for their own super rises on July 1.

Explaining why she doesn’t plan to do anything about the practice, Senator Hume has told news.com.au that it’s a simple fact that there was a trade off between wage increases and super rises.

And she’s accused unions of effectively trying to have their cake and eat it too, after they were warned that a mandated increase in super to 10 per cent may come at the expense of pay rises.

Her comments follow revelations that some businesses can legally force workers to absorb the cost of the super increase under some employment contracts. That means that some unlucky workers could face a pay cut on July 1, when the new super guarantee increase comes into force.

“Despite months of Labor and Industry Super Australia denying the trade-off between super increases and take home wages, ignoring the findings of the Retirement Income Review, the RBA, Grattan, ACOSS and others, the Government has always been aware that there is in fact a trade-off,’’ Senator Hume said.

“While denying this trade off, Labor have again demonstrated they can’t be trusted with the nation’s finances, pushing not just for a rise to 12 per cent, but an increase to 15 per cent.”

While the government flirted with the idea of freezing the super increase, it ultimately decided to allow the already legislated increase to proceed as planned.

“The Government weighed this increase to the super guarantee rate carefully against the economic data prior to the budget,’’ Senator Hume said.

“The Morrison Government is committed to growing the economy, to drive down unemployment and in turn increase wages.”

Ms Hume’s comments come after workers were warned about the sneaky trick some Australian bosses were trying to pull, to force employees to pay for their own mandated super increase resulting in a cut to their take home pay.

The practice has been slammed as “shocking” by unions and it means some workers could face a pay cut when the super guarantee rises to 10 per cent on July 1.

But only workers who have contracts that stipulate that super is included as part of their total package are at risk.

If your employment contract states super should be paid on top of your base salary you’re not in that category.

The problem for workers who are in the first category is that if your contract states super is included as part of your total package your boss might try and take the super rise out of your base salary.

The superannuation guarantee is the mandated amount that employers must contribute to their workers’ retirement savings.

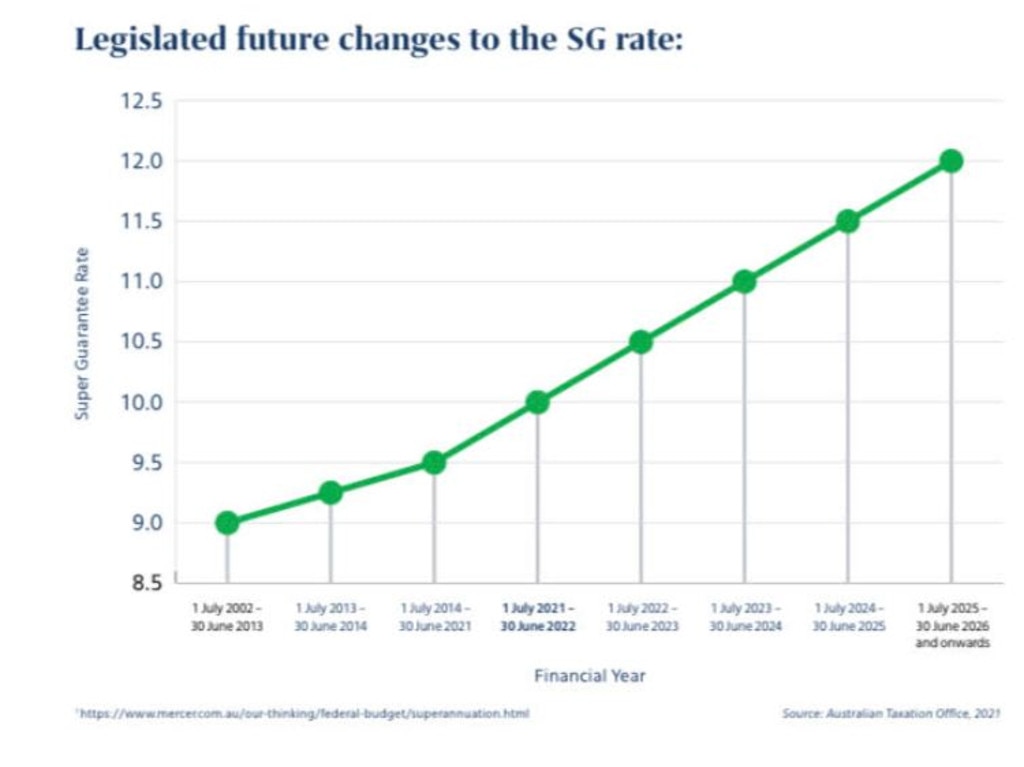

It’s legislated to increase from 9.5 per cent to 10 per cent from July 1, and then rise 0.5 per cent each year, until it reaches 12 per cent by 2025.

RELATED: What you need to earn to be rich

RELATED: Covid forces big job change for Aussies

Employment lawyers say they have been receiving calls from bosses wanting to know if the sneaky trick is legal. The short answer is yes, when the contract allows it but Labor says that doesn’t mean you should do it.

Labor’s superannuation spokesman Stephen Jones told news.com.au that employers should simply “do the right thing”.

“Real pay has been frozen for a decade,’’ he said.

“The .5 per cent super increase has already been delayed for eight years and is less than $6 a week for average workers. Businesses should not use tricky words in an employment contract to avoid doing the right thing.”

The number of employers who want to try to dud their workers on super is surprisingly larger according to asset management firm Mercer.

Some employers who already pay more than the mandated super guarantee won’t maintain that bump gap under the changes while others who only pay the 9.5 per cent minimum will try to pass on the entire cost to staff.

According to a recent survey of businesses Mercer found that of those companies that could pass on the super rise to employees one in three – 30 per cent – of companies said they planned to.

Another one in five bosses said they had not made their minds up yet about passing some or all of the cost onto employees. But there are risks for companies that try to pass on the costs to workers.

“Asking employees to absorb or split the additional SG, or even subsume the increase in existing above-minimum employer contribution all might be perceived as putting economics before empathy,’’ the Mercer report warns.

“Moreover, reducing the real or perceived employee benefit is likely to put pressure on employee engagement and retention. Employers should be mindful of the current – and extraordinary – socio-economic context when strategising their SG approach, not just for 1 July this year, but towards 2025.”

RELATED: Push for workers to get extra paid leave

RELATED: Public servants salary sacrificing $500k

The super increase carries significant costs for business. But by forcing employees to bear those costs Mercer warns some of those staff may decide to walk and get a new job.

“Reducing take-home pay (by passing the SG increase on to employees) in the face of stagnant wage growth is likely to impact employee advocacy,’’ the report warns.

“Employees are potentially more likely to seek new opportunities in order to secure salary increases.”

Unions have also slammed the practice as unacceptable. But the problem for workers in some cases remains that it is legal.

“It is absolutely shocking to me that employers would be trying at this point to try and avoid paying that small increase in superannuation,” ACTU President Michele O’Neil said.

“For the economy, and for our social security and pension system, we’ll be better off if people have enough money to retire on and retire without living in poverty.”