MLC vows to learn

MLC Wealth chief Geoff Lloyd has outlined a new structure that paves the way for a separation or sale by NAB.

MLC Wealth chief Geoff Lloyd has outlined a new structure that paves the way for a separation or sale by NAB.

Banks contractually required to pay trailing commissions will have to pass them on to clients, under new rules.

Banks have started fighting back against the regulatory backlash, declaring it has resulted in a cut-back in loans.

ANZ boss Shayne Elliott says regulators should put a “fully-functioning financial system” ahead of jail for bankers.

An avalanche of “black letter law” is taking Australian finance back 40 years, AMP chair David Murray says.

Consumer groups are alarmed as the government walks away from recommendations of the banking royal commission.

ASIC tallied up an eight-figure legal bill in the financial services royal commission, although it was outspent by the major banks.

Chairman David Murray is taking a pay cut as embattled AMP scraps short-term bonuses and cuts directors’ fees.

A class action will allege wealth manager IOOF failed to tell shareholders about possible breaches of super laws.

Credit union CUA has contrasted itself to banks and says it took a hit to profits rather than pass higher costs on to members.

CBA still plans to exit its wealth business, despite bowing to the inevitable and suspending the demerger amid uncertain times.

The most powerful voice in the superannuation industry is urging a zero-tolerance cleanout of dud funds.

The Treasurer has given mortgage brokers respite on a plan to ban trailing commissions by 2020, opting for a 2022 review instead.

ASIC has accused six major institutions of “unreasonably” delaying probes into fee-for-no-service scandals.

Westpac chief executive Brian Hartzer has urged an examination of industry data on business loans of less than $5 million.

CBA is checking for “further consequences” from the Hayne inquiry, after paying out $1.4bn for wronged customers.

One of the nation’s top business leaders has warned against an overly ‘paternalistic’ approach to managing risk.

The Treasurer has sounded the alarm on financial activism, warning unions are “pressuring superannuation funds”.

Top bankers at the big four have suffered a sharp drop in pay as heightened scrutiny from the royal commission takes its toll.

Acting NAB CEO uses his first day to tell staff they must focus on customers in the same way that airlines are obsessed with safety.

If ASIC’s objective is to put the frighteners up Australia Inc, especially in financial services, it’s not going to come cheap.

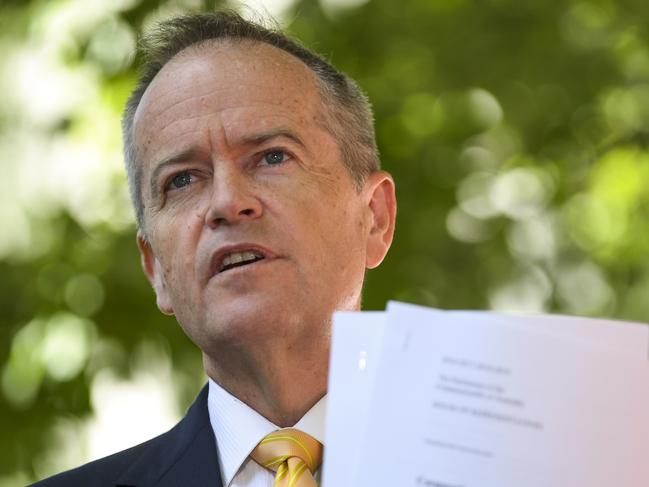

Bill Shorten is set to hit banks and financial institutions with a new levy for a $640 million fund to support victims of misconduct.

Labor has walked back from a commitment to implement all of the banking royal recommendations in full.

Broking group Mortgage Choice has cut its dividend as it warned of the impact from uncertainty sparked by the Hayne report.

James Shipton warns the regulator has an “urgent imperative” to launch court action against large financial companies.

Corporate cop ASIC has responded to its bank inquiry bruising, saying it now has almost 40 investigations underway.

Bill Shorten has ramped up pressure on the government to ban grandfathered trailing commissions on a faster schedule.

Now that Hayne has basically let the banks off the regulatory hook, attention must turn to where it belongs: customers.

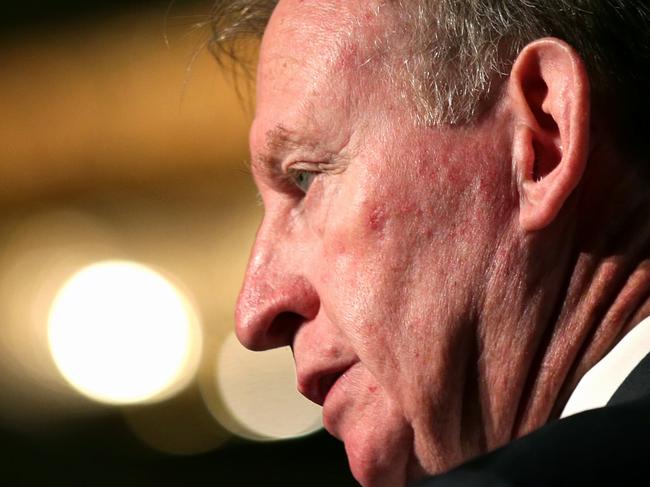

The banking royal commission handed Ken Henry his biggest career challenge. He pushed back. But then it was too late.

Ken Henry was reluctant to step down as NAB chair but in doing so he has satisfied community concerns about accountability.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/2