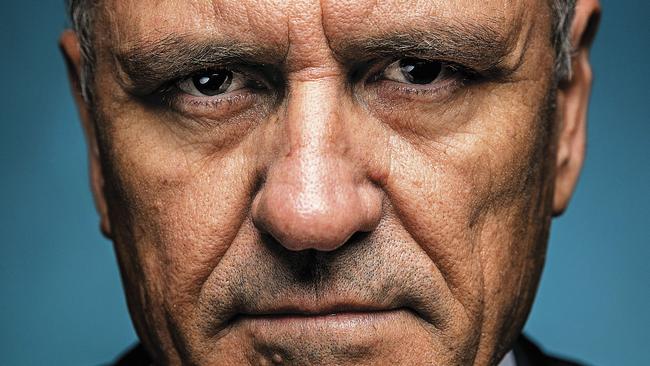

I’ll prove the royal commission wrong, Henry vows

Ken Henry was reluctant to step down as NAB chair but in doing so he has satisfied community concerns about accountability.

Ken Henry was at first reluctant to step down as chair at National Australia Bank but in doing so he has at least satisfied one of the concerns the community has with big business, which is a lack of accountability.

“We’ve got to hold ourselves responsible for all the bad things that happen or the occasions on which we don’t get it right,” Henry told The Deal in an interview before the royal commission’s final report was published.

He also clearly thinks that while NAB has a long way to travel to meet community expectations it is heading down the path, telling The Deal: “I will prove him [Ken Hayne] wrong.” That was on the Tuesday last week, before stepping down two days later.

“We all know we’re on the right path but we’re nowhere near the top of the mountain,” Henry said, announcing his resignation.

The NAB board plans to follow moves by Suncorp to establish a special board committee focusing on the customer.

THE INTERVIEW: The pride, the fall

The entire Suncorp board, under chair Christine McLoughlin, is on the customer committee.

Henry may have satisfied some people with his decision to join chief executive Andrew Thorburn in stepping down from the board but his decision to remain until a new chief executive is found has angered others, including his old nemesis, former treasurer Peter Costello.

Henry is following the lead of his predecessor Michael Chaney, who was there for Thorburn’s appointment in 2014 before handing the reins to Henry in 2015.

As Treasury secretary Henry was regarded as one of great public policy minds in the country but even friends say he was a polarising character because he knew he was the smartest person in the room.

This perceived attitude may have played a part in the fateful royal commission testimony late last year.

Henry told The Deal he certainly didn’t intend to appear arrogant, adding: “I think there are issues I referred to in the appearance that are probably too difficult to talk about in that sort of environment.”

Acting CEO and likely heir as chairman, Phil Chronican, said the NAB resignations were not the result of the testimony or the fateful three paragraphs on page 411 of the royal commission’s report.

“It was what led to the paragraphs, and you realise the commission had all our misdemeanours and probably was across more of their detail than anyone,” he said.

The circumstances of Henry’s resignation are on any reading a sad end to a brilliant career.

The irony being he, more than anyone in the industry, had pushed for the commission to be established and more than any had contributed to the public debate on a range of issues.

He admits asking himself why the board didn’t jump in earlier on issues like fees for no service.

He also inexplicably presented to last year’s annual meeting a remuneration report that received the biggest “no” vote on record.

Yet he and Ken Hayne agree on the central issue, with Henry telling The Deal: “Everyone in business acknowledged the need to keep customers happy but how much time do they spend actually doing so?”

He said the impact of the commission would depend on how banks responded, “because if the banks just say ‘we have done all that is needed’ then questions will be raised”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout