The actual regulation causing the most worry was the APRA missive known as APG 223, which detailed how small business expenditures had to be considered, but the royal commission hoopla has made frontline staff very nervous.

Governments hate slowing economies, maybe more than banks, so the thinking may be if the regulatory pendulum has gone too far, with ASIC deputy Daniel Crennan threatening jail, then it’s not a bad time to ring the warning bell.

What better time for the banks to cry poor and say “you are shackling us with so much regulation that we are scared to lend”?

ASIC, of course, must be careful not to raise expectations too high.

Parliamentary committee chair Tim Wilson noted “overzealous regulation could have an impact on credit”.

Westpac’s Brian Hartzer confided last week he was finally seeing some light at the end of the tunnel after 120 per cent of his time was focused on royal commission issues.

ANZ chief Shayne Elliott told The Australian the work he was doing flowing from the commission was part of the way forward, making the bank less complex, more focused on customers and fixing mistakes.

Elliott was the latest to express his concern, saying the bank had become too risk-averse and the regulatory backlash was the principal cause, rather than lack of demand.

This follows similar comments made earlier this week by Westpac’s retail chief David Lindberg, who said the bank’s conservatism had cut business lending.

AMP chair David Murray was the most outspoken on the issue.

But NAB’s Phil Chronican bucked the party line by saying it was a lack of demand.

This was in line with earlier comments from CBA’s Matt Comyn and Westpac’s Hartzer, who maintained the banks were ready, willing and able to lend money.

The Westpac and CBA brass were in Hong Kong this week speaking to investors at the Credit Suisse conference.

Just how effective this lobbying switch will be remains to be seen because the ALP for one is keen to maintain the pressure on the banks.

Elliott stressed: “We need to have a fully functional financial system.”

Ever the diplomat, he also expressed support for more parliamentary hearings and declined to say anything negative about such measures as the bank levy and increased controls on executive pay.

Chronican has a few things on his to-do list, given he is the chair acting as chief, but confided interviews for the new boss would happen in the next month.

He also has at least two board vacancies to fill, where he runs into a conflict between the need to add risk and audit skills to the board while at the same time maintaining the diversity of opinion that everyone says is crucial to a functioning board.

A bunch of well-rounded accountants may not satisfy the diversity angle.

New broom at ACCC

Veteran lawyer Stephen Ridgeway is set to be unveiled as the new mergers commissioner at the ACCC, replacing Roger Featherston, who leaves in June after five years on the commission.

Ridgeway was a partner at King & Wood Mallesons for the past six years after starting his career with the Australian Government solicitor and then moving to what is now Ashurst.

Ironically, Featherston was also a long-term partner at Mallesons.

The role as mergers commissioner is often filled by an economist, with Jill Walker and Stephen King filling the role before Featherston’s appointment.

Ridgeway is a highly regarded member of the so-called trade practices mafia, having represented a string of high-profile clients from BHP to Flight Centre, and working both sides of the street for the government and companies under attack.

The appointment is subject to approval from the majority of state and federal governments and is expected to be made shortly.

It comes as the ACCC has shown itself to be more commercially aware than some think with its decision to bring forward its call on the IPH bid for rival patent attorney firm Xenith to today.

As reported yesterday the ACCC was originally due to decide the issue on May 2, which was after the April 3 scheme meeting to decide on the proposed Qantm-Xenith merger.

It may clear the IPH bid or issue a statement of issues.

Xenith and Qantm control 15 per cent of the intellectual property and patent market and IPH controls 22 per cent.

The Xenith-Qantm deal was cleared last week.

The ACCC bought forward its ruling on Transurban’s purchase of the WestConnex toll road concession by a week to meet NSW government timetables.

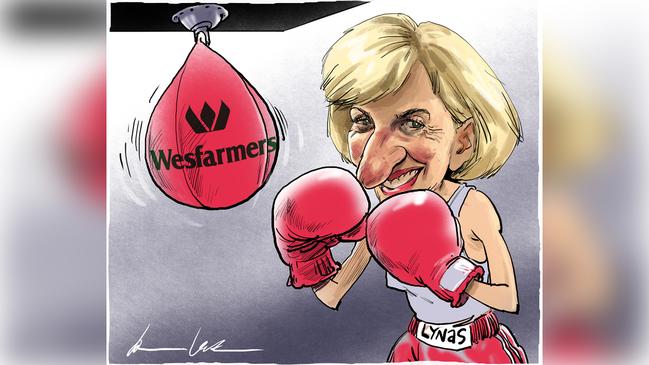

Fighting her corner

Wesfarmers could build 45 new Bunnings stores for the cost of its hostile Lynas bid, and when the target’s chief Amanda Lacaze is finished Rob Scott may wish he took the former route.

Before a slight bounce yesterday its market value fell by $1.3 billion on Monday, just below the $1.5bn bid value.

Lacaze came out all guns blazing yesterday, which was a welcome sight but risky because any stumbles from here will be magnified.

She does have actual reputational and practical issues to cope with in Malaysia.

The heavily shorted stock fell early yesterday but continued its climb, closing 1.9 per cent higher at $2.14 a share, bring the two-day rise to 38 per cent, which suggests, short interest aside, the market is backing a Wesfarmers deal.

Malaysian Environment Minister Yeo Been Yin is on the record wanting the waste out, and Lynas auditor Ernst & Young (the same auditor as Wesfarmers) noted earlier this year the environmental issues “may cause significant doubt about the consolidated entity’s ability to continue as a going concern”.

Lacaze talked a bigger game yesterday, as though the issues were under control, so it remains to be seen. Meanwhile, Wesfarmers is waiting on the sidelines.

Its proposal first went to Lynas on Monday last week in a call from Scott to Lynas chair Mike Harding, and when the letter arrived on Tuesday it was considered, then thrown in the bin.

It resurfaced on Monday when Wesfarmers revealed its highly conditional offer.

Lacaze told The Australian: “Wesfarmers has a fine opinion of itself, but as a Wesfarmers shareholder I am very disappointed.”

“It brings nothing to the table but a cheque book,” she added, noting “I will not hesitate calling out bullying when it happens.

“Wesfarmers simply doesn’t have access to the critical information on this company, which is a lot more complex than an Australian retail business.”

Lacaze has no such doubts as she painted a bullish picture.

She is a veteran with spells at Nestle, Incitec and Telstra.

“Wesfarmers thinks because it runs a fertiliser plant it can run a complex business like this one.”

She rejected suggestions that waste materials from the Kuantan plant be exported to Australia, saying it was inconsistent with world trading rules — the country that gets the economic benefit should deal with the waste.

Australian banks have started fighting back against the regulatory backlash, declaring it has resulted in a cut-back in loans that is slowing the economy.