AMP ignored prophet for profits

Rewarding executives for chasing short-term profits at the expense of long-term stability was dangerous, an AMP executive warned.

Rewarding executives for chasing short-term profits at the expense of long-term stability was dangerous, an AMP executive warned.

And it would be sheer political madness to take the company tax cuts to the next election.

The finance sector is more cartel than competition – that’s what must change.

Kelly O’Dwyer doesn’t agree banks should be quarantined from getting the government’s planned business tax cut as opposed by Derryn Hinch.

Financial Services Minister’s fiery TV defence of the government over the bank inquiry shows it has learned nothing, Labor says.

In the night of the long knives at AMP, careers were ended, reputations trashed and wall-to-wall reviews set up.

ANZ subsidiary RI Advice allowed an adviser who failed its audits to continue giving advice to clients, the inquiry heard.

The forced resignation of AMP’s CEO appears to have fallen short of expectations as company is warned of a “death spiral”.

Wrongdoing uncovered by the royal commission forces bank heads to admit their opposition to the inquiry was a mistake.

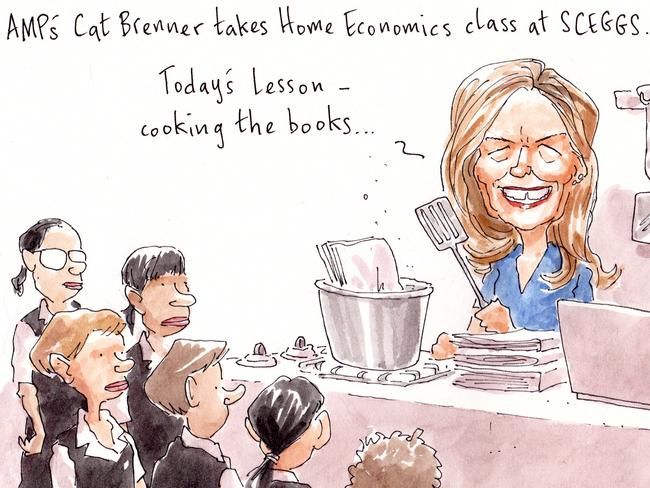

When Catherine Brenner accepted the role as chairman of AMP, it was the pinnacle of a glossy career. But she should’ve known.

So are we still to believe Australia has the best regulated banking system in the world?

Percentage fees are the dirty secret at the heart of the corruption of financial services. Ban them.

John Howard has declared it too early to tell whether the Hayne royal commission will turn out to be worthwhile.

For much of its 169 years, the AMP has been the most trusted financial institution. This week that trust was shattered.

AMP chairwoman Catherine Brenner was caught red-handed in the middle of the cover-up.

More horror stories from bank inquiry as ANZ exec says the “right advice was to give no advice” in case of widowed pensioner.

An ANZ exec says it took too long to compensate customers dudded by a planner poached before new laws came into effect.

Westpac did not pass on “serious concerns” about a financial planner to his subsequent employer, bank inquiry hears.

Treasurer Scott Morrison has put company boards on notice that they are ultimately responsible for corporate culture.

AMP chair Catherine Brenner moved to save herself by fast forwarding Craig Meller’s exit, but her position is untenable.

Senior lawyers have played down the prospect of AMP executives or directors going to jail.

It might pay you to take a leaf out of AMP chairman Catherine Brenner’s personal playbook of wealth management.

Major banks could face maximum fines of $210m or be stripped of 10 per cent of their annual turnover for serious misconduct.

Banks delayed their crackdown on dodgy practices in favour of more lucrative activities, an inquiry has heard.

Nurse Jacqueline McDowall paid tens of thousands to a Westpac planner for help on her retirement dream. His advice cost her dearly.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/22