AMP: Calls for more sackings as CEO Craig Meller quits

The forced resignation of AMP’s CEO appears to have fallen short of expectations as company is warned of a “death spiral”.

The forced resignation of AMP chief executive Craig Meller has not soothed investors baying for more blood at the top ranks of the besieged wealth management giant.

The fledgling chair of the $13 billion group, Catherine Brenner, yesterday announced the first scalp collected by Kenneth Hayne’s royal commission — bringing forward her chief executive’s resignation by about eight months.

Mr Meller said last month he would be departing AMP at the end of the year to spend more time with his family, in an announcement that came weeks before the company was required to front up to the second round of hearings for the banking royal commission.

But angry shareholders are continuing to circle the troubled company, and putting pressure on acting managing director Mike Wilkins to sack more executives and board members responsible for the egregious misconduct aired in the royal commission this week.

This week it was revealed AMP was charging customers for services not received and then repeatedly lied to the Australian Securities & Investments Commission about it, while Ms Brenner and the board manipulated a supposedly independent report to suppress Mr Meller’s name in the audit.

AMP group counsel, Brian Salter, was forced to take leave while a review of the company’s regulatory compliance is undertaken. Mr Meller was also forced to forgo any equity bonus relating to the latest financial year.

Ms Brenner, who took over from former AMP chair Simon McKeon in 2016, said the company “apologises unreservedly for the misconduct and failures” in the advice business. “The board is determined that we will meet these challenges head on, accelerating changes in both culture and performance at AMP,” she said.

But shareholders believe there will have to be more senior managers sent to the guillotine.

The head of one of the country’s largest institutional investors, speaking on the condition of anonymity, said the board had to be “completely” rebuilt.

“It’s a bit like Watergate,” the person told The Weekend Australian. “There will need to be a reverse (burden) of proof. Each individual director will need to prove they were not complicit. They will need to prove they spoke out against it or reasonably prove they had no knowledge of it.

“The crimes are bad enough, but lying to the regulator, amending the Clayton Utz report to within an inch of its death — I can’t believe AMP, such an iconic organisation, I would have never thought they would have done that. I never would have thought any major institution would lie to the regulator.

“It could be the death spiral for the company.”

Mr Wilkins, a non-executive director on the AMP board since September 2016 and a former chief executive of Insurance Australia Group, will take over from Mr Meller until a permanent replacement is found. A board committee that will look at the issues raised by the royal commission will be led by Mr Wilkins and assisted by law firm Kingwood & Mallesons.

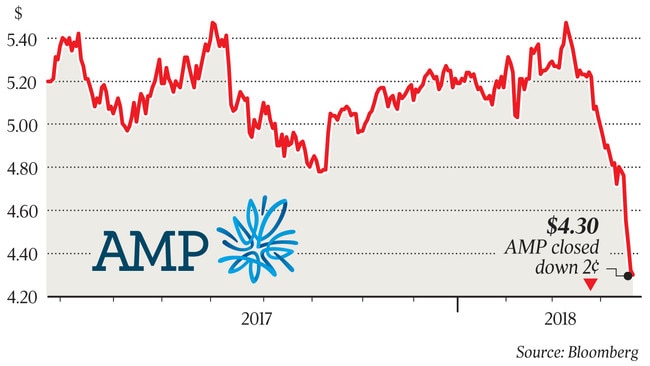

Shaw & Partners analyst Brett Le Mesurier said the royal commission “could just be the start” and the group’s share price could tumble to $4, down from its close yesterday at a four-year low of $4.30. The stock has plunged more than 20 per cent since early last month.

“A management shake-up is coming and it may extend to the board,” Mr Le Mesurier said.

Another fund manager, with shares in AMP, who declined to be named, said this week’s revelations were “clearly disappointing”.

“There’s going to have to be change. There has to be complete transparency in terms of the operating results and how they move forward from that. I’d like to see a new managing director hired from outside the company — a fresh set of eyes.”

Jason Beddow, chief executive of fund manager Argo, said the board had to “accept some responsibility about the disappointment of what’s gone one” and said the board set the tone for the entire organisation.

Mr Wilkins’ appointment will not prevent further questions being asked about his time on the board. He was made head of the company’s risk committee in May last year, about the time the board was told about its advice division’s misleading statements to the regulator.

Peter Morgan, a private investor and former Perpetual and 452 Capital money manager, said: “They should all be chucked out. I don’t care how good the bloke was previously at other places. Serious questions need to be answered. Drain the swamp.”

Financial Services Union national secretary Julia Angrisano said bad culture in companies began at the top.

“It’s in the executive ranks where the real change needs to happen — change to remuneration structures and change to systems that value and reward compliance over revenue and profit,” Ms Angrisano said.

One insider, who has dealt with Mr Wilkins for years, said he would force change throughout the business.

“He’s a real meat-and-potatoes sort of guy,” they said. “He used to drive an old Merc — the car was 10 years old — he’s tight with money. He’s not Mr Charisma.”

Regal Funds Management portfolio manager Omkar Joshi said there could be a board clear-out if the bad headlines continued.

“Although they haven’t personally been involved in much of what has gone on, obviously the buck does stop with them,” Mr Joshi said. “Mike Wilkins is obviously a positive appointment, but he’s been on the board for more than a year. If it’s a cultural issue, does a board clear-out fix it? Probably not.”

Since assuming the chair of the financial services giant, Ms Brenner’s leadership style has ruffled feathers.

In her first months in the job, she said management had to work “faster” to deliver returns for shareholders and then, subsequently, disclosed a major shareholder had called for the sacking of Mr Meller.

Persistent talk that a divided board led to the abrupt departure of former AMP chairman Simon McKeon in early 2016 has plagued the company.

The reasons for Mr McKeon’s exit have still not been publicly revealed, but several reports have suggested there was friction between board members.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout