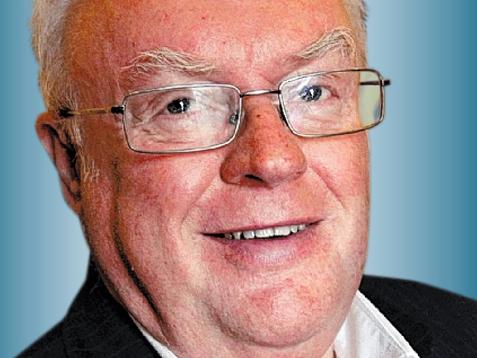

David Murray takes AMP chair

David Murray has been appointed incoming AMP chairman and will join the company’s board on or before July 1.

David Murray has been appointed incoming AMP chairman and will join the company’s board on or before July 1.

We’re finally waking up to the fact that most people simply didn’t need the services that were being rammed down their throat.

Customers are being treated as an afterthought when it comes to data privacy.

Financial advisers also have a poor record in the US.

The inclusion of female directors does not appear to have improved company ethics.

CBA now admits it should have told customers it had lost historical records for close to 20 million accounts.

The woman who ran the CBA wealth management arm that charged fees to the dead has received a million-dollar windfall.

It’s hard to know what was worse: the woeful advice or the lack of action by watchdogs.

After six years of not making any disclosed political donations AMP gave over $350,000 to the major parties, which started just after Catherine Brenner joined.

If banks had of stuck to the subject of banking instead of making political statements they may not be where they are now.

Chris Bowen says Scott Morrison should explain his comments on CBA resignations, describing them as “cynical and dishonest”.

The CBA is expected to cut executive pay again this year and has been slammed for a culture where no one learned from mistakes.

The royal commission is revealing a deep malaise — venality, in fact — in the boards of all the big banks.

Financial advisers and big banks are breaking up even before the royal commission has finished its work.

Chris Bowen says the CBA review is a report on one bank, when we should be receiving final royal commission findings on the whole sector.

Commonwealth Bank will order 500 executives to read a scathing report on the bank’s culture and come up with ways to fix it.

Commonwealth Bank CEO Matt Comyn will forgo a short-term bonus of up to $2.2m this year in the wake of bank scandals.

The politicians who moralise about the banks are no white knights when it comes to doing the right thing. Far from it.

CBA has been forced to top up capital levels by $1bn after a review of culture found big profits “dulled its senses” to risks.

AMP legal counsel Brian Salter has hit back at criticism of his role in the fee-for-no-service scandal.

Many of the 14,000 or so financial planners working for arms of the big banks could face prosecution for shoddy advice.

On average, the more a person pays for experts to manage their superannuation savings the worse the investments perform.

AMP’s handling of the fees-for-no-service scandal has been akin to “putting a Band-Aid on a haemorrhaging wound’’.

It’s now two boards that Catherine Brenner is off, the former AMP chairman standing down from the Art Gallery of NSW.

AMP’s Brian Salter has defended his role in the fees-for-no-service affair and says he learnt of his sacking via the ASX.

Bill Shorten claims tax cuts for the big banks would be the “biggest reverse political donation in Australian history”.

AMP has today carefully avoided any acceptance of the fact it was caught stealing from customers and lying to the regulator.

Catherine Brenner resigns as chair and AMP company secretary Brian Salter will depart after bank inquiry revelations.

Superannuation companies owned by the big four banks are boosting their revenues by paying low interest rate returns.

The AMP board held a crisis meeting last night to resolve the future of chairwoman Catherine Brenner.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/20