Banking royal commission: higher fees and lower returns for big banks’ super funds

On average, the more a person pays for experts to manage their superannuation savings the worse the investments perform.

On average, the more a person pays for experts to manage their superannuation savings the worse the investments perform.

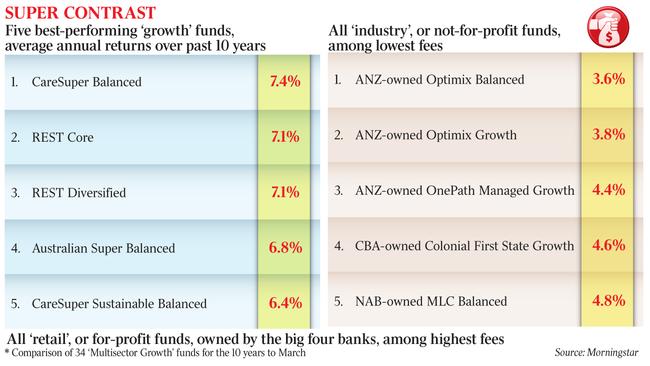

According to data by analyst Morningstar, the five worst-performing “growth” super funds over the past decade were all owned by one of the big four banks, with the three worst performers owned by ANZ. Funds owned by NAB and CBA were also among the worst.

By contrast, the five top-performing funds were all “industry”, or not-for-profit, super funds, with top performer CareSuper’s Balanced fund delivering an average total return of 7.4 per cent a year over the past decade, more than double the 3.6 per cent annual return delivered by the ANZ-owned Optimix Growth fund.

Despite the poor returns of retail funds — more than 95 per cent failed to deliver above median super returns over the decade to 2017 — on average they continued to charge investors the highest fees.

Data from the Rainmaker Group shows that in 2016 retail funds charged ordinary working super investors average annual fees of 2.01 per cent on their investments, compared with average fees of 0.97 per cent to investors in industry funds.

A major contributor to the poor performance of retail funds, such as those funds owned by the big four banks, which hold $309 billion across 12.3 million super accounts, is higher fees.

But there are other factors at play, as revealed by The Australian yesterday, with super companies owned by the big four banks boosting their collective revenues by hundreds of millions of dollars a year by paying customers invested in low-risk cash options interest returns as little as one-quarter of actual market rates.

Regarding the poor performance of ANZ-owned funds, a spokesman yesterday said those three funds that had performed the worst in the country were “legacy funds”. ANZ had moved the “vast majority” of these investors out of those funds by July 1 last year.

“Customers left are those who chose the investment options,” the spokesman said.

According to Morningstar, the average 10-year return for growth funds was 5.7 per cent a year, with a median return of 6 per cent. For retirees, said to be in the “pension” phase, retail funds charged average fees of 1.86 per cent in 2016, compared with 0.97 per cent paid by investors to industry funds.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout