NAB inquiry attack falls flat

NAB concedes it had no lawful entitlement to seize the proceeds of a sold home to repay the owner’s business debts.

NAB concedes it had no lawful entitlement to seize the proceeds of a sold home to repay the owner’s business debts.

CBA’s chief risk officer concedes the bank’s risk management is not up to scratch, and it did not properly log misconduct.

Bankwest pressure to sell a pub despite a clean payment history wasn’t surprising, CBA’s chief risk officer has told the inquiry.

Inquiry hearings into agricultural lending may widen to probe banks’ dealings with indigenous communities.

Shine Lawyers has refused to detail funding arrangements for its class action suit against AMP amid law firm bidding war.

ASIC’s approval of the banking code of conduct depends on evidence at the royal commission, it has told Kenneth Hayne.

A former pub baron has told the bank inquiry how receivers appointed by CBA ripped out $180,000 worth of chandeliers.

In a highly anticipated appearance, CBA’s David Cohen detailed the disasters in Bankwest’s loan book.

Wheeling out a blind pensioner was a new low for the royal commission’s theatrics.

Expect to hear some gory details when CBA chief risk officer David Cohen faces banking royal commission lawyers.

The bank ombudsman says Suncorp should drop its demand a jobless widow repay $220,000 in six months to clear a loan.

A Westpac chief didn’t understand legal documents used to demand customers put $100,000 into a term deposit.

Shine Lawyers has become the third firm to file a claim against AMP over revelations aired at the bank inquiry.

Suncorp chief of banking and wealth David Carter agrees the bank acted irresponsibly in approving loans.

AMP has tapped David Cullen to replace Brian Salter as its top in-house lawyer as five class actions loom.

Financial advisers have been urged to take the lead in repairing their industry’s battered reputation after bank inquiry shocks.

Westpac bankers still receive bonuses largely based on selling financial products, the royal commission has heard.

Pauline Hanson wants the bank inquiry widened and says jail for executives guilty of misconduct “should be looked at”.

ANZ executive admits a bonus scheme encouraging bank staff to “relentlessly” sell small business loans made little sense.

Bank directors bear responsibility for the poor treatment of small business lenders and the ATO is following in their footsteps.

ANZ executive admits the bank did not demonstrate the care and skill of a prudent banker in the case of a franchise loan.

It was common practice for Westpac bankers to fill out loan documents with false information, the royal commission has heard.

The way banks deal with the franchise industry has come under the spotlight of the financial services royal commission.

NAB has foreshadowed an overhaul of executive pay practices that will include incentives linked to the treatment of customers.

NAB will tie the treatment of customers to executive bonuses as it looks to foster cultural change, says chair Ken Henry.

Westpac allowed a vulnerable woman to pledge her house despite her daughter’s loan application containing falsehoods.

The government is set to suspend the operation of the Financial Sector Advisory Council while the bank inquiry is underway.

Easy to get outraged at banks after someone loses their home when they go guarantor for bad loan. But what’s the alternative?

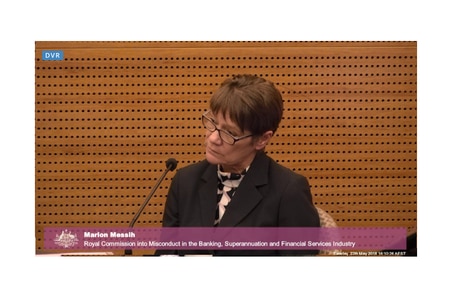

Marion Messih has told the banking inquiry how she is still in debt after taking out a loan through Westpac to open a Pie Face franchise.

Agri lending has put a royal commission road trip on the agenda, as a special guest turns up at the latest bank inquiry hearings.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/18