Fancy flats should keep Catherine Brenner in clover

When it comes to wealth management it might pay to take a leaf out of AMP chairman Catherine Brenner’s personal playbook, rather than trusting the advice of her disgraced financial services giant.

Brenner, 47, and her husband Phillip Brenner, who turns 58 in June, are not leaving their retirement savings to chance.

The pair, who appear to have coined their own celebrity power couple pet name via their PhilCat Pty Ltd corporate vehicle, have just sold a substantial residential development site on Military Road in Cremorne on Sydney’s lower north shore.

The Brenners spent a large part of the past year gaining council approval for a 20-unit, multi-storey luxury development branded Cremorne 211 on the site, with an estimated project cost of $6.2 million.

The successful DA process was undertaken by their Phine Pty Ltd, which had previously controlled the investment property — currently comprising four tenanted units — until half of the property was recently transferred to the Brenners’ self-managed super fund and a quarter to each of the pair.

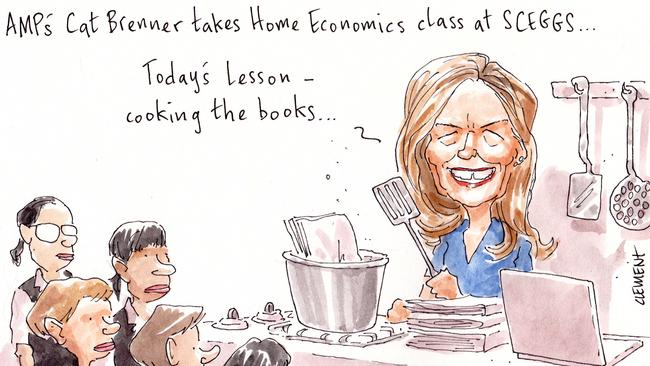

With that substantial private project, you have to wonder how the AMP chairman had time for her also heavy directorial duties. The David Gonski-mentored Brenner is also on the board of Boral and Coca-Cola Amatil, as well as prestigious Sydney girls’ school SCEGGS Darlinghurst.

This week Kenneth Hayne’s royal commission heard how Brenner as AMP chairman sought to have law firm Clayton Utz’s independent report into the fee-for-no-advice debacle modified to protect execs including her CEO Craig Meller.

What a role model for the young ladies, with many of Brenner’s boardroom contemporaries now wondering aloud how long the former investment banker can survive as a director, let alone chair, of the $14 billion AMP.

Brenner’s is an extended family not unfamiliar with corporate scandal and sage advice may be close at hand.

Husband Phillip is the big brother of highly successful lawyer and now company director Maxine Brenner, who is the wife of Jodee Rich — the founder of the James Packer and Lachlan Murdoch-backed phone company One. Tel.

Rich knows what it’s like to be on the receiving end of ASIC’s wrath.

He spent almost a month in the witness box in the early 2000s defending his role in the dramatic collapse of One.Tel, but he was ultimately exonerated.

Hard week

It hasn’t exactly been a banner week for the Sally Loane-led Financial Services Council.

Two of its directors — one brand new on the Perpetual boss Geoff Lloyd-chaired board — have been in the hot seat this week at Kenneth Hayne’s headline-grabbing royal commission.

On Monday, there was AMP’s head of financial advice, Jack Regan, unfolding his devastating evidence on a boardroom cover-up at the financial services giant that also implicated top-tier law firm Clayton Utz.

Then over the past two days we’ve heard from the Commonwealth Bank’s Marianne Perkovic, who has been in Melbourne after travelling from her Forestville McMansion, in her role as head of the CBA’s exclusive, richies-only private bank.

Perkovic, a long-term wealth management exec, only joined the board of the FSC at the end of last month, apparently taking the slot previously occupied by her former colleague at the bank Annabel Spring, who as head of wealth management also knows a thing or two about being in the hot seat and corporate scandal.

Spring stopped working at CBA in December, but remains on gardening leave and in the bank’s employ until mid-2018. Lucky her.

As Margin Call told you last week, Spring and her MacBanker husband Peter Stokes are close neighbours of also-in-hot-water AMP chairman Catherine Brenner and her doctor husband Phillip Brenner on Centennial Park’s prestigious Lang Road — one of the eastern suburb’s 11 streets where the homes are worth $10m-plus.

But back to Loane’s FSC, where there has been some friction recently with AMP (represented by Regan) over the council’s handling of the recently finalised Insurance in Superannuation Voluntary Code of Practice, which comes into effect on July 1.

Word is that AMP, led by CEO Craig Meller, believes its concerns haven’t been properly addressed, and has been wondering about the leadership of the FSC.

We guess that’s unlikely to go anywhere now though — between James Shipton’s ASIC and Hayne’s inquiry, AMP has enough on its hands.

Nothing to see here

A warm and fuzzy early morning phone call yesterday from the friendly folk in compliance at Dominic Stevens’ ASX to Garry Hounsell’s Myer left the retailer confident that its nothing-to-see-here approach to disclosure was just fine.

But the market, it seems, had different ideas, with the beleaguered department store group’s shares slashed by 5 per cent on news (via Margin Call on Thursday) that its $20m rental dispute with its Chadstone landlord was back on foot.

Myers shares closed at just 35.5c.

This means that its market value is now half of the group’s already written-down $580m in net assets.

One of Myer’s banking covenants dictates that the group’s net assets must be more than $500m, but investors are now voting with their feet on their own view of the value of Myer’s operations.

In January Myer was happy to officially report to the market that it had won its legal battle in the Supreme Court of Victoria with Vicinity Centres and billionaire John Gandel — its Chaddy landlords.

But the pair appealed in March (a week before Myer’s red ink-splashed interim result), bringing with it a potential $19.4m contingent liability, which Myer still hasn’t told the market about.

So now the company, floated in late 2009 for $2.2bn, is worth just $291m.

Like Hounsell says, nothing to see here, folks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout