Royal commission: banks face new fines of up to $210m

Major banks could face maximum fines of $210m or be stripped of 10 per cent of their annual turnover for serious misconduct.

Major banks and financial services companies could face maximum fines of $210 million or be stripped of 10 per cent of their annual turnover for serious misconduct, under a new criminal and civil penalties regime imposed by the federal government in the wake of scandals exposed in the banking royal commission.

Dodgy advisers as well as banking executives and directors will also be targeted with more punitive sentences and ASIC will be granted greater powers to investigate and prosecute dishonest and criminal behaviour in the financial services industry.

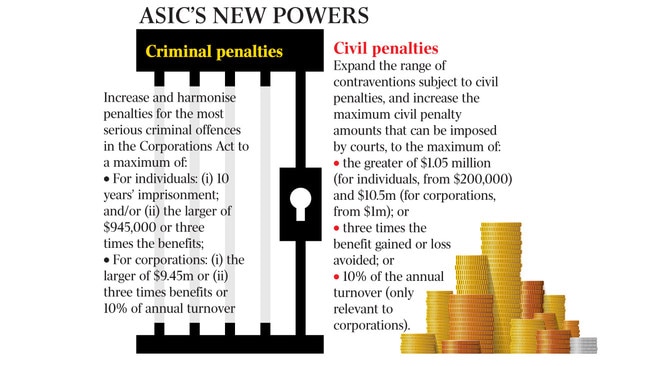

Under the reforms criminal convictions would attract up to 10 years in prison and a fine of $945,000 and corporations could be fined up to $9.45m or 10 per cent of their turnover. Civil infringements would attract a fine of up to $1.05m for individuals and $210m for corporations.

The broadening of the clampdown on a sector reeling from scandals follows admissions by Finance Minister Mathias Cormann that the government would be open to extending the Hayne royal commission by a year if needed.

Scott Morrison said yesterday the almost daily confessions of misconduct in the industry before the commission were “deeply disturbing” as Bill Shorten accused the government of having to be dragged into calling the inquiry.

The Treasurer, who warned that finance executives faced a risk of being sent to jail, said the new penalties regime was designed to deter future criminal and fraudulent behaviour as well as punish those caught.

“The punishment has got to match the crime … these are crimes that have multiple victims,” Mr Morrison told The Australian. “They bring Australia’s penalties into closer alignment with leading international jurisdictions, and ensure our penalties are a credible deterrent to unacceptable misconduct.”

In further bombshell evidence to the commission yesterday, it was revealed that Commonwealth Bank charged fees for ongoing services to clients who had been dead for years — at least seven years in one case and as much as a decade in another. None of the planners, who worked for CBA subsidiary Count, was disciplined with anything harsher than a warning, a document tendered to the commission showed.

One planner’s client had been dead for seven years before the planner contacted his widow. The planner took no action to fix the continuing charges, according to the document, a management report from Count’s risk and compliance forum from late 2015.

CBA spokesman Danny John said the customers involved had been compensated in 2016 and last year. “We owe the families of our deceased customers a sincere apology, not only for the oversight and the length of time to resolve this but for what happened in the first place,” he said.

Westpac was also targeted by the commission yesterday after nurse Jacqueline McDowall gave evidence that, in 2015, the bank’s financial adviser, Krish Mahadevan, tipped her and her truckie husband into a self-managed super fund to follow their dream of buying a bed and breakfast.

She said the bank then soaked them for tens of thousands in fees and insurance commissions.

Despite assurances from Westpac banker Karl Sleiman, who described himself as the “money man”, that the couple could borrow up to $2m to buy a business if they sold their home, the strategy was a failure. After losing their Melbourne home and much of their $200,000 nest egg, the couple has moved to the Northern Territory for work.

Ms McDowall said her plans for a retirement at 60 were in ruins and she would now probably be working until she was 80, “in a wheelchair or Zimmer frame”.

Mr Mahadevan still works at the bank in Melbourne but could not be reached for comment yesterday.

The Treasurer and Financial Services Minister Kelly O’Dwyer will today announce the overhaul of penalties that in some cases have not been changed for 25 years. They are among 30 recommendations adopted from the Australian Securities & Investments Commission enforcement review taskforce, established in 2013, in response to the Murray inquiry into the financial system.

It will double to 48 the number of civil offences available to ASIC while elevating 19 of the most serious criminal offences relating to financial services such as defective disclosure, corporate fraud or dishonest conduct to the equivalent of insider trading or market misconduct. Individuals would face up to 10 years in jail and corporations would be fined up to 10 per cent of their annual turnover.

While the new penalties will apply to any company or company director found to have engaged in serious misconduct under the 346 offences contained in corporate law, the government has framed them as being primarily targeted at the banking and financial services sector.

Strengthening ASIC, including a new deputy commissioner to focus on law enforcement, Daniel Crennan QC, follows sensational disclosures in the commission this week that AMP, one of the five financial pillars, had misled the corporate regulator and knowingly ripped off customers.

Ms O’Dwyer said the increases in punitive fines and jail time were the most significant in decades. “These reforms represent the most significant increases to the maximum civil penalties, in some instances for more than 20 years,” she said. “Stronger new penalties for corporate and financial misconduct will ensure that those who do the wrong thing will receive appropriate punishment.”

Don Argus and David Murray, previous chief executives of National Australia Bank and Commonwealth Bank respectively, said separation of the major banks’ advice divisions from their product development arms would not resolve the conflicts of interest that have contributed to so much customer pain.

The two senior business figures were responding to a call by former competition watchdog chairman Allan Fels for “structural separation” of advice from so-called product manufacturing. Professor Fels said legislation should be introduced to force the big banks to sell their advice businesses. This would remove a conflict of interest created by the bank manufacturing the product at the same time as employing financial advisers to guide customers on their investment strategies.

“The banks are purporting to be independent and impartial on the sale of financial products, including those of competitors, but it sets up a dangerous situation,” the former Australian Competition & Consumer Commission chief said. “The royal commission has showed banks can’t manage these conflicts, and the solution is not in government or third-party regulation, let alone self-regulation.”

The commission has heard evidence of customers getting poor or inappropriate advice as advisers enriched themselves through incentive-based remuneration.

In January, ASIC also found that in vertically integrated institutions, 68 per cent of funds invested by customers went into in-house products compared with only 32 per cent for external products, despite external products dominating approved lists.

Mr Argus, who retired from NAB in 1999 before it spent $4.6 billion on advice business MLC, said legislation to unwind vertical integration was one solution, but it still left the problem of a workforce lacking the relevant skills to deliver the right solution to customers.

“I’m sceptical about a regulatory solution,” he said.

Mr Murray, who engineered CBA’s $9bn takeover of the Colonial group in 2000 and led the 2014 financial system inquiry, said vertical integration wasn’t the main issue causing trouble in the financial advice industry.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout