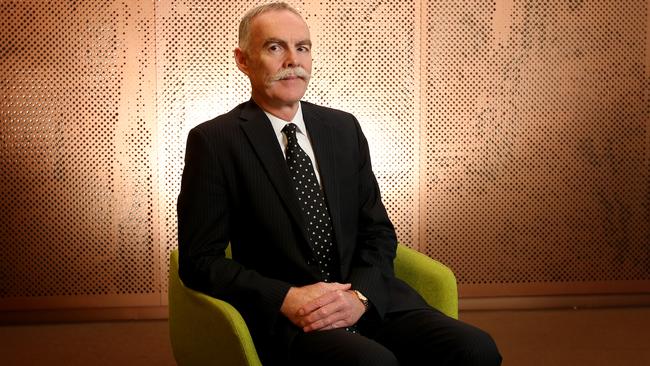

Australian Super’s Ian Silk urges hard line on underperforming funds

The most powerful voice in the superannuation industry is urging a zero-tolerance cleanout of dud funds.

The nation’s most powerful superannuation boss has urged the $2.7 trillion industry to adopt a zero-tolerance approach to consistently underperforming funds as part of a new era of accountability and higher standards in the wake of the Hayne royal commission.

In a keynote speech to a conference in Brisbane today, Ian Silk, chief executive of the $140 billion not-for-profit fund AustralianSuper, will unveil an ambitious blueprint for the industry to perform at an optimal level, reflecting commissioner Ken Hayne’s final report.

“Firstly, and most crucially, there should not be any consistently underperforming funds. This is the most important change that will benefit members,” Mr Silk will say.

“You shouldn’t be able to be in a consistently poor fund because they simply shouldn’t exist.

“If those running consistently underperforming funds don’t do the right thing, [the prudential regulator] APRA must.”

The AustralianSuper boss will urge industry funds to consider five issues in relation to the threshold requirement of serving the best interests of members. The first was whether preservation of the status quo was the best option if cashflow and member numbers were declining, or if performance was consistently below the median.

They should also ask if they were aggressively transferring members to an eligible rollover fund to serve their best interests instead of the economics of the fund, and whether they had instructed financial advisers to tell the member about a better fund and facilitate any transfer.

Funds should also ask themselves if they vigorously pursue non-payment of super contributions on behalf of members.

Mr Silk will seek to allay emerging fears industry funds, which are now bigger as a group than the for-profit retail funds, are becoming increasingly active investors, promoting governance causes that are sometimes seen as political.

Business Council of Australia CEO Jennifer Westacott said last week she’d want to “see the fine print” if her super fund said it wanted to be politically active.

This followed commentary by ACTU president Michele O’Neill last month that 30 industry funds should use their muscle as major shareholders to convince BHP to save the jobs of 80 shippers. BHP had previously announced plans to use cheaper foreign shipping crews to transport iron ore from Western Australia to the Port Kembla steelworks in Newcastle.

The ACTU’s intervention triggered a response from Treasurer Josh Frydenberg, who wrote in a letter to the prudential regulator saying super was “not a plaything for union bosses nor a platform for pushing their industrial relations agenda”.

Mr Silk will say today that, notwithstanding some of last week’s “hysterical” commentary, industry funds had proven themselves to be responsible owners and managers of members’ capital and were committed to delivering strong investment performance.

More broadly, he will say 2018 was a year that “shook the foundations” of the super system, with the royal commission, a Productivity Commission review and changes in the budget representing a huge wake-up call for the superannuation industry.

While the PC review showed industry funds, on average, “massively” outperformed retail funds, some of the poor performers were also in the not-for-profit sector.

There was also no cause for celebration, complacency or hubris among industry funds.

“The retail sector may regroup and become strong performers for their customers — though their business model makes this a challenging prospect for them,” Mr Silk will say.

“But if it’s not retail funds, then any number of new models might emerge.”

The new era, he will say, was likely to be characterised by more challenging investment markets.

In the past, the award-based distribution system had facilitated low-cost growth at a healthy scale, and there had been few new entrants to the industry and little in the way of new business models.

Industry funds, however, were now the hunted instead of the hunters.

While member and community expectations would be higher, regulators would be more aggressive and the political and media scrutiny would be more intense.

Mr Silk will say the industry fund sector shouldn’t complain about greater scrutiny.

As the superannuation sector became more sophisticated it would need more specialist expertise at board level, but member representation was critical and should be maintained as boards and committees diversified their skills. The funds should also develop the expertise to provide digital services that were the equal of the banking and airline industries.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout