Panic in face of pressure, or does board know more?

Yesterday’s extraordinary action at NAB begs the question: what more does the bank know about leadership team?

Yesterday’s extraordinary action at NAB begs the question: what more does the bank know about leadership team?

Mortgage brokers hope to convince both sides of politics to back away from a ban on trailing commissions.

NAB will embark on a global search for a new CEO, but internal contenders are also expected to be among the candidates.

After 48 hours of “deep reflection”, NAB’s outgoing chief says he hopes the bank will go on to be great without him.

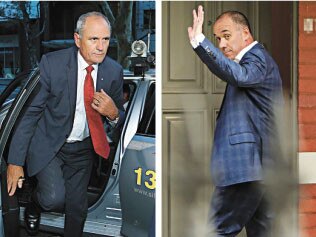

After serving the bank well for many years, Thorburn and Henry were dumped after just three paragraphs in Hayne’s report.

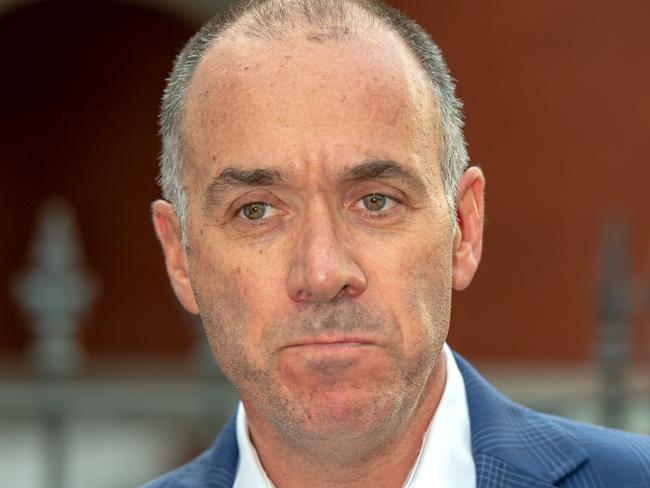

Ken Henry apologised for NAB’s failures as the bank announced his retirement and axed CEO Andrew Thorburn.

Regulators will likely be forced to test claims of insider trading on leaked Hayne report details despite internal scepticism.

Westpac’s CEO says Hayne’s suggestion of a combative relationship with ASIC relate to past events.

The AMP exec who admitted AMP had charged dead people has been replaced as head of its wealth unit.

Josh Frydenberg should realise he’s not going to be able to do anything about a credit squeeze from the opposition benches.

Talk of a credit squeeze has been vastly overstated, says the banking sector — a view fully supported by the Reserve Bank.

CBA chief Matt Comyn has cleverly positioned himself as a new face open to change and ready to adopt the Hayne religion.

What sort of farewell cheque will NAB boss Andrew Thorburn get now the board has decided the CEO should walk the plank?

RBA chief says bank accountability starts at the top, but leaves it others to “speculate on what that means”.

Under-siege NAB chief Andrew Thorburn concedes there are no guarantees he’ll last out the week.

It is remarkable that Kenneth Hayne singled out just one bank chair, Ken Henry, and his chief executive, Andrew Thorburn.

Scott Morrison has rejected Labor’s move to wedge the government over extra sitting days to debate Hayne findings.

Compliance and bureaucracy have been the big winners, along with the banks and wealth giants.

Embattled NAB chhief Andrew Thorburn is planning to jolt the bank out of its cultural malaise before the end of the year.

Australia’s biggest bank, the Commonwealth, is also its dirtiest, racking up a dozen breaches in Kenneth Hayne’s final report.

Kelly O’Dwyer has increased pressure on Labor to pass stalled legislation aimed at driving out underperforming super funds.

Consumers will lose out if a ban on trail commissions for mortgage brokers is adopted, say industry leaders.

National Australia Bank chief Andrew Thorburn has vowed to stay in his role and revisit the bank’s plan to fix its culture.

Major banks staged their biggest rally since the GFC amid investor relief about the royal commission recommendations.

Consumer advocates claim borrowers will no longer be shunted into super-sized loans if the government adopts a Hayne proposal.

Hayne was only meant to examine misconduct, yet the market expected him to fix an industry that actually wasn’t broken.

Banking royal commission gave evicted farming couple the sense they were not alone in their fight for survival.

Mortgage broking became a huge industry with no legal requirement for advisers to act in clients’ best interests.

Hayne appears to have used an axe on the mortgage broking sector when a scalpel would have done the trick.

PM stops short of calling for NAB resignations, but says Hayne’s sharp criticism means its CEO and chair must ‘reflect’.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/4