Banking royal commission: mortgage brokers say changes will hit consumers and ‘decimate us’

Consumers will lose out if a ban on trail commissions for mortgage brokers is adopted, say industry leaders.

Consumers will ultimately lose out and the mortgage broking industry will be decimated, if the government moves forward with the banking royal commission’s recommended ban on trail commissions, industry leaders say.

Currently, mortgage brokers receive both an upfront commission from banks, at the time a client takes out a loan, and a trail commission which continues for the duration of the loan. Commissioner Kenneth Hayne’s recommendations propose scrapping trail commissions altogether.

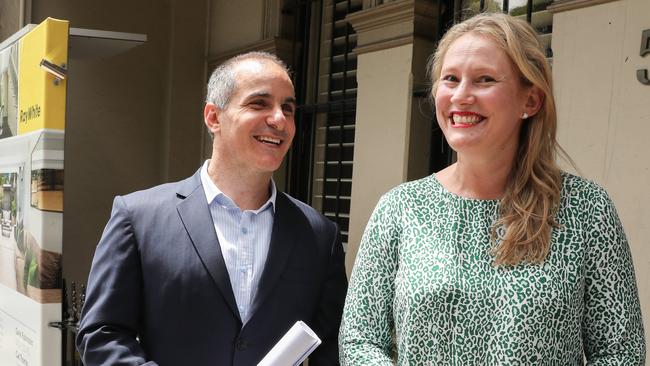

Managing director of mortgage broker Intelligent Finance Justin Doobov said brokers had been the scapegoat of the royal commission, and consumers would pay the ultimate cost.

“(Commissioner) Hayne spent less than 2 per cent of his time on mortgage brokers, and then he gives this bold statement of getting rid of trail (commissions),” Mr Doobov told The Australian.

“It will completely decimate the broking market — the banks won’t have any competition.” Mortgage brokers were made the sacrificial lamb of the royal commission, according to Mr Doobov, and the banks were actively lying about how mortgage brokers worked.

“The banks’ CEOs have played the royal commission like a fiddle, the banks have used all their political bandwidth and PR machine, and have been like a puppeteer pulling the strings,” he said.

Mr Doobov said the result would be the big banks having a monopoly over the lending market, and the banks would have to hire staff to service customers after settlements, and those costs would be passed on to consumers.

A client of Mr Doobov, Amanda Lacey, has had three properties financed through mortgage brokers and said it was not only the extra costs of having a loan financed by a bank that worried her but the onerous task of the applications process.

“I’m a working parent, and I’m not sure how people don’t use brokers, otherwise you just get stuck with the same bank over and over again, and the applications process is such a lengthy process and the brokers just take all the pain out of it,” Ms Lacey told The Australian.

“I’m not a legal expert but that price will come back to the consumer, which isn’t fair, and quite frankly I’ve had a property done through banks and they don’t even know their own product and they give you a loan agreement that isn’t the right fit.”

Mr Doobov said claims that brokers didn’t work hard enough for their trail commission were untrue, and 60 per cent of his brokers’ time was spent on existing clients, extending their interests and servicing them after settlements.

He said mortgage brokers did not make any upfront profit after setting up a loan, and the proposal to scrap trail commissions would destroy the industry and make it even more onerous for people, particularly those in regional areas, to get a home loan. “The royal commission was lied to — the banks said brokers do not do anything after settlement to service a customer. That is an absolute lie.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout