Banks surge after royal pardon

Major banks staged their biggest rally since the GFC amid investor relief about the royal commission recommendations.

The major banks have staged their biggest rally since the global financial crisis, helping to fuel a $33 billion sharemarket surge amid investor relief the recommendations from the Hayne financial services royal commission were unlikely to significantly dent the earnings power of the sector.

At the same time downtrodden wealth managers AMP and IOOF enjoyed record sharemarket gains as they emerged from the Hayne recommendations with their business models largely intact.

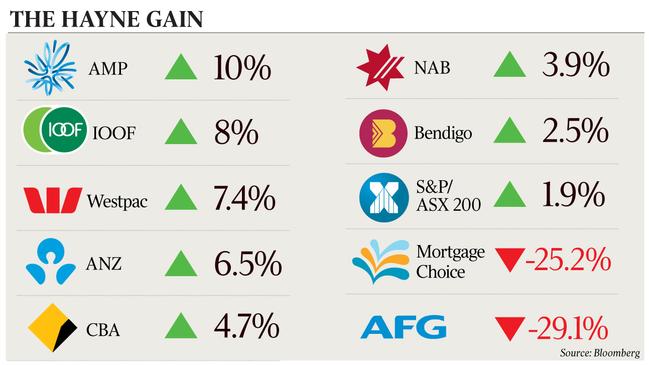

Indeed, the sharemarket welcomed the report after widespread fears of a crackdown on the major banks failed to materialise. The benchmark S&P/ASX 200 hit a three-month high of 6039.2 before closing up 2 per cent at 6005.9 points.

UBS analyst Jon Mott said the much-anticipated final Hayne report, released after the market closed on Monday, was “disappointing”.

After much discussion about misconduct within the banks and the need to change culture, the final recommendations fell well short of market expectations, according to Mr Mott.

“The soft recommendations of the royal commission final report is a clear win for the banks,” he said.

The major banks, along with AMP and IOOF, were slammed for a year after the royal commission was announced in late 2017 with a vicious sell-off wiping more than $100bn off their combined value.

But three of the big four banks yesterday rose the most since the spectacular gains that followed radical policy responses to the global financial crisis in 2009. AMP and IOOF rose the most on record.

Westpac surged 7.4 per cent to $26.70 a share. ANZ jumped 6.5 per cent to $26.86 and CBA rose 4.7 per cent to $73.60, while NAB added 3.9 per cent to $24.97 — its biggest rise since September 2011 — after the royal commission fell short of recommending an overhaul to their structure or capital requirements.

AMP climbed 10 per cent to $2.43 after hitting a record low of $2.15 before the final report of the royal commission was released late yesterday, while IOOF jumped 8 per cent to $5.27.

CBA chief executive Matt Comyn said there was a “clear need for change”, while ANZ described the Hayne report as a “defining moment” for the bank and the financial services industry.

“It has been a humbling experience for me, our leaders and all our people. We have learnt from this and accepted responsibility for our failings,” ANZ chief executive Shayne Elliott said. Westpac said it had already taken steps to address some of the issues raised.

However, the clear losers from the Hayne report were mortgage brokers, with a planned crackdown on trailing commissions and a review of upfront commissions.

Australian Finance Group dived 29 per cent to 90c and Mortgage Choice fell 25 per cent to a fresh low of 79c.

Richard Wiles from Morgan Stanley said that while there were no major surprises, many of the recommendations would create at least some downward pressure on bank profits because they addressed the imbalance between sales, profit and customer service.

There was also the likelihood of more litigation, refunds, remediation and fines, which could cost the sector a further $2.5bn by the end of the 2020 financial year.

But Macquarie analyst Victor German said after a tumultuous year in the financial services sector, commissioner Kenneth Hayne’s recommendations were not as intrusive as expected.

“Except for the mortgage broking industry, we believe the majority of recommendations are marginally better than the conservative market’s expectations, and we expect discounts related to adverse outcomes from the royal commission to partially unwind,” Mr German said.

Citi said the final report fell short of a radical overhaul, and avoided widespread prosecutions.

While the public hearings identified a number of key issues, including responsible lending, financial advice, mortgage broking and wealth management, the restructuring work already underway meant the banks avoided harsher measures.

“We expect the negative sentiment that has engulfed the sector to wane over 2019, presenting an opportunity for investors,” analyst Brendan Sproules said.

“However, the final report has delivered differing implications for each of the banks.”

CLSA said the recommendations were broadly in line with expectations.

Bank share prices could increase, CLSA’s Brian Johnson said, because they had already been de-rated due to predictions of poor outcomes from the Hayne report.

However, he predicted that “bank bashing” by politicians would become more intense ahead of the federal election, and regulators would be emboldened by increased public funding.

Traders said short covering and buying by underweight investors drove most of the gains yesterday.

Despite some anticipation of a “less bad” outcome from the royal commission in recent weeks, the percentage of bank shares sold short was still around the highest in two years and offshore investors in particular are believed to have been quite underweight amid concern about the housing market.

But as ratings agency, Moody’s Investors Service senior credit officer, Frank Mirenzi, put it yesterday: the royal commission stepped back from a shake-up of market structure.

Mr Mirenzi said that while promoting a stronger framework for conduct, culture and operational risk taking by the banks, the recommendations are “unlikely to alter the favourable structure of the banking industry, which supports its profitability”.

S&P Gobal Ratings said: “We don’t expect major changes to the industry structure or competitive landscape, aside from consolidation in mortgage broking and to a lesser extent, changes in life insurance sales … higher regulatory and compliance costs amid subdued credit growth would modestly cut bank earnings in the short term.”

On the face of it, Mr Hayne concluded the regulators were inept, yet he placed the future in their hands. The rebound yesterday showed the commission’s bark was much worse than its bite, and that if real systemic change was needed, Mr Hayne didn’t go far enough.