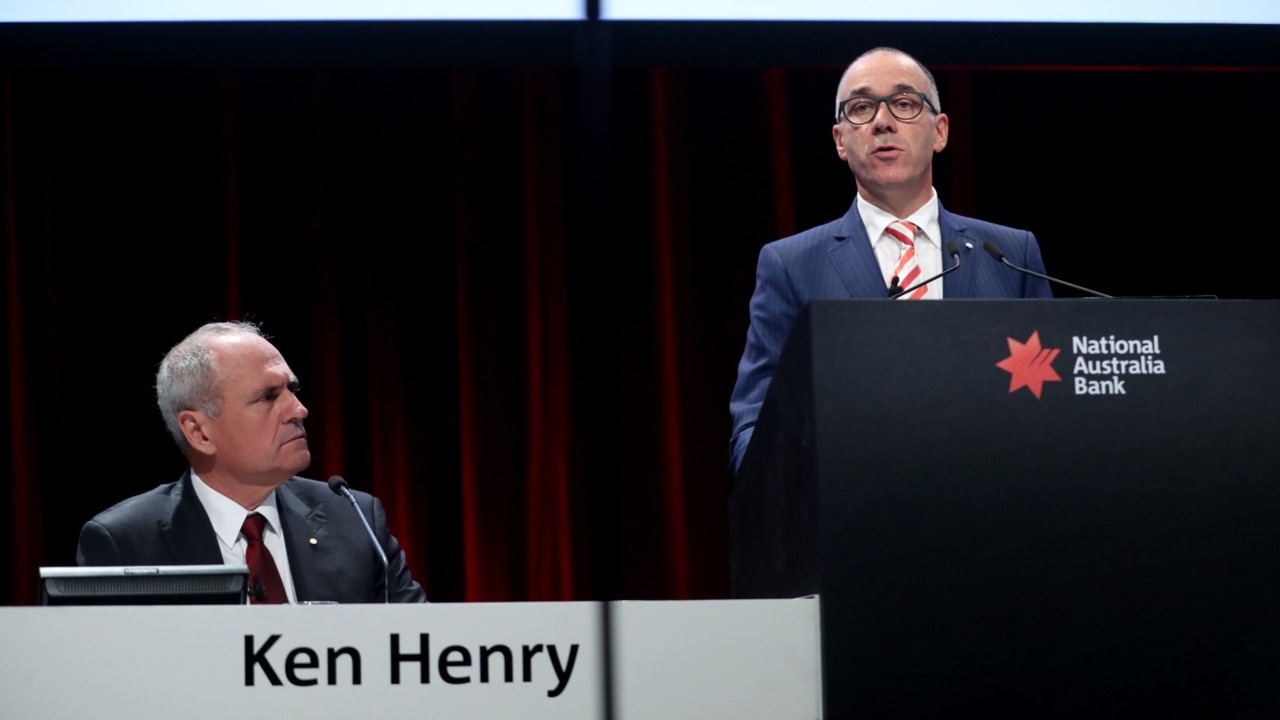

NAB in turmoil as Thorburn, Henry exit

Ken Henry apologised for NAB’s failures as the bank announced his retirement and axed CEO Andrew Thorburn.

National Australia Bank has sought to appease angry investors and address its culture of scandals by forcing the exit of chief executive Andrew Thorburn and announcing the departure of chairman Ken Henry, after stinging criticism of the pair in the Hayne royal commission’s final report.

In a contrite TV appearance last night, Dr Henry apologised for the bank’s failure to meet the expectations of its customers.

Margin Call: How the deed was done

Durie: NAB board panicked in face of pressure

A hefty exit fee for Thorburn

“We’re deeply sorry,” he said. “We’re saying we are deeply sorry. In our departures, we are hoping that we will contribute to the development of a better industry that’s capable of delivering better outcomes for customers.”

Institutional investors have called for greater accountability among bank executives after a series of scandals were revealed at the royal commission, including NAB charging fees for no service, and a police fraud investigation that entangled Mr Thorburn’s former chief of staff and his office.

Board member and former ANZ and Westpac Bank executive Phil Chronican will take the reins as acting chief executive on March 1.

Former NSW premier Mike Baird will be among those considered to lead the bank. Other candidates include Medibank chief and former NAB finance boss Craig Drummond and NAB head of business banking Anthony Healy.

Mr Thorburn’s exit came after he cancelled his extended leave on Tuesday in an effort to hold on to his job. He has agreed to depart the bank on February 28, while Dr Henry will leave once a new permanent chief executive has been appointed, NAB told the Australian Securities Exchange of the changes after the bank placed its shares in a trading halt at 3.14pm.

Dr Henry, who became chairman three years ago, was singled out for criticism by royal commissioner Kenneth Hayne in his report on Monday after what was seen as an arrogant performance as a witness at the hearings.

NAB’s stock closed at $24.93 yesterday, well down from a peak of $37.78 during Mr Thorburn’s tenure but up from a royal commission low in December of $22.84.

Mr Thorburn, who took the chief executive’s job in August 2014, said late yesterday: “It’s been extraordinarily challenging and difficult for us. There has been some desire for change … I accept that. I’ve mainly been sad but I have no bitterness.

“I feel I’ve made a difference.”

Mr Thorburn’s pay amounted to $4.4 million last year. Dr Henry took home $790,000 for his duties as chairman.

The exits at NAB make the bank’s CEO and chairman the latest scalps of the Hayne royal commission, following last year’s departures of AMP chief Craig Meller and chairman Catherine Brenner. Commonwealth Bank chief executive Ian Narev stepped down last April after a string of scandals, including a money-laundering investigation.

Australian Council of Superannuation Investors chief executive Louise Davidson said the group welcomed the “decisive action” taken by NAB. “Investors are keen to see boards demonstrate accountability for the culture of their organisations,” she said. “This includes a preparedness to take appropriate remedial action when things go wrong. We don’t think this will be the end of the story.”

In December, police raided the home of Rosemary Rogers, Mr Thorburn’s former chief of staff, in the midst of a bribery investigation. The investigation by NSW Financial Crime Squad is assessing whether kickbacks were paid by The Human Group to bank staff to secure inflated contracts.

Mr Thorburn has twice refused to answer when asked by The Australian who accompanied him on a trip to a luxury Fiji resort organised by a company at the centre of a NSW police investigation into allegations of fraud by Ms Rogers.

In both cases, Mr Thorburn told The Australian he would not talk about the trip because of the police investigation.

“That’s not a question I need to answer,” he said yesterday.

There is no suggestion Mr Thorburn has done anything wrong and, yesterday, he said he was not under investigation by police.

Mr Hayne’s criticism of the NAB leaders centred on their failure to take the “necessary responsibility” for the bank’s misdeeds and cultural failings.

“Having heard from both the CEO Mr Thorburn, and the chair Dr Henry, I am not as confident as I would wish to be that the lessons of the past have been learned,” Mr Hayne said in his final report. “I was not persuaded NAB is willing to accept the necessary responsibility for deciding, for itself, what is the right thing to do, and then having its staff act accordingly.”

Scott Morrison said in the wake of the final report that Mr Thorburn and Dr Henry had “a lot to reflect on”. Reserve Bank governor Philip Lowe expressed similar sentiments this week.

Dr Henry, a former Treasury secretary who joined the NAB board in 2011, was a driving force in getting the banking industry to agree to calls for a royal commission, but performed poorly under intense questioning in the royal commission witness box.

“I certainly accept I could have performed better in the witness box,” Dr Henry told ABC’s 7.30 last night.

“I certainly should have.”

Fund managers canvassed by The Australian said NAB was more likely to select an external candidate as the new chief executive to drive change and address issues raised by the royal commission. Dr Henry will lead the global search for a chief executive and there will also be board renewal at NAB. A large NAB shareholder, which declined to be named, said it was keen to see Mr Thorburn exit the bank after his position became untenable.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout