How NAB’s board finally got the deed done

Finally, NAB’s independent directors had determined enough was enough. Now they had to convince Ken Henry.

That Andrew Thorburn was a terminal CEO was as clear as the sharp words on page 411 of Kenneth Hayne’s final report.

Margin Call understands the majority of the NAB board — which held another crisis meeting in the bank’s Sydney George Street tower while Thorburn was marooned in Melbourne — had come to that view in the days before yesterday’s announcement.

No one could bear to let the dead-man-walking upload another arm-flapping Twitter video, saying he wasn’t going anywhere.

Convincing former Treasury secretary Henry was the tricky bit.

The chair and the bank’s internal advisors — overseen by NAB’s head lawyer Sharon Cook, who ran its failed royal commission “war room” — seemed incapable of understanding what all the fuss was about.

But NAB’s other board members weren’t short of other sounding boards.

Yesterday morning, an external adviser was finally brought in — someone the board could speak to outside of Thorburn’s direct report Cook or her corporate affairs lieutenants, Thorburn-loyalists to a man.

“They needed someone to knock over the old team,” said a source familiar with the situation.

We understand the decision to bring in external help was made not by Henry but by his increasingly alarmed boardmates, who include former ANZ exec Philip Chronican (a favourite with institutional investors who will take over as acting CEO at the end of the month), former Westpac exec Ann Sherry (chair of cruise ship outfit Carnival Australia), former PwC partners David Armstrong and Anne Loveridge, and former IBM exec Geraldine McBride.

Just after 3pm, Thorburn had accepted what had been obvious to everyone but him for days.

And after a day of delicate discussions with the most celebrated mandarin of his generation, Henry had been convinced to call time on what was supposed to be the plum role of his corporate career.

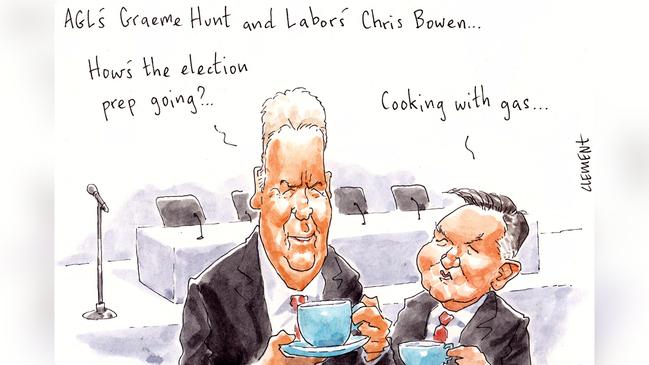

Bowen on board

We’ve written a bit recently about the business community cosying up to Treasurer-most-likely Chris Bowen ahead of the May election.

But this is something else.

Margin Call can reveal the Labor shadow Treasurer was a special guest at chair Graeme Hunt’s AGL board meeting on Wednesday in its Sydney CBD tower, the day before the energy company released its half-year results.

Bowen was invited by AGL to get a briefing on the investment plans of the $14.5 billion energy giant, which last year became the federal Coalition’s corporate bete noir.

For his part, Bowen explained Labor’s energy policy to Hunt and his boardmates, which include Oil Search boss Peter Botten, Wesfarmers director Diane Smith-Gander and Australia Post chair John Stanhope.

AGL, like its energy peers Origin and EnergyAustralia, has become completely fed up with the Coalition, whose energy policy turns on the construction of a “Big Stick” with which to whack them.

The collapse of the National Energy Guarantee in the twilight of Malcolm Turnbull’s administration was seen as the end of its serious engagement with this constituency.

In AGL’s case the rupture came some months earlier when then PM Turnbull put his old investment banking hat back on and called AGL chair Hunt to pitch a proposal — on behalf of rival outfit Alinta — to buy AGL’s rickety Liddell power station.

Hunt couldn’t believe what he was hearing.

The legacy of that thoroughly unsuccessful bit of deal-making was a profound breach of trust between AGL and the Coalition.

So long as they are right about Bill Shorten’s chances against Scott Morrison in May, that’s going to become increasingly irrelevant.

Demolition derby

Atlassian billionaire Scott Farquhar is quietly getting on with the renovation of his

$70 million-plus historic Double Bay estate Elaine. Having purchased the home in 2017, the rich lister Farquhar and his investment manager wife

Kim Jackson have set the ball rolling with local Woollahra Council.

Farquhar is seeking to modify planning approvals already gained by the prestigious estate’s previous owner JB Fairfax via his Marinya Capital to allow a staged demolition and construction at the home.

At this stage the couple have not asked to change Marinya’s 2015 approved plans, which include permission to build three new homes in Elaine’s gardens.

Farquhar lodged his application to amend JB Fairfax’s schedule at the end of January. Farquhar’s staged approach follows his friend and business partner Mike Cannon-Brookes’ $100 million purchase last year of the home next door to Elaine.

Cannon-Brookes bought the home, Fairwater, from the estate of Lady Mary Fairfax.

At last count the Atlassian business partners were estimated to be worth $5.16 billion each.

Fairwater was only the latest in a flurry of property deals from Cannon-Brookes in Sydney’s prestigious eastern suburbs in recent years.

In November he settled on another property play in Double Bay, paying what’s believed to be $17 million for the Ocean Avenue family home of Gresham deputy chair David Feetham.

Settlement followed a deal that was first struck between the rich lister and veteran investment banker last May, with Cannon-Brookes financed into that buy via Brian Hartzer’s Westpac.

Feetham and his wife Caroline have since downsized to a nearby luxury three bedroom harbourfront semi, which is also owned by Cannon-Brookes.

The tech rich lister bought that piece of real estate from London-based fund manager Peter Hall early last year for

$9.1 million.

Cannon-Brookes, who has four children with wife Annie, in 2016 paid $7 million for what was their first home in Double Bay, with that property held via his private company Grokco.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout