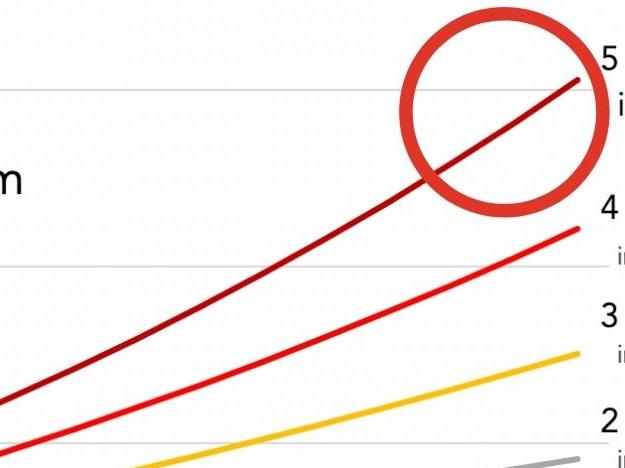

Real reason young people can’t buy homes

A new graph has showed exactly why buying a house is so much harder now than it was in the past – and all homeowners should take notice.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

A new graph has showed exactly why buying a house is so much harder now than it was in the past – and all homeowners should take notice.

It’s been an uncertain year for Aussie homeowners and there’s a worrying sign that this pain could continue well into 2022.

One of the world’s biggest financial institutions is scrambling to deal with a fast-approaching truth in the world of cryptocurrency.

The boss of Australia’s central bank has issued a serious warning about investing in crypto and flagged the possibility of a new currency.

The Reserve Bank of Australia has issued a warning to Australian homeowners as more people take on dangerous levels of debt.

A single word within the Reserve Bank’s monthly interest rate statement has set tongues wagging among senior economists.

Homeowners will have their eyes peeled on today’s RBA cash rate decision but there’s another figure that could seriously impact the viability of your home loan.

Of all the major cities, this one didn’t see property prices surge in 2021 – but that looks like it could be about to change.

Deep down we knew it couldn’t last and now predictions are showing it probably won’t – but the impact it will have is still unknown.

The pandemic phenomenon of millions of workers quitting their jobs is a ‘US story’, a Reserve Bank official says.

Fears of an interest rate rise are growing as inflation creeps up around the world but the RBA says Australia is being helped by one unique factor.

There are four crucial issues homebuyers need to look closely at when considering borrowing in the current interest rate environment.

It is ‘still plausible’ official interest rates will stay on hold until 2024, but there’s some way to go until important targets are met.

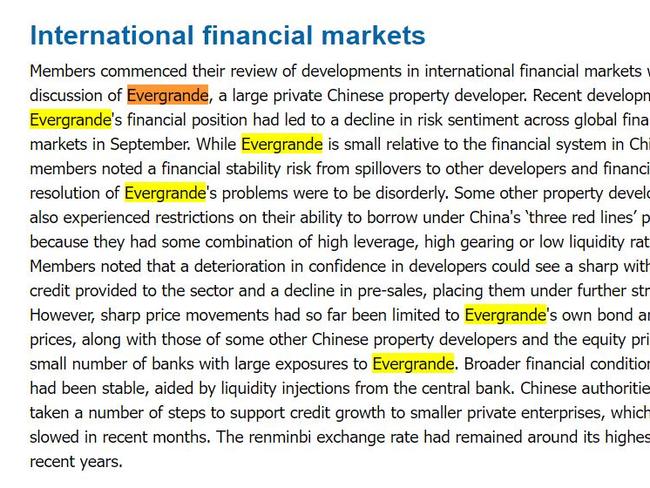

Aussie experts are growing increasingly concerned about the Chinese property giant after it missed yet another payment, as more key deadlines loom.

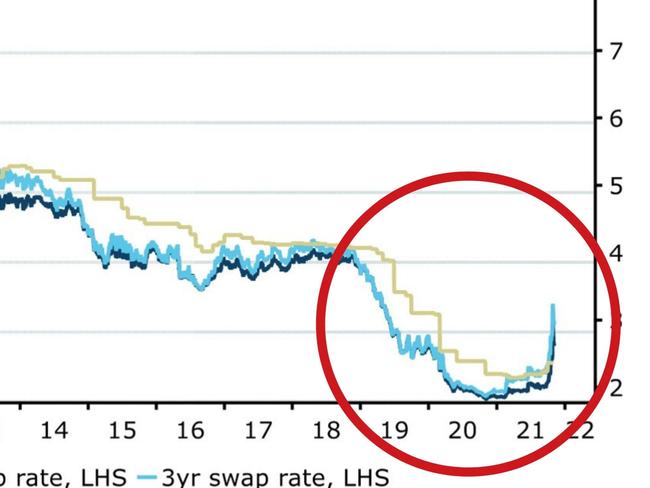

The RBA still hasn’t raised interest rates but that won’t stop the banks doing something that will cause a world of pain for Aussie home buyers.

A decision that was made to ensure Australia stayed afloat during the pandemic is now wreaking havoc in the economy.

The ASX surged after the RBA flagged keeping the cash rate at its historic low for another two years, but couldn’t hold onto the gains.

The central bank now seems open to the possibility of lifting the all-important cash rate before 2024 – but expect your own bank to move beforehand.

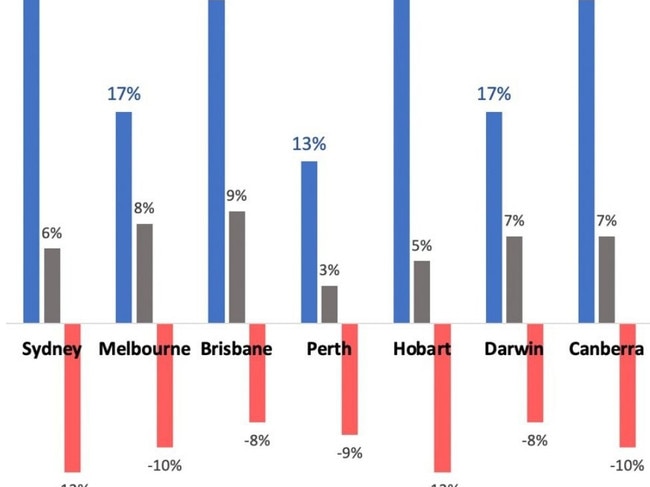

Australian housing prices keep creeping higher, pushing more would-be first home buyers off the property ladder and fuelling rate hike talk.

There’s been a dramatic change as great uncertainty grows over what inflation and interest rates will do to the Australian economy.

The Reserve Bank has previously guaranteed Aussies the interest rate would be unchanged until 2024, but new data may change that.

A crisis that has been bubbling along in Australia for years has reached a terrifying new high – and it’s bad news for Sydney in particular.

There are growing signs the escalating Evergrande crisis has rattled Aussie finance experts, amid fears it could impact local markets.

Aussies emerging from lockdown have another hurdle approaching as a worrying 10-year high grips the US and abroad.

A promise was made to keep interest rates low until at least 2024 but new circumstances could see a world of pain for Aussie homeowners.

Excessive mortgages have been handed out to people who may not be able to pay them back. This is why that’s bad news for Australia.

The pandemic and the “Hemsworth effect” have seen thousands of Aussies relocate to northern NSW and southern Queensland – but it all may come crashing down.

An upbeat economic speech from RBA governor Philip Lowe has provided a pleasant surprise for local traders.

Australia’s historic low official cash rate has been kept on hold, with the RBA saying the Delta outbreak has caused the economic recovery to lose momentum.

There’s a clear indication that Aussie households are struggling and a swift plan needs to be put in place to counter it.

Original URL: https://www.news.com.au/topics/reserve-bank/page/25