Aussie households are struggling: Here’s what the RBA will do about it

There’s a clear indication that Aussie households are struggling and a swift plan needs to be put in place to counter it.

ANALYSIS

Australia is in recession. There’s no doubt about it. Arguing about whether it is one or two quarters is wowserish and pointless.

What can we expect from the Reserve Bank of Australia next week to counter it?

The likelihood that the bank will act is high. In all recent communications, it has said that it will ease policy in the event that the economy needs it. It does amid lockdowns.

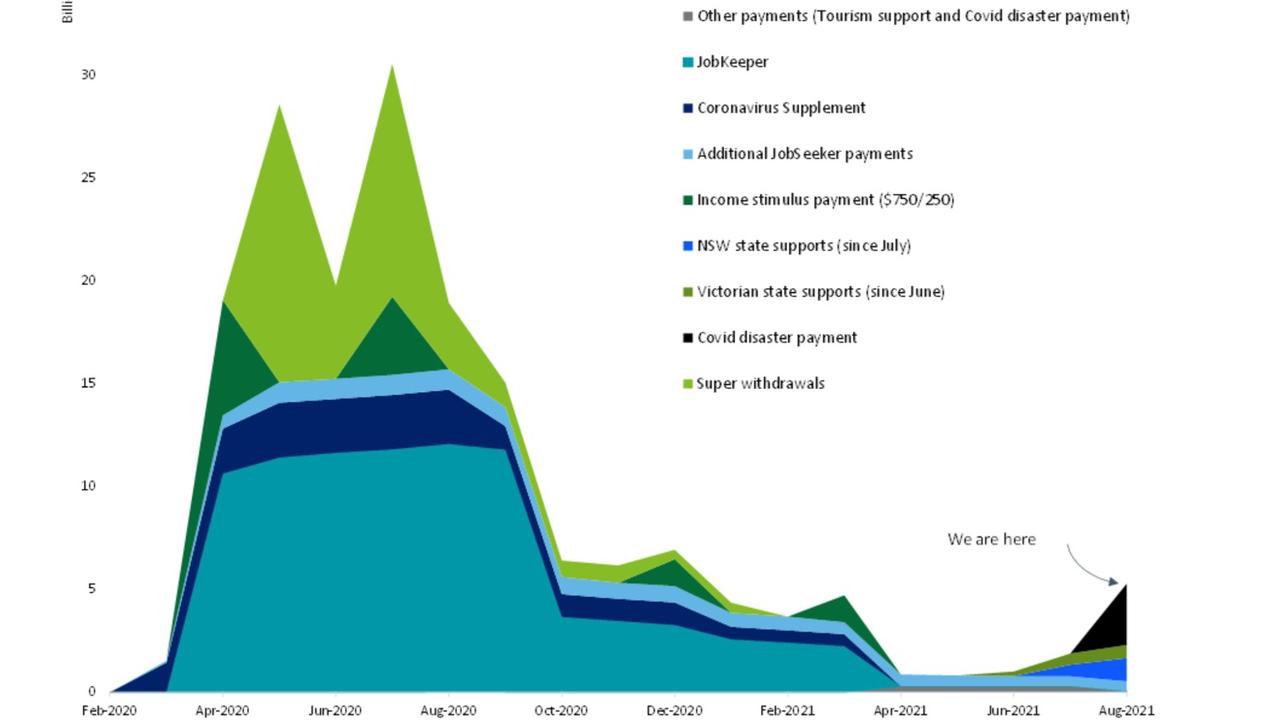

Despite NSW and Victoria being in deep lockdown, the Federal Government is being much more parsimonious with stimulus than the last time around. This is a political decision based upon the waste of JobKeeper. It is not what the economy needs. Moreover, it means fewer people are able to stay home, so actually makes the pandemic worse.

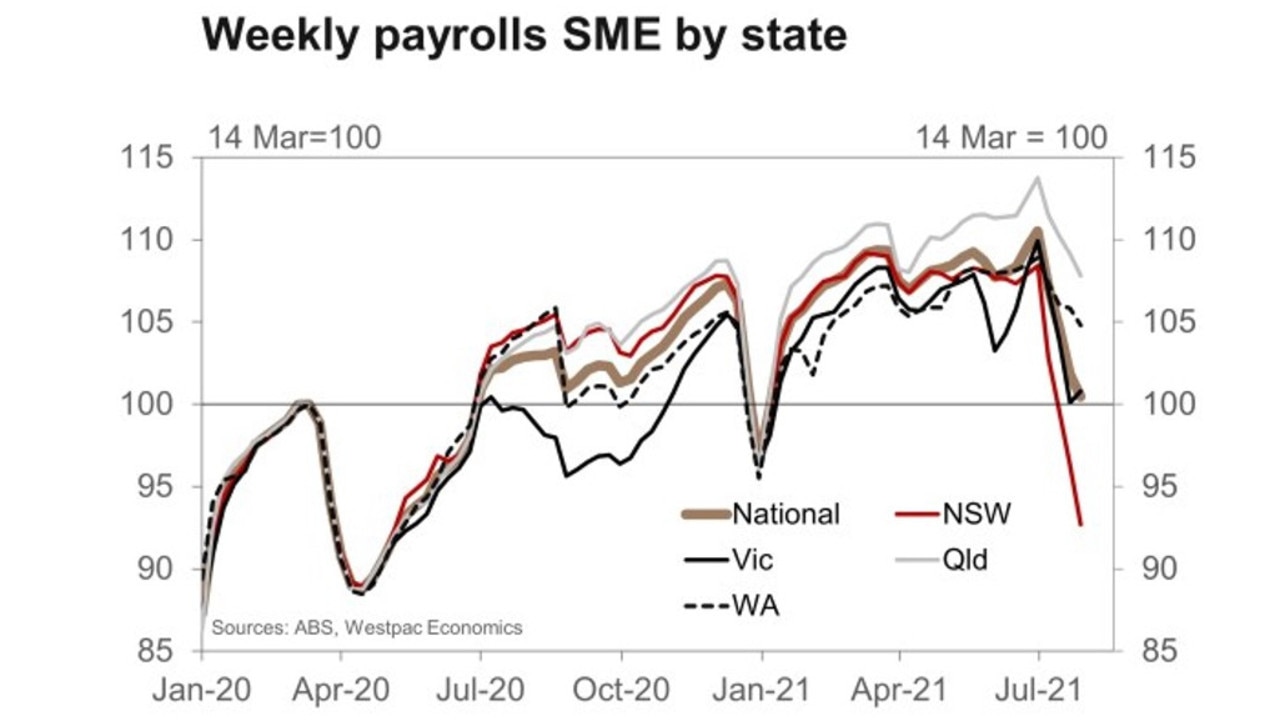

There is also mounting evidence of damage to the labour market. The ABS produces a fortnightly series called “payrolls” which is a good leading indicator for its larger monthly employment reports. It is showing some nasty trends in locked down states – and there appears to be contagion getting into those states not in lockdown as well.

The RBA cannot allow job, wage and hours worked losses to accumulate in material damage to households without relief or an offset. Not if it wishes to see a sharp recovery and reach its inflation targets. The lever of monetary easing will need to be pulled.

WHAT IS THE RBA LIKELY TO DO?

The playbook used in the original pandemic scare of 2020 serves as a guide. The bank will likely increase its asset purchases in the form of more buying of government bonds to drive down borrowing rates. This will help state governments borrow and spend in lieu of a strangely reluctant Federal Government. It will also help lower the Australian dollar to boost tradeable sectors. This has no downside with the borders shut and tourists stuck at home.

WHAT ABOUT THE TERM FUNDING FACILITY?

The more interesting question is will the RBA restore the Term Funding Facility for banks? This is printed money that the RBA gives to the banks virtually free, thus allowing them to reduce fixed mortgage rates.

Australian mortgage rates are still quite high relative to other monetary jurisdictions like Europe. The RBA can easily resume purchases of bank bonds for free or even a negative interest rate to lower fixed mortgages rates further.

It is unlikely that the RBA will go this far … yet. It is still concerned about runaway house prices and has not prepared the ground for such a potent reversal. But there are a few reasons why it is likely to be forced this way in 2022.

Australia’s second post-Covid recovery will be nothing like the first boom. Households will be cautious coming out of lockdowns given the community has no natural immunity to “live with Covid” and activity will be sluggish.

As noted, the levels of stimulus this time are much lower as well.

Finally, China and the US are converging on a global slowdown that a reopening Europe will not be able to offset. We have already had a taste of what this will entail in the 40 per cent crash of the iron ore price. More of that is ahead with iron ore likely to drop below $100 in the next six months.

More Coverage

This kind of trade shock sucks income out of every corner of the economy, from budgets both public and private. It is immensely deflationary for wages and goods as nominal growth crashes. It is very poor timing.

The RBA is ready to move and will do so next week. But ahead are much larger challenges that it has not yet factored in that will force its hand for more radical stimulus.

David Llewellyn-Smith is chief strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.