Global inflation could force interest rate rise in Australia

There’s been a dramatic change as great uncertainty grows over what inflation and interest rates will do to the Australian economy.

Around the world there is one issue that is dividing economists, commentators and central bankers alike, an issue that could decide the fate of the global economy and Australia’s economic future.

Inflation.

This single indicator as defined by the consumer price index is the key factor in the interest rate decision-making process of central banks around the world, including Australia’s own RBA.

In recent years inflation, as defined by statistics agencies, has ceased to be major issue in the

developed world. In fact, central bankers throughout the developed world have been concerned

that inflation is too low and have continued to cut interest rates in pursuit of higher inflation.

But in one of those ironic little twists that happen in life, they now have quite a bit more than they bargained for.

Around the globe central bankers repeatedly insisted that rate rises were years away, stating that they would be telegraphed to the public well in advance.

Here in Australia, RBA Governor Philip Lowe continues to insist that interest rate rises are at least three years away, affirming that it’s unlikely that the inflation target of 2-3 per cent will be achieved over a sustained period.

Rate hikes in all four corners of the globe

Despite the popular central bank narrative that rates wouldn’t rise, they are doing just that in

nations around the world.

First it was developing nations raising rates in order to protect their currencies and stave off

inflation. Then nations in the former Soviet bloc such as Poland and Czech Republic were forced to raise rates.

But more recently inflationary and interest rates pressures have begun to significantly impact how rate hikes are being priced in the developed world.

And this has occurred far more quickly than many are comfortable with.

Global Central Bank Update:

— Charlie Bilello (@charliebilello) October 14, 2021

-Chile hikes rates for the 3rd time this year, 125 bps increase to 2.75%. pic.twitter.com/uVxfOyaWso

In August, a survey of economists concluded that the Bank of England would not raise interest rates until at least 2023.

Today interest rate futures are pricing in a Christmas rate hike and a 50-50 chance of a rate hike in both November and December.

It’s a similar story in the United States. Federal Reserve Chairman Jerome Powell continues to insist that inflation is “transitory” and that rates are not going to rise for a long time to come.

Yet despite Powell’s defence of the Fed’s narrative on rates, interest rate futures are now on the cusp of pricing in two rate hikes by the end of next year.

Central banks are influential but they are not gods

As money markets continue to price in rate hikes around the world, this brings us to a challenging and often poorly understood point.

Central banks, like the RBA, do wield an immense amount of power over interest rates, but at the same time they are not all powerful and are subject to market forces.

For example, the RBA could in theory resist raising interest rates for quite some time, even if the market was to price in an aggressive cycle of rate hikes and its global peers pulled the trigger on hiking rates.

But in a high inflation environment, in time, all reticent central banks would be brought into line or face the potentially disastrous consequences of mismanaged monetary policy.

The future of Aussie interest rates

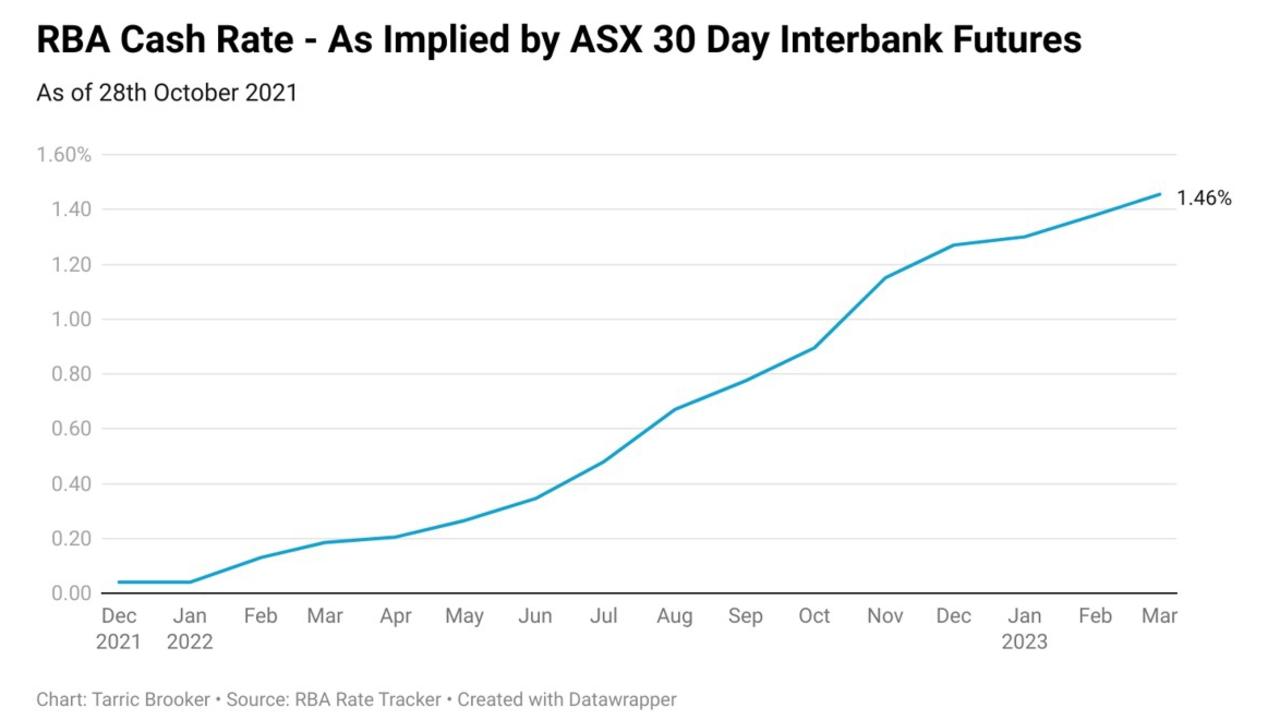

While money markets aren’t pricing in nearly as aggressive a rate hike cycle as those in Britain or the US, they are worlds apart from Governor Lowe’s insistence that rates would not rise for at least three years.

On October 11 interbank cash rate futures were pricing in a rate hike for December 2022.

On October 18, a rate hike was priced in for October 2022.

In the wake of the Q3 inflation data coming in hotter than expected, all of a sudden things have changed even more dramatically.

Full 0.25 per cent rate hikes are now priced into the market for June, August, October and November next year. With a fifth rate hike priced in for February 2023.

If the market is correct by February 2023 the RBA cash rate would sit at 1.35 per cent, an increase of 1.25 per cent on today’s figure of 0.1 per cent.

Whether the market will be correct is a matter of great debate, but it has been wrong many times in the past.

A murky future outlook

As we head into an uncertain future, the direction of inflation has become a multi-trillion dollar question, which could define the prospects of everything from the global economy to Aussie interest rates in the years to come.

If inflation remains too hot for comfort, central banks could be forced to raise rates whether they want to or not.

On the other hand, if inflation shows signs of being brought under control, rate hikes may end up being much further away than the markets are currently anticipating.

While this week’s stronger than expected CPI numbers may have provided some clue on where inflation and rates will head in the coming months and years, it may be quite a while before we know with a high degree of certainty which way things are going to go.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator