Rising fertiliser and energy prices could hit Aussie supermarkets hard

A crisis with unprecedented consequences is likely to hit Australia with shoppers being forced to make difficult decisions as prices skyrocket.

In the run-up to the French Revolution, Queen Marie Antoinette allegedly uttered a now infamous phrase “Let them eat cake” when confronted with the fact that French peasants could not afford bread.

In one of history’s little twists, Antoinette never did actually say those words, but the lack of a solution from the French monarchy to skyrocketing bread prices did play a major role in sealing her fate.

But now, as the world attempts to come to terms with the consequences of the Covid pandemic and governments’ response to the virus, there are some indicators that are looking increasingly similar to those of France prior to the revolution.

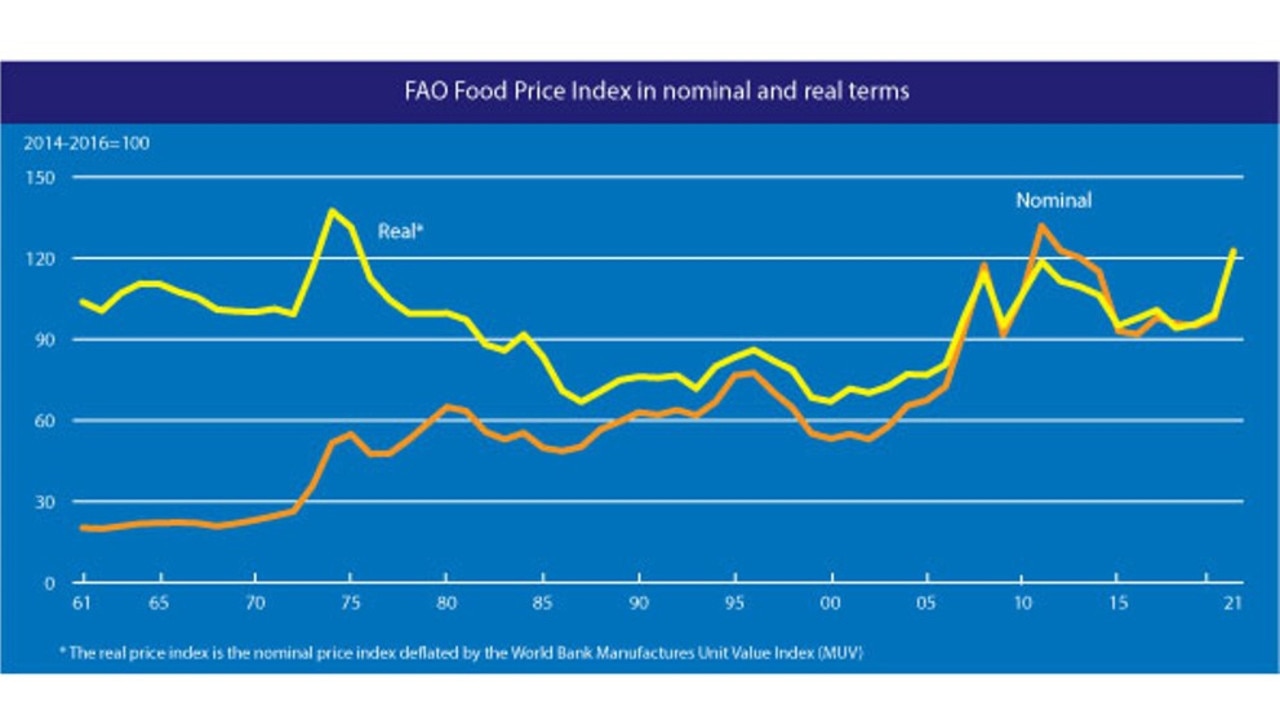

According to the United Nations Food and Agriculture Organisation (FAO) Food Price Index, the cost of food globally is currently at its highest level since 1973. While there are many factors that have contributed to rising prices such as insect swarms and natural disasters, the impact from the pandemic is arguably the chief driving force.

For Australians, some of you may have already noticed supermarket bills steadily rising or the sizes of products shrinking, as companies attempt to come to terms with rising costs.

In the United States, the wholesale cost of food products has risen by 8.3 per cent in the past year, far outstripping wage growth and the consumer price index.

Energy crisis and unintended consequences

When the world was initially plunged into lockdown in March last year, energy prices swiftly fell off a cliff. In an event that will likely be talked about for decades to come, oil prices actually went negative as contract holders were forced to pay others to take millions of barrels of oil off their hands.

Natural gas and coal prices were also hit by the pandemic, although not to the same degree as the oil market.

As a result of plummeting prices, energy companies and energy producing nations slashed production in an attempt to put a floor under prices.

Despite demand for oil recovering toward pre-pandemic levels, OPEC+ (a collection of oil and petroleum producing nations led by Russia and Saudi Arabia) has been reticent to ramp up production.

As a result, oil prices now sit at their highest level since 2014 and there is increasing speculation among energy analysts that it could continue to rise, potentially hitting $100 US dollars a barrel.

For natural gas prices the story is even more dire.

In Europe, some natural gas price indexes have risen by up to 895 per cent and these higher costs are wreaking havoc with industry and households exposed to the rising cost.

The link between energy prices and food prices

Despite its generally green reputation (no pun intended), fertiliser is often manufactured using hydrocarbons such as natural gas.

As Europe attempts to come to grips with skyrocketing gas prices, some fertiliser manufacturers have suspended production and closed their plants.

This has put an even greater strain on already challenging fertiliser market for farmers and other food producers. With crop plantings postponed due to the pandemic and farmers looking to take advantage of high food prices, the demand for fertiliser was already strong.

Now, as gas prices continue to impact production, fertiliser prices have joined other commodities in setting off for the stratosphere.

🇺🇸 Fertilizer Index Hits Record, Threatening Higher #Food Prices - Bloomberg

— Christophe Barraud🛢 (@C_Barraud) October 9, 2021

*Link: https://t.co/NMuVx9C7mYpic.twitter.com/A53ds8vG19

According to the Green Markets North America Fertilizer Price Index, the cost of fertiliser is currently at a record high, eclipsing its 2008 heights recorded during the last strong inflationary episode.

Due to current rise in prices Bloomberg Green Market analysts are forecasting the cost of US corn production to increase by 16 per cent.

With more fertiliser plant closures possible as producers attempt to come to grips with rocketing gas costs, fertiliser prices may continue to head even higher as the impact of reduced production begins to hit the market.

Gas prices, fertiliser and your grocery bill

If the increased cost of fertiliser feeds into an already expensive food commodity market, developing nations are likely to feel the pinch the strongest.

Unlike wealthier nations where less of the cost of a food product is the fresh produce itself, in the developing world the produce itself makes up a significantly larger proportion of the overall cost to consumers.

If fertiliser prices continue to rise as feared, Australians are likely to see their grocery bills rise more swiftly than we have become accustomed to, as farmers pass on the higher cost of production.

With many of us already feeling the pinch at the petrol pump, higher grocery prices would be most unwelcome hit to household budgets, particularly those employed in industries still struggling to recover from the pandemic.

2021 has seen some enormous moves in commodity prices, from lumber to iron ore, prices setting off to the moon has become almost normal.

More Coverage

If fertiliser prices do continue to hit new record highs, the world may face a challenging road ahead and Australians may find themselves with a bit less in their pockets after their weekly shop.

Ultimately, high global food prices are a key indicator for rising levels of social unrest. Hopefully this time the global political and economic elite have a better strategy than telling the lower classes to eat cake.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator