‘Income shock’ for Australia as Chinese property market collapses

Evergrande is just the beginning for China which is in the midst of a financial crisis. The impact on Aussies could be catastrophic.

ANALYSIS

There is no one way that a property bubble deflates. Some do due to policy changes. Other booms collapse under their own weight as a pause triggers price falls and collapsing sentiment. Others can be choked off by an external shock and tightening credit.

Now, we can add another path to property bubble deflation. The Chinese property bubble is headed into a great deflation owing to a collapse on its supply side. That is, Chinese property developers are in so much trouble that they are threatening to take down the entire $64 trillion market.

Extreme leverage

Chinese property developers are not like others of the same species. For many years, they have operated on extreme leverage that would long ago have blown them up anywhere else.

Typically, property developers operate on a leverage ratio of around 20 per cent (enterprise value to debt). In China, that average is much higher, with many of the largest operating at 80 per cent and higher.

This leaves them very vulnerable to debt deflation if any kind of shock comes to bear upon the sector, and that is exactly what has happened.

For many years, Chinese policymakers have allowed this extreme leverage because they knew that China needed a lot of new houses for the national urbanisation program. But that day is now passed and Beijing has instead installed what is called the “three red lines” policy to force property developer leverage to fall.

Evergrande was only the worst and first of these. A long queue of other developers are now lining up to join it in bankruptcy, whatever form that will take.

Property bust

So, how is that threatening to take down the wider Chinese property market? Wouldn’t less new property mean more pressure on prices to rise?

Normally, yes, but not in China. Owing to the huge urbanisation project, the new apartment market is the mainstay of property investment in China. So any disruption within it jeopardises a far larger proportion of the asset markets and economy than it would in, say, Australia.

This, in part, helps explain why the “three red lines” policy has been so disruptive. Chinese property developers move so fast and have so much inventory of land and empty apartments, that any hiccup in their funding models leads to stressed sales in the apartment market.

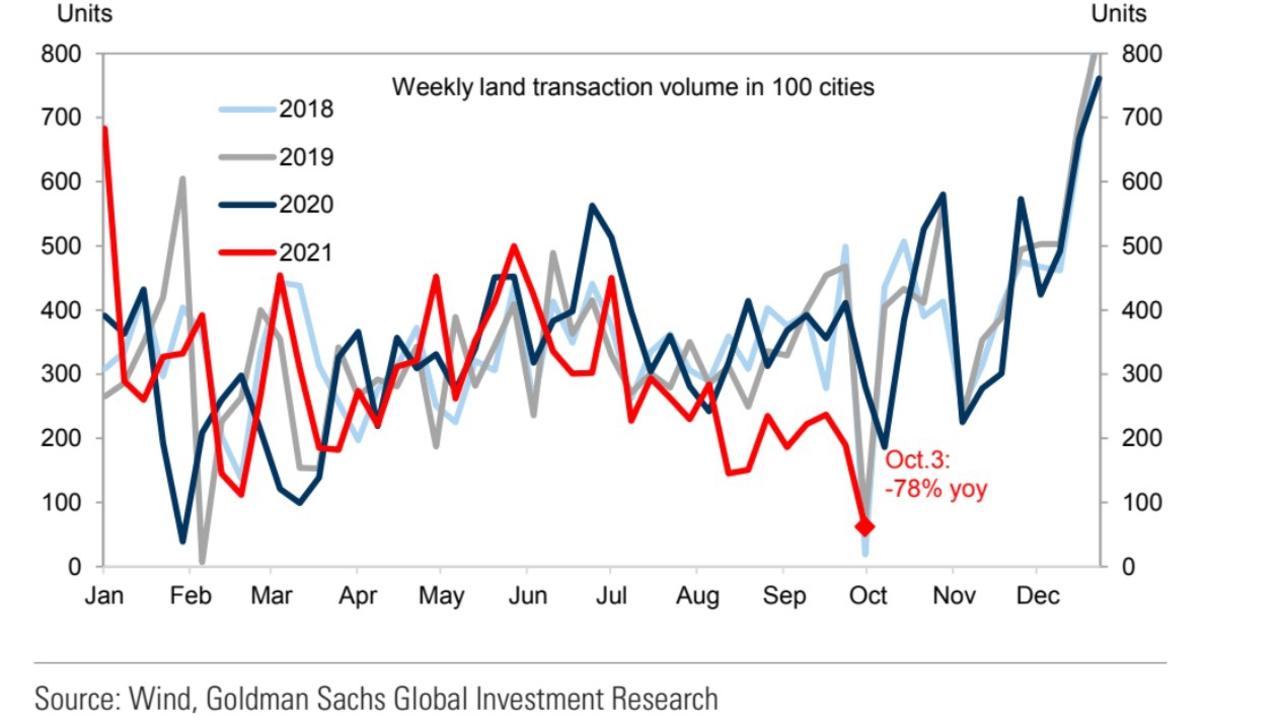

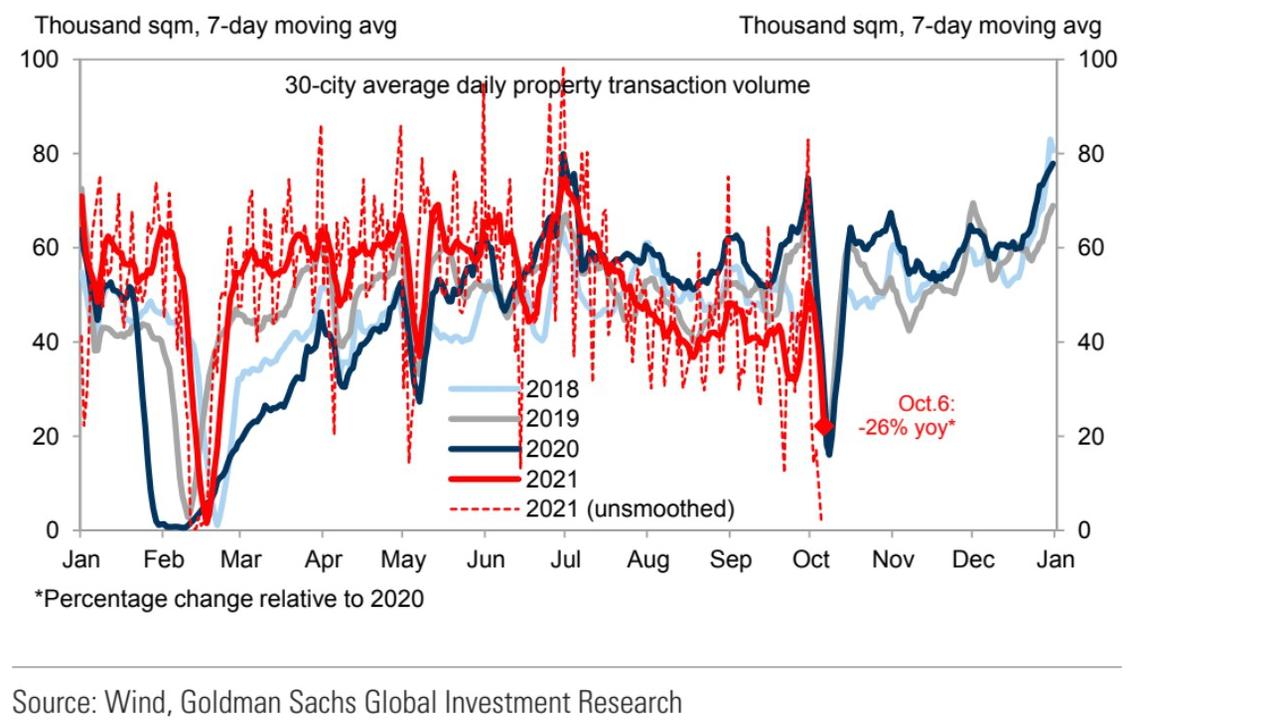

That is where we are today. Chinese developers have lost access to their offshore funding markets as investors wonder who is the next Evergrande. This has crashed their transaction volumes.

And the very bad publicity that has engendered has now crashed demand from Chinese people as well.

So, Chinese developers are now in what we might describe as a “doom loop” as denied funding leads to stressed sales and falling prices which leads to more falling sales and stress, so and so forth into the abyss.

Policymakers

At a certain point, Chinese policymakers will probably be forced to relent as the crashing property market drags down the wider economy and it all overshoots to the downside.

But, for now, they still have their foot on the brake for a number of reasons.

First, they want to end the Chinese property bubble because it distorts economic and social outcomes.

Second, China has now been hit with a secondary energy crisis derived from coal shortages and they need that to deflate before they stimulate again or they’ll be blowing themselves up anyway.

Third, they want to reduce the commodity intensity of the economy to get away from former friends like Australia.

The fallout

We have already seen the beginning of the global fallout stemming from the Chinese property shake-out in the fastest and largest iron ore crash in history. Yet it is not over.

As things stand, Chinese construction is likely to fall 25 per cent over the next year and that equals roughly 200 million tonnes of less steel that will be needed. This is a staggering 300

million tonnes of iron ore equivalent, nearly one-third of the seaborne market.

This puts iron ore on track to match its 2015 price crash to somewhere below $50 in the near future.

Second, so far, Australia has been protected by the unexpected energy crisis that has driven coal and LNG prices wild in Asia. But these are very short-term in nature. China has already commissioned oodles of new coal mines to resolve the issue by the northern Spring. So these prices will crash just like iron ore before very long.

That means a gigantic income shock is headed to Australia. Just as the RBA and APRA are tightening credit availability for our own property market.

This is called a pro-cyclical policy error and, if it transpires, will knock the stuffing out of our own property price boom.

As they say, when China sneezes, Australia catches a cold.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.