Huge cost of China’s informal ban on Australian thermal coal

The dramatic impact of China’s ban on one Australian product has been revealed – and it highlights the pain Beijing can inflict on us.

China’s unofficial ban of Australian coal resulted in the country’s largest ever fall in thermal coal exports, a new report reveals.

The latest update of the Resources and Energy Quarterly for March 2021 has noted the significant impact of China’s actions on Australia — particularly on the price of thermal coal.

Thermal coal is mainly used for electricity generation, in contrast to higher grade metallurgical coal, which is mostly used to make steel.

China is the world’s biggest buyer of thermal coal, consuming 20 per cent of the world’s exports, including $2.5 billion worth of coal exports from Australia last year.

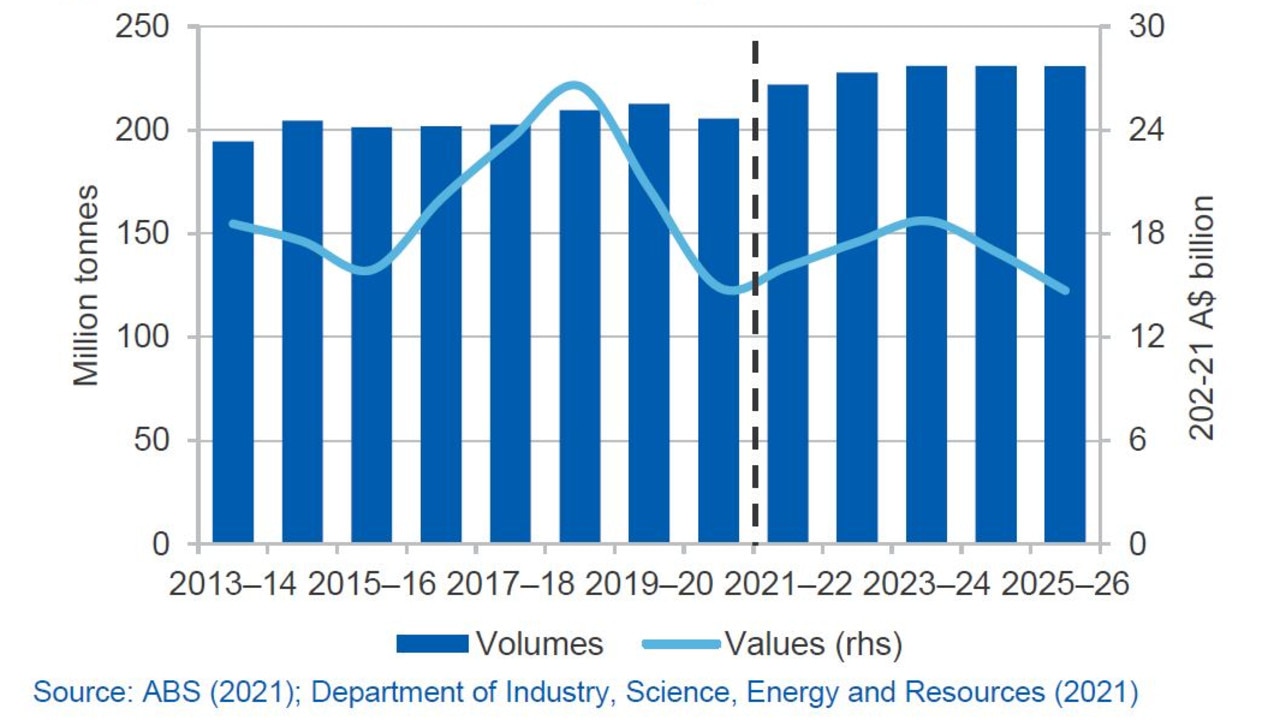

But import restrictions imposed by China on Australian coal last year, saw a 15 per cent decline (year on year) in exports for the September quarter 2020, which was the “largest ever fall in exports”.

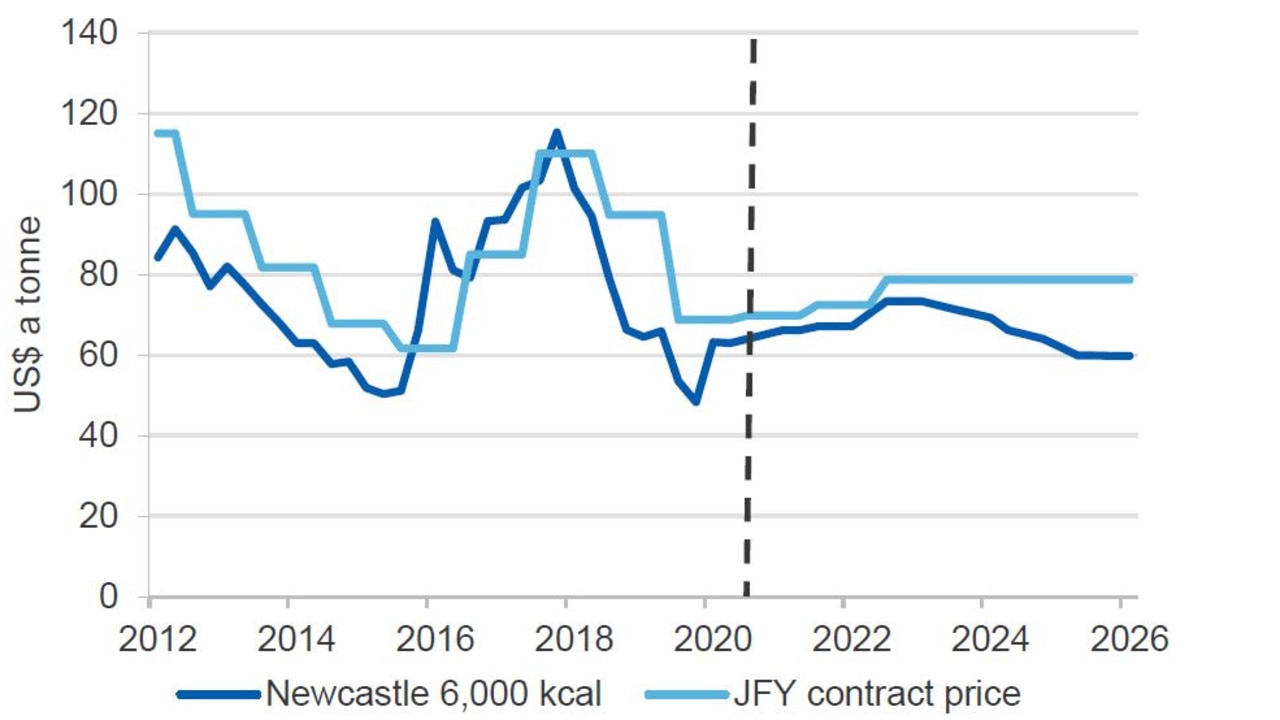

It also saw prices drop for Australia’s coal.

The report prepared by Australia’s Office of the Chief Economist, said export revenue recorded its “largest fall for more than 30 years in 2020”.

The value of thermal coal exports are now expected to drop by $6 billion, from $21 billion in 2019/20, to $15 billion in 2020/21.

The report highlights the pain that China can inflict on Australia’s economy, as China announced yet another action against Australian wine, leading Australia to threaten to take it to the World Trade Organisation.

However, it noted the impact of China’s informal import restrictions was not as significant as initially expected by markets as countries had quickly adjusted.

“As China switched to buying cargoes (from Indonesia, Russia, Colombia, South Africa, Canada and the United States) normally destined for other consuming nations in the region (such as India, Japan and South Korea), Australian exporters have filled the void,” the report said.

In fact, China’s $2.5 billion trade with Australia last year was dwarfed by the $6.9 billion exported to Japan. South Korea also took about $2.1 billion worth of Australian coal, Taiwan took $1.9 billion and India took $0.5 billion.

Despite the adjustment, there was an impact on prices.

“The bottom line for Australian coal exporters being that they are receiving lower premiums for their coal,” the report stated.

“If this is sustained, it could raise broader questions around production levels at some of the higher-cost mines.”

RELATED: Australia threatens action after China’ extends wine tariff

Conditions remain ‘difficult’

There are already signs of strain within the industry.

Glencore announced plans last year to close four Australian mines by 2023 as their currently-developed resource becomes exhausted.

This could include the Liddell, Integra, Glendell and potentially Newlands mines, representing about 4 per cent of the country’s thermal coal production.

“Conditions for Australian thermal coal producers remain difficult on balance,” the report said.

Overall, global thermal coal use fell sharply in 2020 due to the pandemic, which led to large falls in electricity use around the world.

“World thermal coal trade fell in 2020 for only the second time this century (the first being in 2015).”

Trade has also been affected by significant competition from gas. Over time, global coal imports are expected to decline in many regions.

Despite a rise in the early part of 2020, Australia’s thermal coal exports to China are expected to fall slightly from 213 million tonnes in 2019/20, to 206 million tonnes in 2020/21.

However, exports are expected to grow over time, reaching 231 million tonnes by 2025/26, as supply chains adjust and global markets increasingly prioritise high-quality coal.

“On balance, it is expected that Australian exports will grow slowly after a brief decline, though prices will remain constrained,” the report said.

RELATED: Prices for coking coal rise in China amid Aussie ban

Australia’s products still in high demand

There is good news in other sectors.

In particular Australia’s iron ore sector is booming, with earnings in the industry set to record an all-time high in 2020/21. Earnings are expected to rise by one-third to $136 billion in 2020/21, after topping the $100 billion mark (for the first time ever for any commodity) in 2019/20.

Australia’s exports of lithium, nickel and copper are also expected to surge thanks to “growth opportunities” linked to new and low emission technologies.

The minerals are central to these new technologies, with lithium exports expected to rise five times higher, while nickel exports expected to double and copper exports expected to increase by a third.

Lithium exports are estimated to be $1 billion in 2020/21.

It’s expected the surge in export earnings for copper, lithium and nickel will replace the fall in thermal coal earnings arising from the transition to cleaner energy sources.

Demand for higher grade metallurgical coal — used for steel — is also expected to recover after world trade fell by around 13 per cent in 2020.

Australia’s exports of metallurgical coal were expected to fall to 173 million tonnes in 2020/21, “largely due to China’s informal restrictions on imports of Australian coal persisting into 2021”.

However, export earnings are expected to improve over the next five years as mines resume operations, newly formed supply chain strengthen and demand grows in India, Europe and South Asia.

“This recovery is expected to lift export volumes back to 191 million tonnes, and export earnings up to $31 billion (in real terms) by 2026.”

Prices have already lifted sharply — by around 60 per cent — in January, effectively reversing the fall after China’s informal restrictions were put in place in October 2020.

Overall Australia’s resource and energy exports are expected to hit a record $296 billion in 2020/21.

The report described this as a “strong result” in the context of the COVID-19 pandemic.

A small decline to $288 billion is likely in 2021/22, before earnings stabilise for the next few years.

The report said the outlook for Australia’s minerals exports continued to improve as the world economy rebounds from the impact of the COVID-19 pandemic.

“Australian miners have found their product in high demand, helped by the impact of government and central bank measures abroad,” it said.

However, it warned there were risks if there were substantial delays in the successful rollout of effective COVID-19 vaccines to a large number of the world’s working population, or there were further disruption to Australia’s resource and energy commodity trade with China.

charis.chang@news.com.au | @charischang2