Era of ultra-low rates coming to an end, says ANZ

ANZ has said the era of ultra-low global interest rates is coming to an end, although CEO Shayne Elliott expects the Reserve Bank to hold the line on its rock-bottom cash rate.

ANZ has said the era of ultra-low global interest rates is coming to an end, although chief executive Shayne Elliott expects the Reserve Bank to hold the line on its rock-bottom cash rate despite inflationary pressures sweeping the economy

Mr Elliott noted that the New Zealand Reserve Bank had lifted its official cash rate by 50 basis points earlier this month, and there was a continuing debate about the US Federal Reserve taking similar action.

“But we don’t think that the cash rate in Australia is going to rise any time soon,” he told The Australian.

“As a bank and through the Australian Banking Association, we get a reasonable number of opportunities to hear from (RBA governor Philip Lowe) and he’s been remarkably consistent about the criteria: unemployment would have to fall significantly and we’d start to wage-price growth, but he can’t see that happening until 2024.

“Now he might be wrong, but he’s very consistent.”

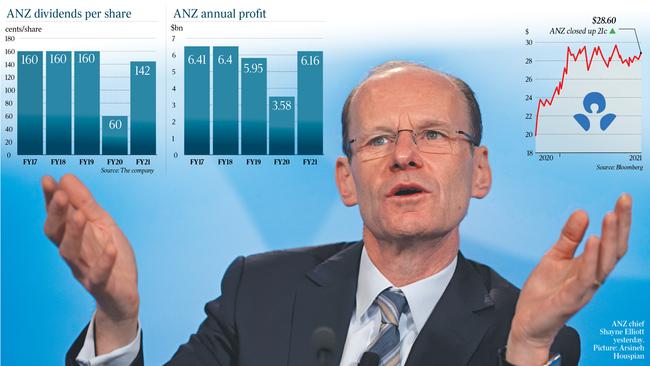

Mr Elliott’s assessment, which came as he announced a 72 per cent increase in net profit to $6.2bn, followed this week’s unexpectedly high annual underlying inflation rate of 2.1 per cent.

It was the highest figure for six years, propelling inflation into the RBA’s target range of 2-3 per cent and prompting some economists to bring forward their expectations of rise in official cash rates from the ultra-low 0.1 per cent.

Addressing a Senate committee on Thursday, RBA deputy governor Guy Debelle said a little bit more inflation was “welcome” but “a lot more inflation isn’t”.

He declined to provide the bank’s latest inflation forecasts ahead of next Tuesday’s board meeting and the release of the RBA’s quarterly statement on monetary policy on Friday.

“I’d rather not update them in the middle of a Senate estimates hearing,” Dr Debelle said.

However other business are starting to feel the pinch of rising costs.

This week Woolworths boss Brad Banducci cautioned that his suppliers were pushing through price rises given “material” increases in supply chain costs.

Elsewhere Peter Wilson, the chief of plumbing supplies chain Reece Group, warned of rising costs across his own business were expected to accelerate in the December quarter and persist for the balance of 2022. Driving costs were supply chain disruptions together with tight labour markets and wage inflation, Mr Wilson said.

Graeme Kerr, the chief of miner South 32 said the concern was for inflationary pressures starting to have an impact on global economic growth.

The ANZ result was driven by the partial reversal of Covid-19 related provisions, with a net release of $567m, comprising a collective provision release of $823m and specific provisions of $256m.

While the collective provision release reflected the improved outlook in the first half, uncertainty from extended lockdowns in NSW and Victoria had limited further releases in the second half.

Mr Elliott said the year had demonstrated the benefit of a diversified portfolio of businesses, as shareholders enjoyed the benefits of ANZ successfully navigating the impact of the pandemic.

This was offset by the continuing poor performance of the mortgage business due to unresolved processing issues.

“Experience tells us the full impact of Covid-19 will not be fully understood until at least the end of 2022, however we’re well-positioned financially and culturally to respond,” Mr Elliott said.

“There will be opportunities that arise and we are investing for growth with the mindset and agility to continue to deliver for customers, shareholders and the community.”

The board declared a final dividend of 72c, taking the annual payout to $1.42, up 82c.

The bank finished the September financial year with a common equity tier one ratio of 12.3 per cent, or $6bn above the prudential regulator’s “unquestionably strong” benchmark.

ANZ is almost halfway through a $1.5bn share buyback announced in August.

The bank said it would continue to consider the best use of any surplus capital, as the share price lifted 21c to $28.60.

Citi analyst Brendan Sproules said asset quality and ANZ’s strong balance sheet were key positives.

While cash earnings of $6.2bn, up 65 per cent, were slightly ahead of consensus, core earnings were a “slight miss”.

“Out of this result, we expect the market will be looking for further detail as to the sustainability of institutional pricing, future potential to extract funding cost benefits given rising yields, and the sustainability of two strong halves of markets activities,” Mr Sproules said.

“Issues in the mortgage book persist, and we expect further clarity in ANZ’s financial year 2022 priorities.”

Mr Elliott acknowledged the challenges with the bank’s mortgage business, saying second-half volumes were impacted by processing issues, a competitive refinancing market, and customers paying down loans faster.

At the end of August, ANZ recorded the lowest of the major banks’ home lending growth of about 2.5 per cent year-on-year compared to 6 per cent for the banking system.

This contributed to the bank’s loss of market share and followed a period until March 2021 when ANZ was ahead of its peers.

Mr Elliott said home loan revenue grew more than 10 per cent but the size of the loan book fell in the second half as customers paid down loans.

There was no excuse for the processing issues, he said, but assessment capacity had been increasing for several months, with home loan assets only marginally down in October.

“Our expectation is that the improving trend will continue,” the ANZ chief said.

“All else being equal, we forecast home loan assets to grow during the first half and at some point in the second half we should be growing in line with our peers.”

Mr Elliott said the bank was well on the way to meeting its aspiration for an $8bn cost base by end of 2023, comprising $7bn to run the bank and $1bn of investment.

“This year we reduced the cost of running the bank a further 3 per cent on a constant currency basis to $7.4bn, so well on the way to exit 2023 at our $7bn ambition,” he said.

“We will not underinvest in the business just to meet a target.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout