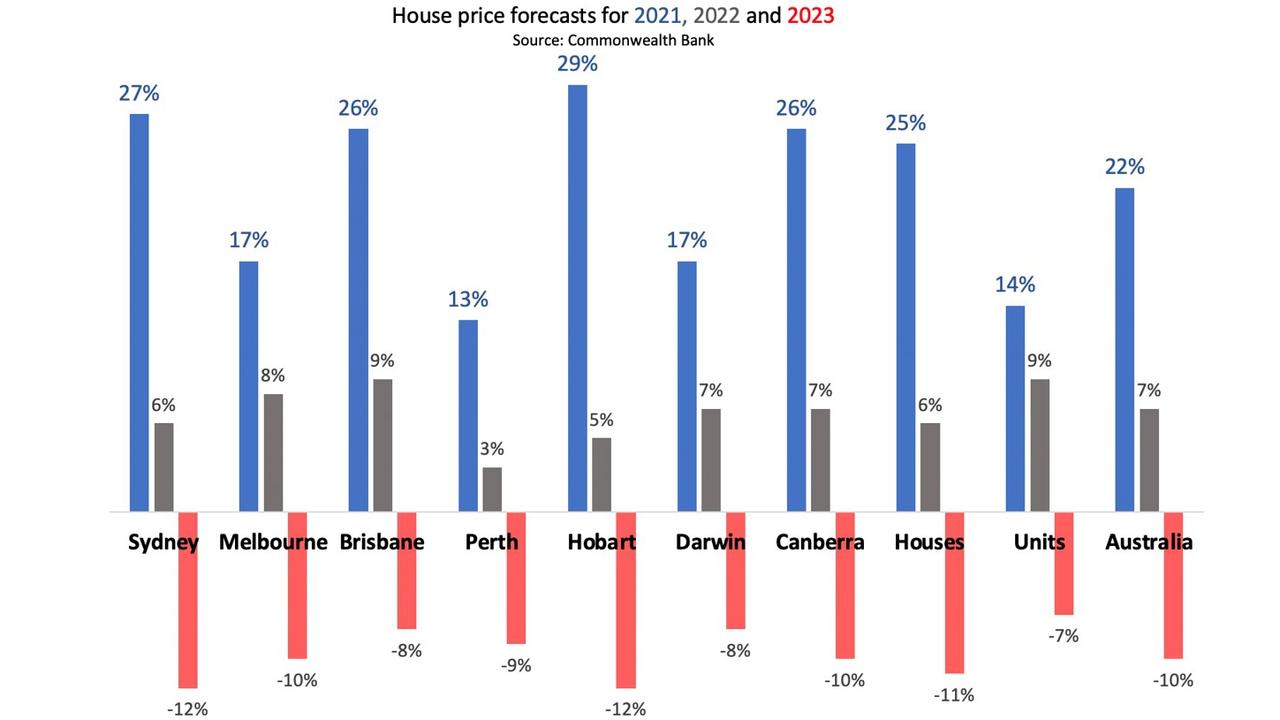

Comm Bank predicts small rise in house prices before dramatic fall in 2023

Deep down we knew it couldn’t last and now predictions are showing it probably won’t – but the impact it will have is still unknown.

Warning sign for Australia: New Zealand is hiking its interest rates. The Reserve Bank of New Zealand lifted interest rates by 0.25 per cent on Wednesday, in the latest clue that interest rate hikes could be coming to Australia sooner than expected.

And of course higher interest rates will be a huge dampener on house prices.

Deep down we all knew this kind of house price growth couldn’t last.

The crazy rate of acceleration in Aussie house prices – as shown in the next graph – is now forecast to come to an end, with a big fall in prices in 2023 across the country.

The Commonwealth Bank of Australia is predicting that house price growth will slow down substantially in 2022 and then actually go backward in 2023.

“Interest rates become a headwind on property prices if they are rising. That is the place we believe we are moving towards over the next two years,” wrote the Commonwealth Bank in a note to clients last week.

“We expect a cooling feedback loop to intensify whereby subduing buyer expectations coupled with general fatigue and a growing anticipation of RBA rate hikes sees prices peak in [July, August, September of] 2022.”

ANZ is predicting the same pattern, albeit at a gentler level. They expect falls of 4 per cent in 2023.

Interest rates are everything

The key issue is interest rates. Everyone expects them to go up. But when? If they rise in 2022, that should pour cold water on the housing market sooner rather than later.

The Reserve Bank of Australia is in charge of setting official interest rates. They have said they don’t expect to hike rates until 2023, or even 2024. But the RBA’s forecasts are not exactly famous for, shall we say, perfect accuracy. And in this case, they may even be pouring on a little sugar, because expectations of low interest rates work almost as well as low interest rates in boosting the economy, which is what they’re trying to do.

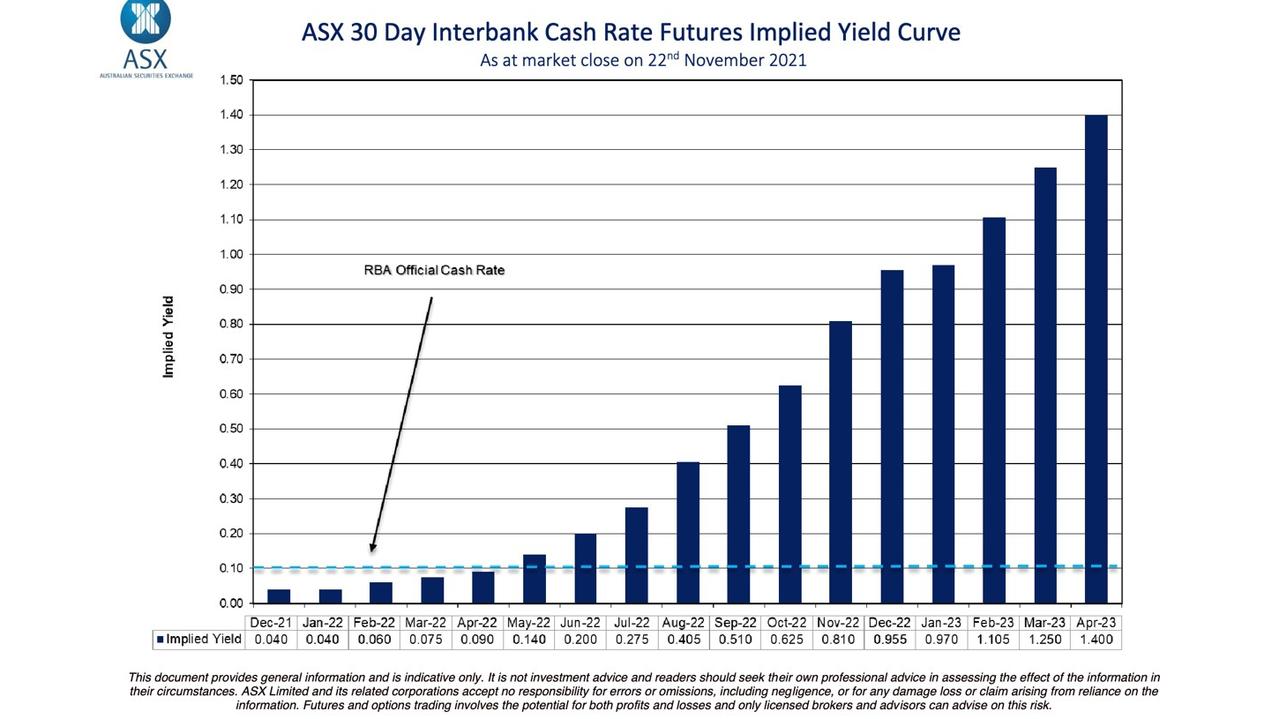

So when should we expect interest rates to actually go up?

To get a hint, we can look to New Zealand. Interest rates have gone up this week. The Reserve Bank of New Zealand lifted rates this very Wednesday, by a chunky 0.25 per cent. That is a sign that the era of super-low interest rates is over in that country, and make their interest rates more than seven times higher than ours (0.1 per cent vs 0.75 per cent).

Like Australia, New Zealand has had some crazy house price rises, and like Australia, it is getting a bit uncomfortable about that. It has also experienced a bump in inflation. Also like Australia, house price falls are forecast. The Reserve Bank of New Zealand expects house prices to fall over there for the next two years.

Ask the market

Interest rates will go up if inflation rises, and if wages go up. This is why watching consumer price inflation and the wages index is vital to understanding the Australian economy these days. Wages have shown a little bit of strength recently, and consumer price inflation is higher than expected.

So is it possible interest rate rises will come sooner than the RBA says? That’s what the market is forecasting. We can look at the next graph and see what the market expectation is for the official interest rate at various points in the future. The blue bars show the expectation. They are higher than 0.5 per cent by September 2022, suggesting the market believes the RBA will hike interest rates to over 0.5 per cent by then. That’s just 10 months away.

The future is now

More Coverage

The funny thing about predicting future price changes is it can make them happen now. If people believe house prices are going to fall, they may hold off buying and thereby cause the price falls to happen sooner than predicted. Likewise, the reverse, if people believe house prices will rise they try to buy before prices shoot up and actually cause the price rise.

Watching house prices in the last few weeks of the year and the first weeks of 2022 will be fascinating.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.