Major banks to rake in $11.7b in profit

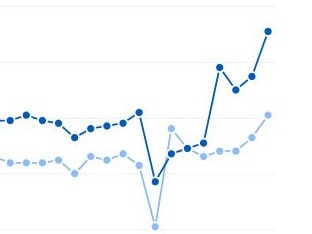

Australia’s big banks are predicted to reveal they have raked in their biggest earnings in the last 30 years.

From ANZ interest rates and credit cards to home loans, we have all the latest banking news.

Australia’s big banks are predicted to reveal they have raked in their biggest earnings in the last 30 years.

The most aggressive round of interest rate hikes in decades in Australia and a rental crisis are creating a surprise outcome in the property market.

The real-world viability of non-physical forms of currency are being explored as the RBA tests new digital payments with e-AUD.

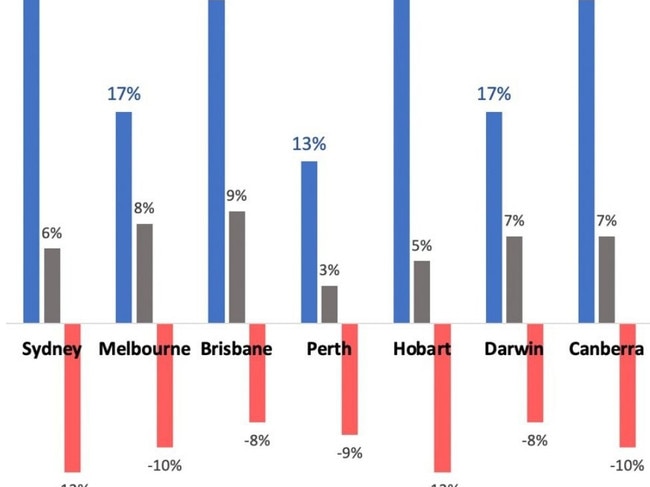

One of the country’s biggest banks has issued a grim warning to property owners, with three cities set to suffer the most.

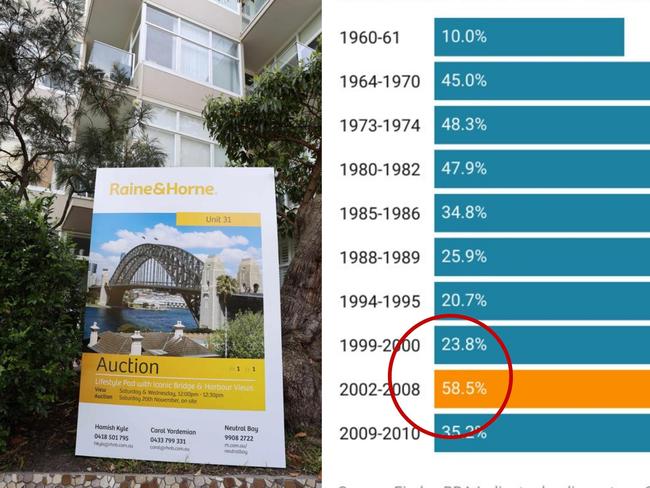

Bring up today’s cash rate and Boomers will often retort with the 17 per cent rate of the 1980s. But it turns out their argument simply doesn’t stack up.

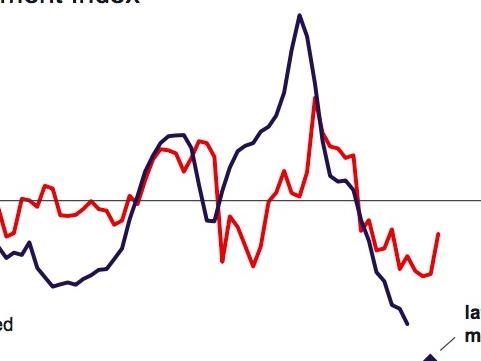

With the RBA almost certain to increase the cash rate on Tuesday afternoon, some economists are predicting it could be a regular monthly occurrence.

Pressure is piling on for homeowners as interest rate rises could leave them struggling to meet repayments on a house worth less than what they paid for it.

The four major banks have revealed alarming predictions for interest rate rises, with expectations borrowers are in for multiple hits this year.

Omicron means that many Aussies are in a bizarre new type of lockdown. And the grim economic impact is already being felt.

Deep down we knew it couldn’t last and now predictions are showing it probably won’t – but the impact it will have is still unknown.

Three banks have announced on the same day a new vaccine mandate with various deadlines looming.

Half of Australian savers believe the big banks are the safest place to keep their money, but they could be missing out on better interest rates.

ANZ has posted a profit plunge due to higher provisions against bad loans as borrowers struggle with the financial hit of COVID-19.

A big four bank has slashed the savings rate on two main deposit accounts in the midst of the COVID-19 recession.

ANZ Bank wrongly charged around 69,000 customers millions of dollars in fees over 12 years and has now been slugged with a massive penalty.

A real estate agent tried to blackmail big bank ANZ when he threatened to expose their thoughtless act in his town by going to the media.

ANZ’s chief executive says Victorian businesses want clarity about when trading can resume instead of the Government keeping them in the dark.

Aussies appear to be approaching their finances differently during the coronavirus pandemic, and it’s hurting the banks’ bottom line.

One of Australia’s major banks has decided it will pay shareholders an interim dividend despite ongoing challenges caused by coronavirus.

New figures reveal 2100 ATMs in Australia were removed between April and June, while the big four banks have shut 175 branches collectively.

Original URL: https://www.news.com.au/topics/anz