ANZ CEO Shayne Elliott says Victorian businesses want clarity

ANZ’s chief executive says Victorian businesses want clarity about when trading can resume instead of the Government keeping them in the dark.

ANZ chief executive Shayne Elliott has warned that many of the bank’s business customers feel they will not survive the extended lockdown imposed upon Victoria.

The big four Australian bank said businesses wanted greater certainty about when some form of trading could resume in the state, with fears the current reopening dates are too late to recoup losses incurred from the extended shutdown.

“What businesses need is clarity and at one level we’ve got some clarity – nobody likes it,” Mr Elliott said on the Today show.

“This is going to be really tough. We’re hearing a lot of feedback from customers who are really worried about their ability to survive through to October and November.”

Mr Elliott said business owners were worried they would miss out on the much-needed Christmas trading season.

“There’s a lot of anxiety out there,” he said.

“Let’s not forget, Christmas for many people is 45 per cent of sales for many of our customers, and they’re sitting there worried that they’re not going to have a Christmas season.”

Mr Elliott also noted the role of the bank during this period is to assist customers through the current trading environment.

“I don’t buy the argument that there’s a necessary tidal wave of foreclosures,” he said.

“That’s the last thing that anybody wants, including us.”

Fears of slumping sales during the traditional festive season have also caused concern for the Australian Retailers Association, which felt blindsighted by Premier Daniel Andrews’ decision to keep retail businesses closed until at least October 26.

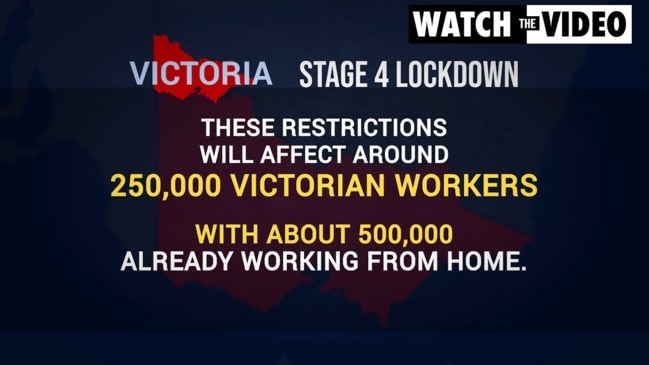

Under the Victorian Government’s road map out of COVID-19, non-essential retail businesses will be able to resume trading on October 26 if daily coronavirus case numbers are on average below five for the past fortnight.

ARA chief executive Paul Zahra said on Monday a majority of small and medium-sized retailers would not survive the extended lockdown.

ANZ also said cheaper interest rates would provide support in ensuring business and mortgage customers were able to access cheaper debt funding, with the bank committing to provide further repayment deferral periods for customers who continue to face hardship because of COVID-19.

“We’ve got the ability to buy time for people to get back on their feet, get back into employment, get their businesses started again,” Mr Elliott said.

“If we have to defer people for paying for three months, six months, that’s what we’ll do.”

Mr Elliott also noted capital city housing markets would likely feel stronger downward pressure, which would likely cause property prices to fall.