Bank’s ‘bleak’ prediction that house prices will fall 18 per cent

One of the country’s biggest banks has issued a grim warning to property owners, with three cities set to suffer the most.

Property prices in Australia’s two largest cities are expected to plunge by an eye-watering 18 per cent by the end of next year.

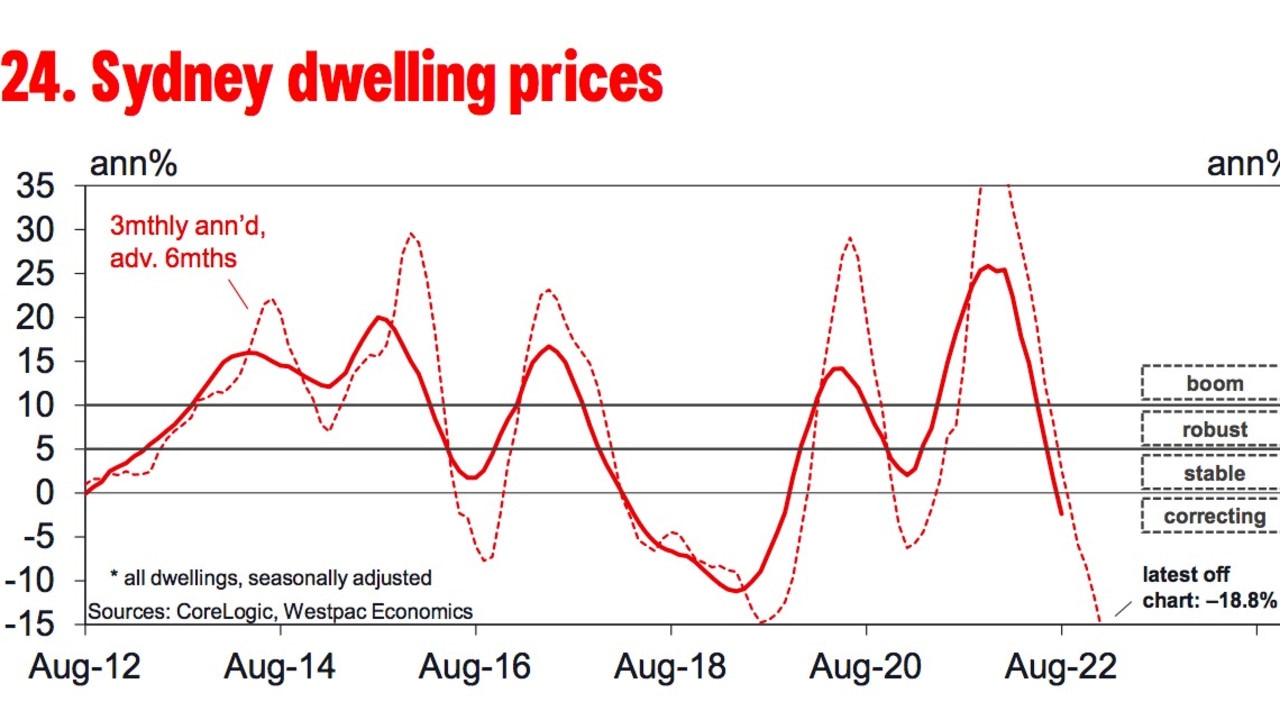

A Westpac economist has forecast that Sydney and Melbourne would soon suffer the massive decrease, with property values in the NSW capital predicted to fall 10 per cent this year and then by another 8 per cent in 2023.

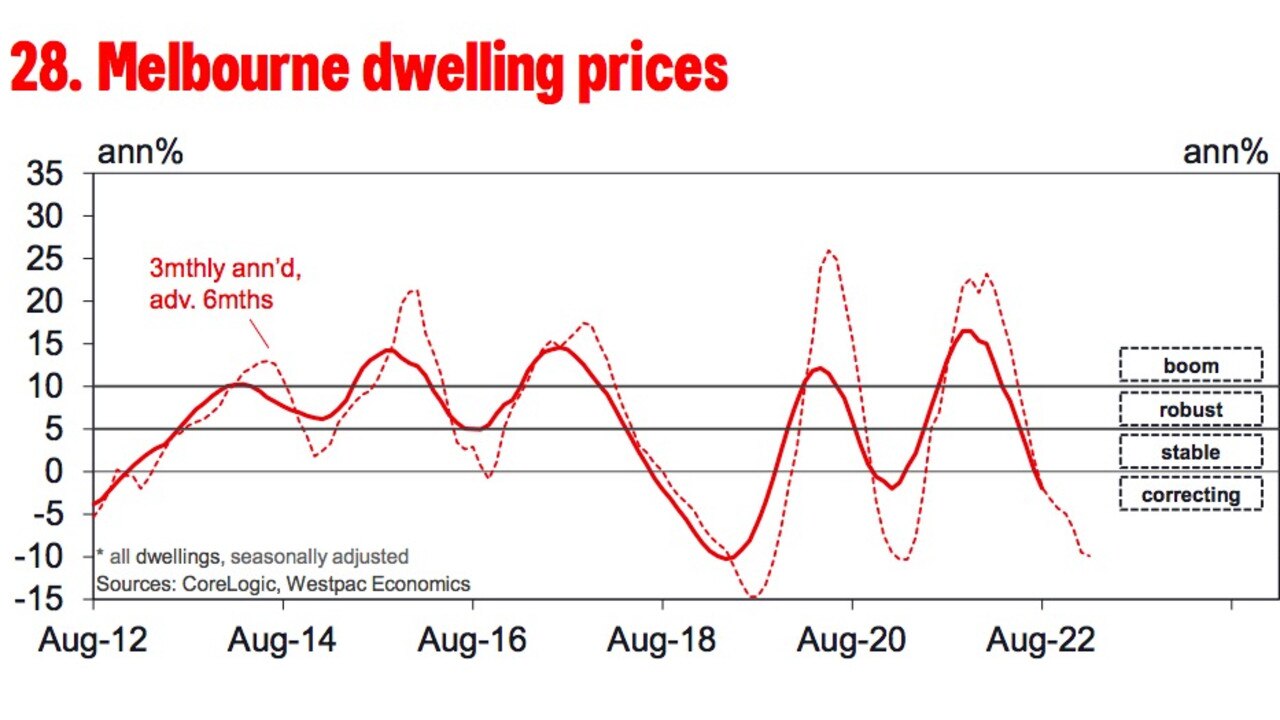

The report also found Melbourne was the inverse of that, expected to drop 8 per cent this year and 10 per cent next year.

Hobart property owners are also slated to miss out as dwellings in the Tasmanian capital are tipped to tank by 14 per cent in the next 18 months.

In all, the author of Westpac’s August Housing Pulse report, senior economist Matthew Hassan, warned that the situation looked “bleak”.

“The housing downturn that began at the start of the year has accelerated and broadened over the last three months,” he said.

Nationally, property prices are still expected to fall 16 per cent over the next 18 months.

Concerned about falling house prices? Check out Compare Money's guide >

According to the report, “corrections are well advanced and firmly entrenched” in NSW, Victoria and Tasmania, with those states set to record the biggest falls.

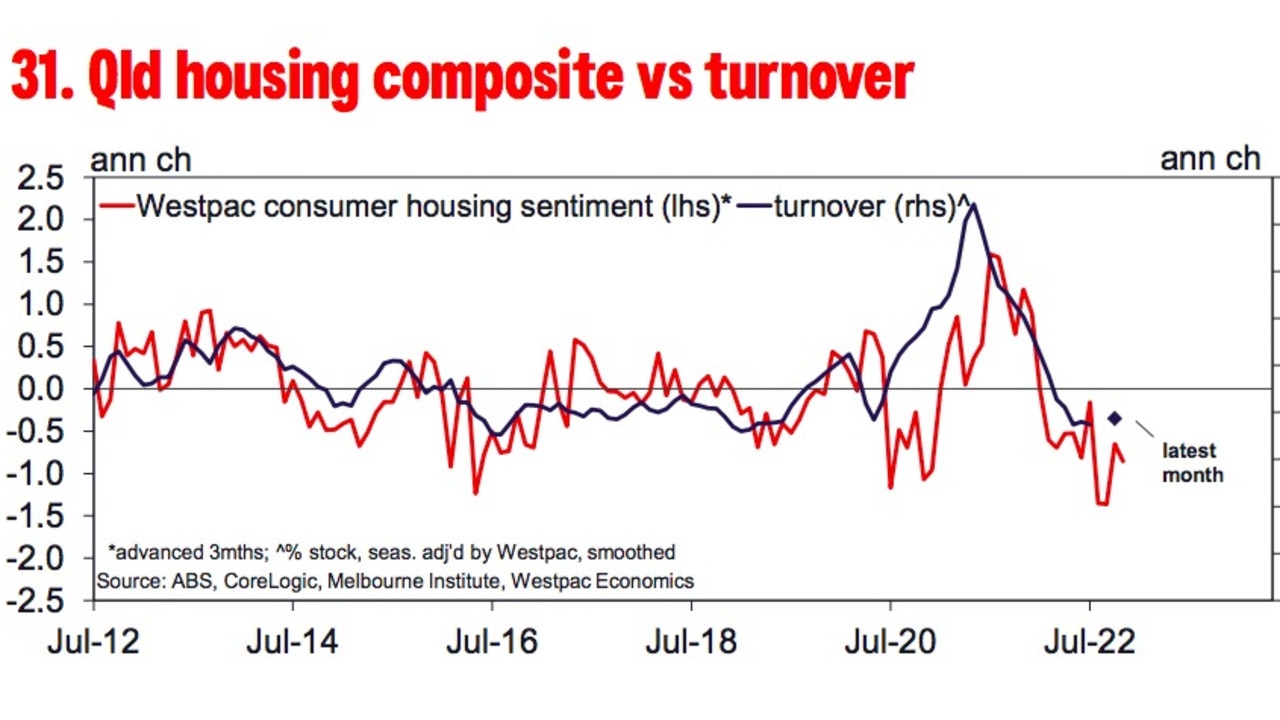

Queensland and the ACT have mostly been spared, however, their prices are “just starting to dip”.

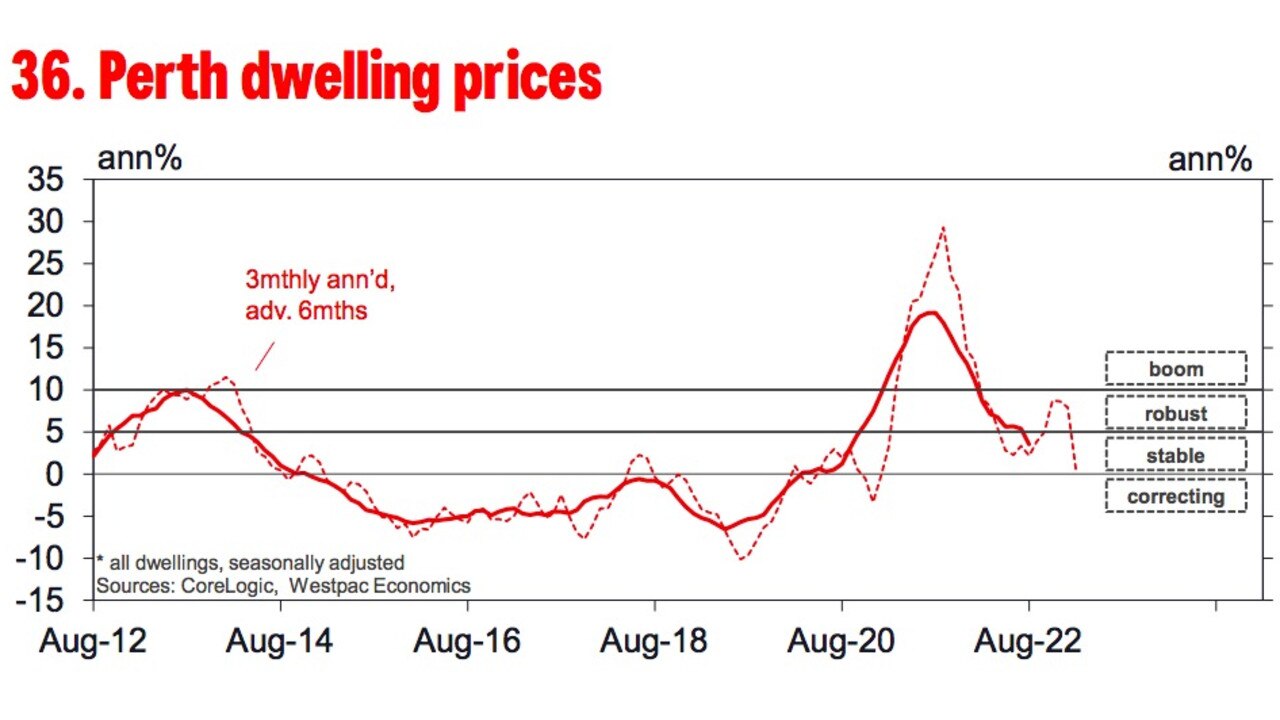

Meanwhile, Western Australia and South Australia are bucking the trend by still growing marginally.

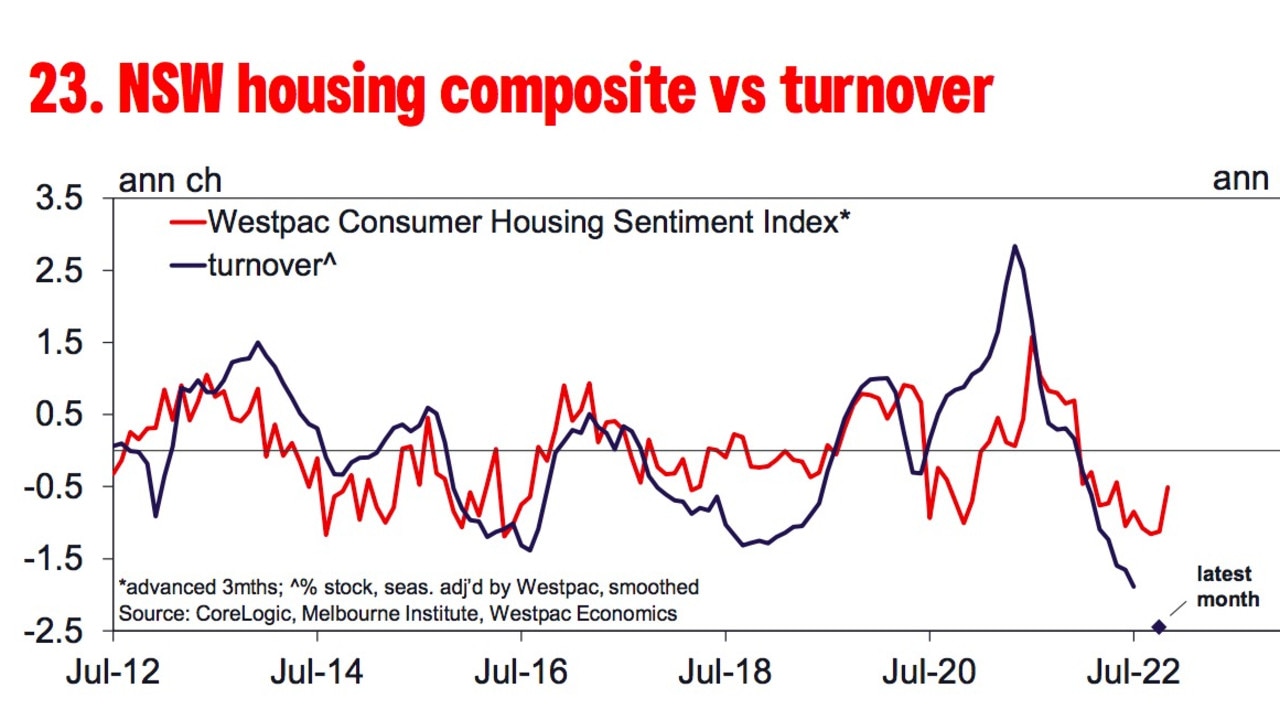

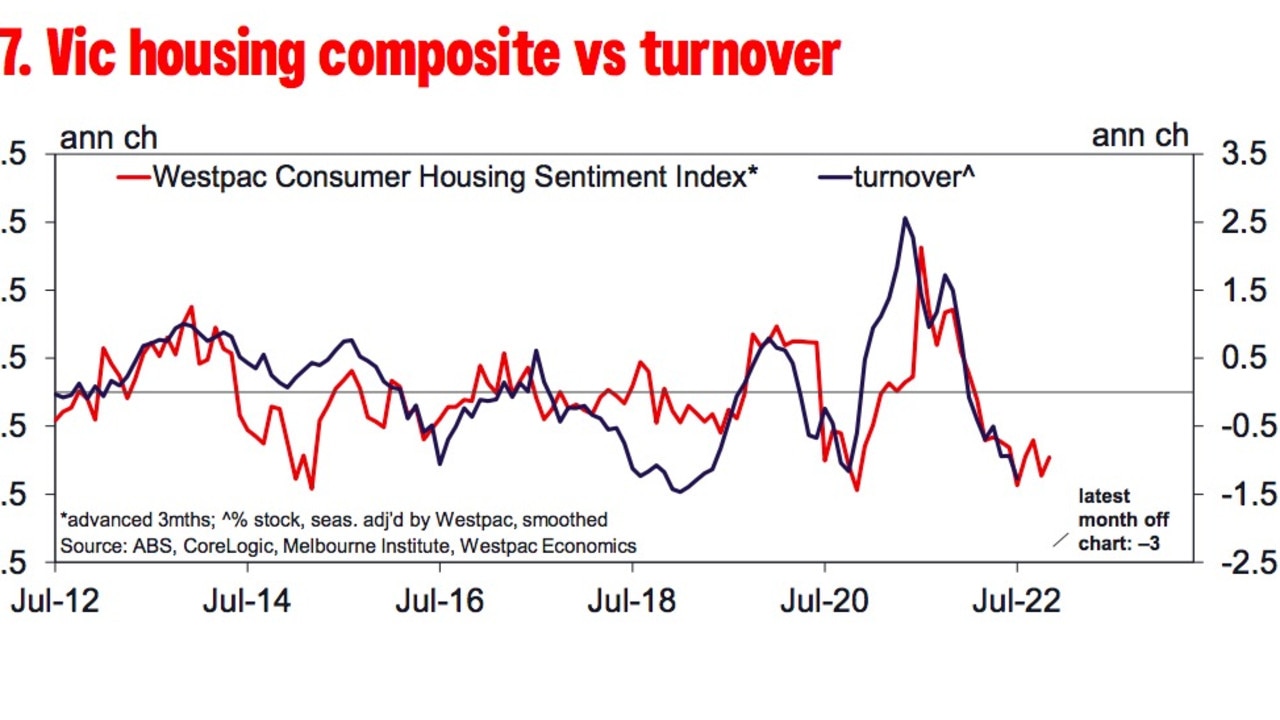

Mr Hassan blamed the sudden downturn on the Reserve Bank of Australia’s (RBA) decision to hike interest rates, which have been raised every month since May, saying that it had “weakened sentiment” when it came to buying properties.

Housing turnover is down 18 per cent since the start of the year.

Prices across the five major capital cities is down 2.7 per cent over the three months to July and are well on track for a 1.5 per cent decline for the current month.

Some property sales – about 20 per cent – are making less than 5 per cent profit. Just over half of this ‘at risk’ group is in Sydney and Melbourne

There’s been a “rapid reversal” in fortune in NSW, according to the report, with housing turnover down 30 per cent since January while Sydney dwelling prices are already down over 7 per cent.

Perhaps unsurprisingly, the areas in NSW that saw the biggest gains last year – during a time that saw national house prices increase by 25 per cent – are now due for a correction.

“Sub-regionally, prices are reversing more quickly in the eastern suburbs, northern beaches and north Sydney – which outperformed during the boom – but holding up better in the outer western suburbs which lagged on the upturn,” the report noted.

“Regional slowdowns have been more abrupt for Illawarra and Byron Bay.”

Victoria isn’t faring much better with turnover down by a third since the start of last year, although the research did point out it had a “high starting point” when turnover hit a 14-year high in 2021.

Melbourne dwelling prices are about 4.5 per cent off their peak already and are tracking lower at 1 to 1.5 per cent a month.

Melbourne’s northeast and inner south were named and shamed as the two areas “leading declines”.

According to forecasts, Hobart’s property market isn’t safe either, slated to drop 6 per cent for the remainder of this year followed by an 8 per cent per cent decline next year.

It was slightly better for Brisbane, Perth and Adelaide, which will continue to grow into 2022. Although dwellings in those three cities will drop in value next year, it will only be in the single digits.

Last week, ANZ released a similarly sobering outlook on the state of Australian property.

Like Westpac, the bank warned that the most significant price falls will be seen in our two biggest cities, Sydney and Melbourne, but the report noted the trend would occur nationally, including in regional areas and across all capital cities next year.

Driving the grim trend was a “steep increase in mortgage rates between May and the end of this year” coupled with reduced borrowing capacity, with capital city prices tipped to drop by 18 per cent before climbing by 5 per cent in late 2024.