‘Elective lockdown’ means spending shock is almost as bad as Delta

Omicron means that many Aussies are in a bizarre new type of lockdown. And the grim economic impact is already being felt.

Just when you thought it was safe to go back into the water, along comes Omicron and infects Australia’s freedoms again.

This time around, though, the country is an elective lockdown, where people are choosing to stay at home to protect themselves and their loved ones.

But regardless of whether it’s government-mandated or not, the effect on the economic outcome for Australia remains the same. Bad.

Various ‘nowcasting’ indicators are telling us that the shadow lockdown is nearly as bad as that experienced during the official Delta lockdowns in the second half of 2021.

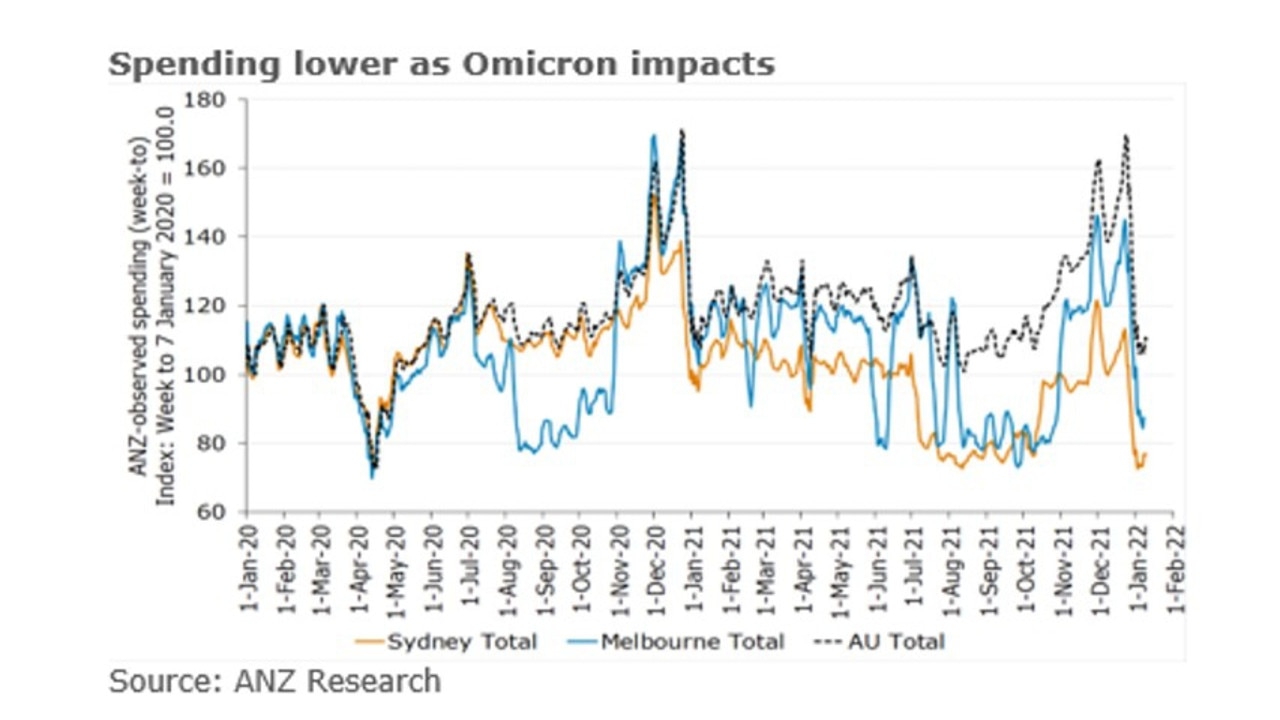

ANZ’s analysis looking at credit card spending is grim:

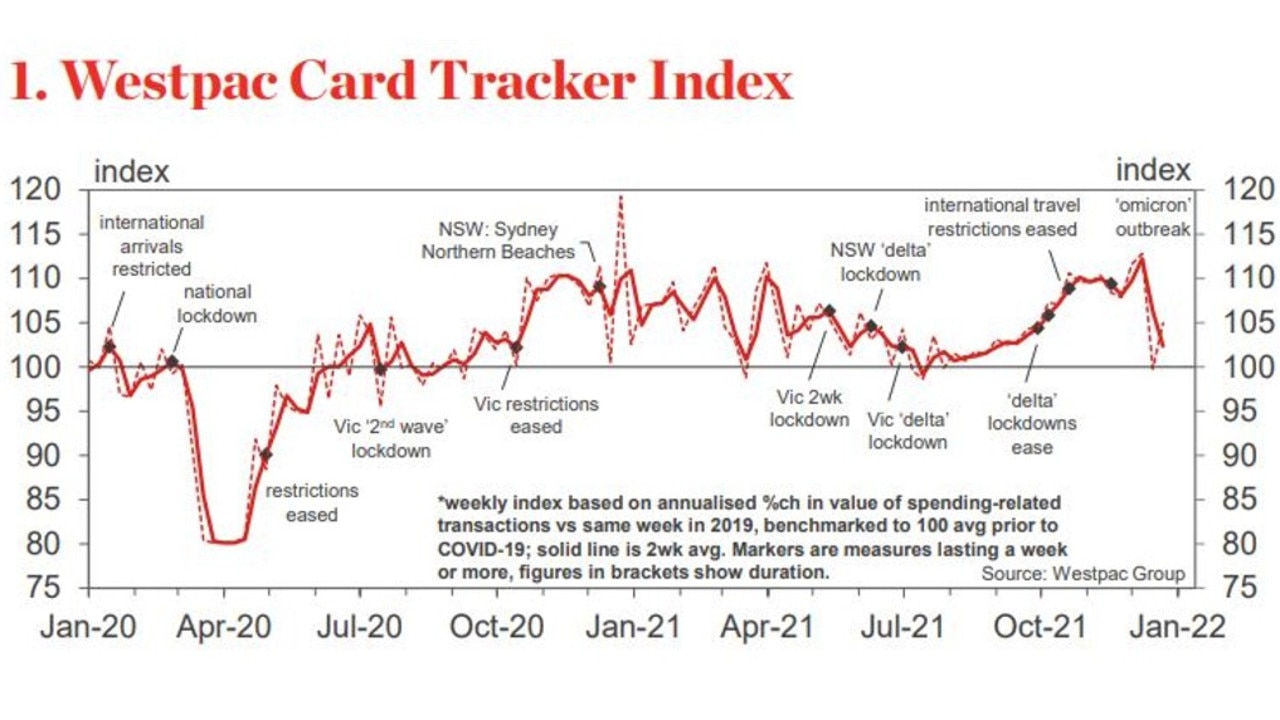

Westpac is almost as bad:

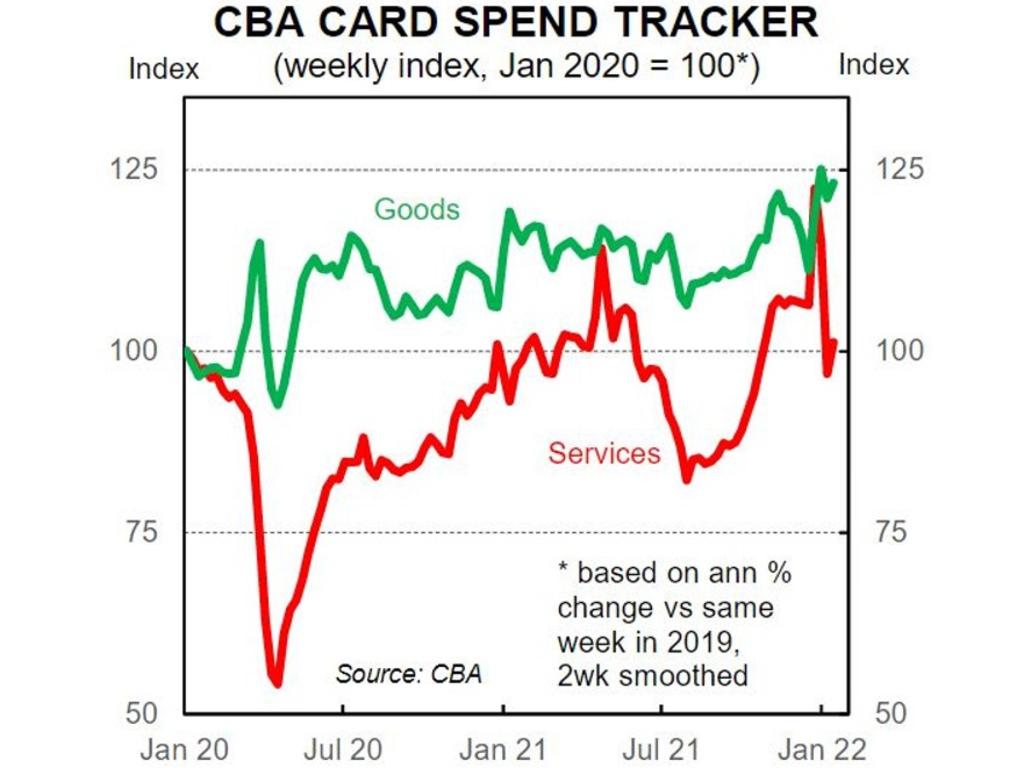

But CBA is a bit better:

These real-time credit card trackers all have compositional biases, but it’s safe to say that Omicron has delivered a substantial household spending shock that is focused on the largest economic segment of services. This comprises 70 per cent of consumption and roughly 40 per cent of GDP.

It is also the most employment-intensive sector of the economy. So the impact is going to be material in the short term. Especially since this will be the first Covid-19 lockdown to transpire without any new government fiscal support to offset it.

However, there are two good reasons to think that the majority of the impact will be temporary.

When will the Omicron recession end?

The first reason is that it has been predicted the intense phase of the Omicron wave will likely pass by the end of February (even January). Because it is so highly infectious, the wave is expected to go hard and fast – which correlates to the experiences of other nations.

But this will not end the case numbers, nor the impact. When schools go back, a spike in virus infections is likely again and may deliver another, probably smaller, elective lockdown. The fact people are choosing to lock themselves down itself will also prolong the Omicron outbreak.

Still, by the end of the first quarter, a substantial amount of Omicron’s impact should have passed. So will economic impacts, though they will linger so long as Australians choose safety over consumption.

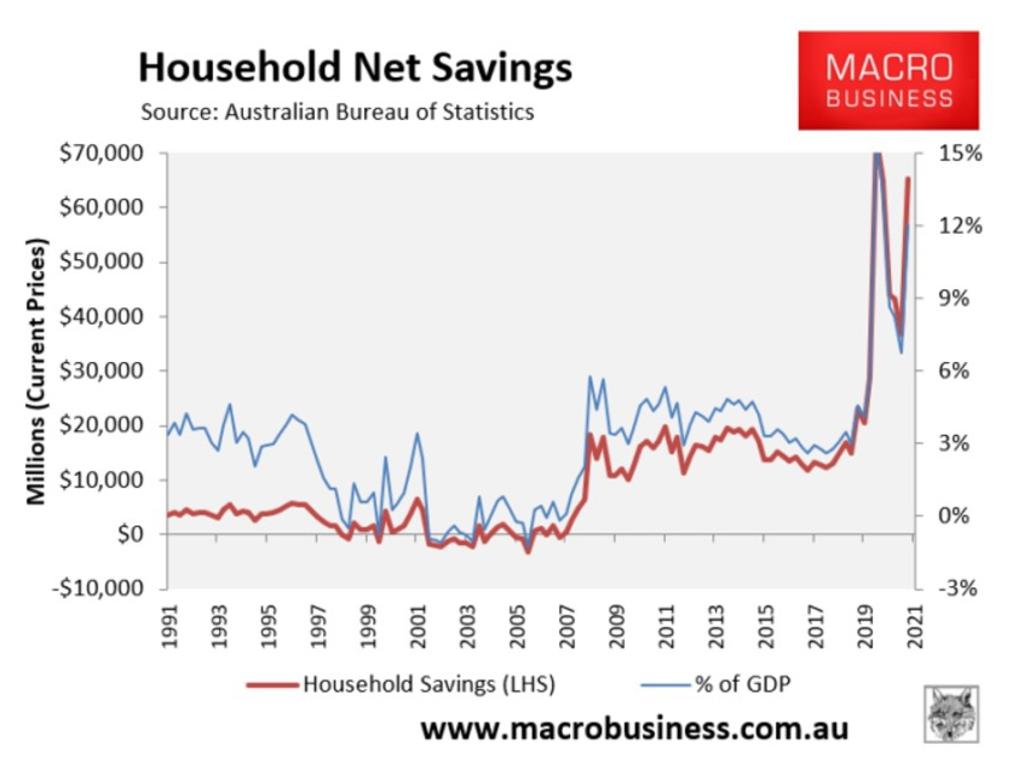

The second reason for hope is that during this time, households will have plenty of savings accumulating – which they will be keep to spend when they re-emerge.

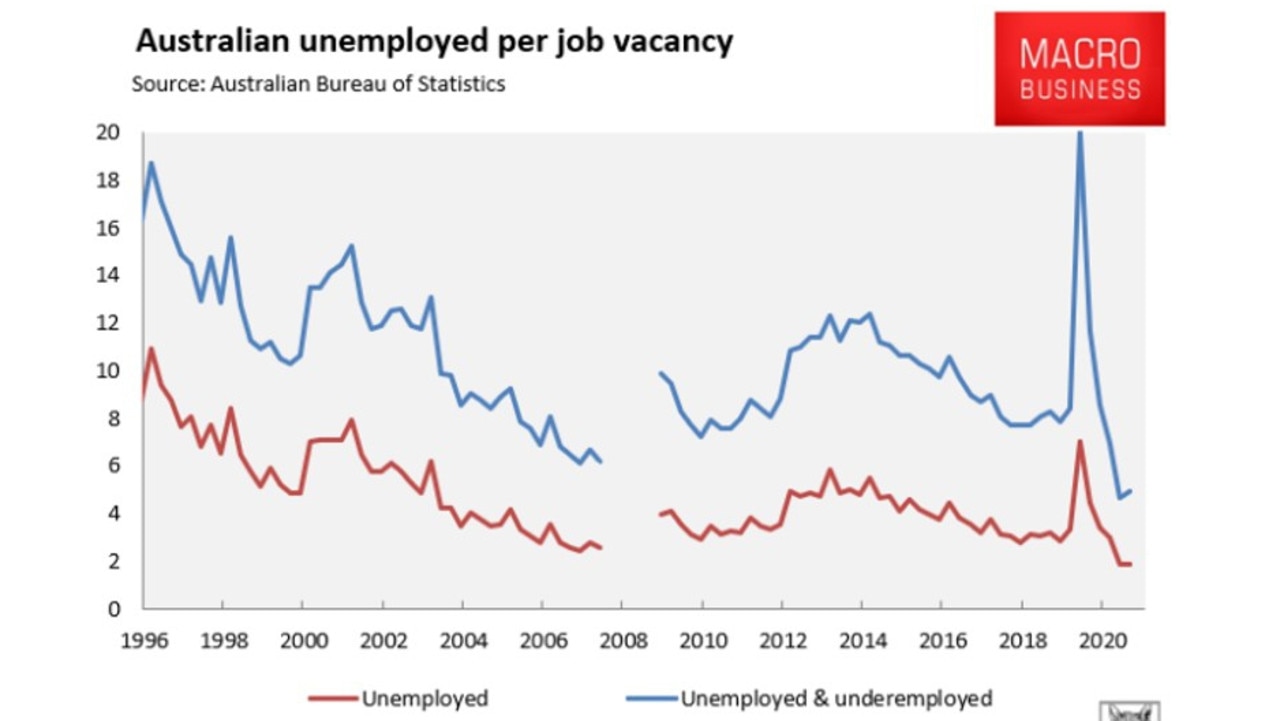

It is also worth bearing in mind that there was a very strong jobs market coming into the Omicron wave, even if it is somewhat exaggerated by the churn of an unusually high number of resignations.

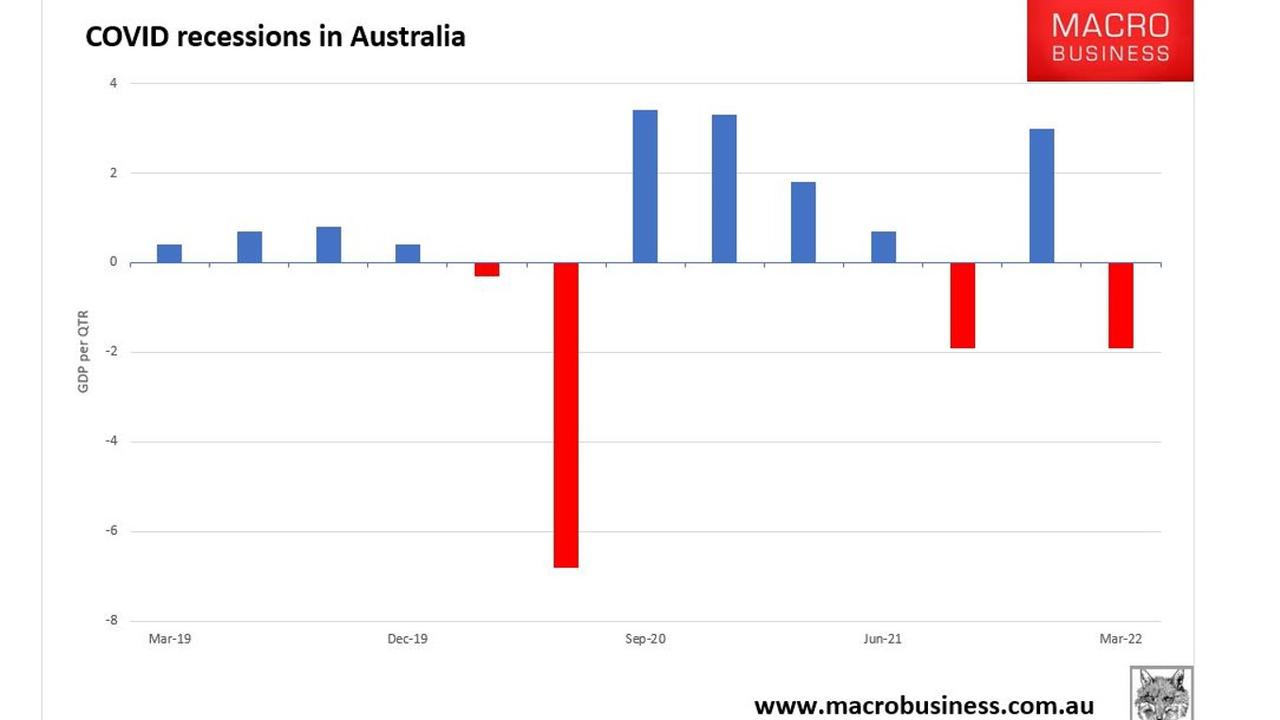

So overall, the first quarter of 2022 is likely to see contracting consumption growth and falling GDP. Arguably, this should be considered an extension of the Delta shock recession. After all, we’ll only have seen one quarter of growth before we are plunged negative again:

We might describe this as the original Covid recession and the Covid variants echo recession.

Looking forward, growth should resume in the second quarter.

But don’t expect any huge charge out of lockdown like we have seen previously. This time around, as the virus lingers, Australians will creep out of their self-imposed lockdowns, which in turn will see some ongoing damage delivering a lower GDP and jobs profile for 2022 overall.

That will help allay inflation fears that are already overblown anyway keep the RBA on the sidelines for 2022.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.