Lower energy prices helping to keep interest rates low in Australia

Fears of an interest rate rise are growing as inflation creeps up around the world but the RBA says Australia is being helped by one unique factor.

Australians’ love of solar panels looks to have helped insulate the country from higher interest rates.

Reserve Bank Australia Governor Philip Lowe this week provided an insight into Australia’s economy and why interest rates may stay low for another year.

In part, this is thanks to Australians’ love of solar panels.

In his address to the Australian Business Economists on Tuesday, Mr Lowe said while Australia had experienced a lift in inflation, it was less pronounced than in many other countries.

There have been stories in recent weeks about inflation jumping up in countries like the United States, fanning fears of interest rate rises and a similar increase in Australia that could see house prices tumble.

During the September quarter, Australia’s inflation was already at 2.1 per cent, something that surprised experts, with many believing the RBA will lift interest rates earlier than 2024.

But in his speech, Mr Lowe pointed to a couple of factors unique to Australia that were helping to keep inflation down.

The main one is slow wages growth with indications businesses are keeping a “cost control mindset” and looking to offer other incentives to attract and retain staff rather than raising people’s pay.

“There are some jobs that are in very high demand where wages have increased, but we are yet to see a broadbased pick-up in wages growth,” Mr Lowe said.

“In contrast … wages growth has already picked up markedly in some other countries.”

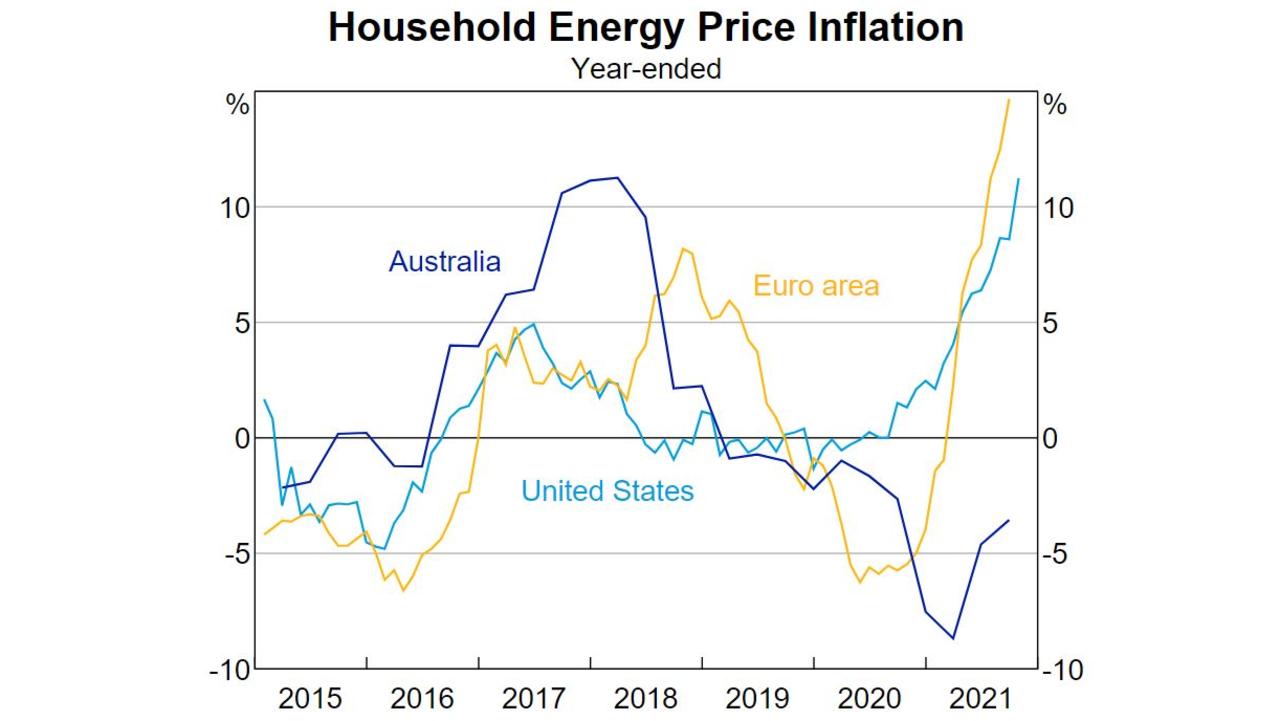

Mr Lowe said another factor was energy prices in Australia, which have been trending lower for a number of years, partly because of increased supply from wind and solar generators.

“In contrast, a number of other advanced economies have experienced very large increases in electricity prices as their power systems struggle to meet demand,” Mr Lowe said.

More affordable electricity, thanks to solar and wind, appears to be helping to keep a lid on inflation in Australia, which will also help to keep interest rates lower for longer.

Victoria University energy expert Associate Professor Bruce Mountain told news.com.au Australia’s energy system was complex and impacted by many factors. But he said it was fair to say that renewables, in particular the high uptake of rooftop solar, had driven down wholesale spot market prices, and by implication contract market prices.

He said it was not unusual for energy prices to go negative during some daylight hours, mainly because solar producers were pushing coal generators out of the market.

This has created the situation where coal-fired power stations actually pay the market to dispatch their electricity, rather than being paid for it.

“Because that’s cheaper than switching off [the power station] and having to restart again,” Prof Mountain said.

Rate rise next year is unlikely

Inflation has been driven up in Australia as demand for goods increased thanks to lockdowns, which saw people spend more on goods for their homes, home offices and for exercise equipment, rather than services such as taking a trip, going to the gym or eating out.

Covid measures also impacted the logistics industry, leading to a sharp increase in shipping costs around the world, longer delivery times and large price rises for many items.

In some countries, especially in Europe and China, adverse weather events reduced the supply of resources like gas, driving up prices and adding to inflation.

The higher price of oil in global markets has also affected Australia, with petrol prices up by 24 per cent over the past year.

As life begins to return to normal, some believe the costs of goods will fall and inflation will moderate over the next 18 months, although this may depend on how employers react to staffing shortfalls and whether wages go up.

The RBA expects underlying inflation to continue rising but believes it will “only do so gradually”.

Mr Lowe said the latest data and forecasts do not warrant an increase in the cash rate next year.

“The economy and inflation would have to turn out very differently from our central scenario for the Board to consider an increase in interest rates next year,” he said.

The RBA has said it will not increase the cash rate until inflation is “sustainably in the target range”, something Mr Lowe said was hard to define precisely.

“We want to see underlying inflation well within the 2–3 per cent range and have a reasonable degree of confidence that it will not fall back again,” he said.

More Coverage

At the moment the RBA expects underlying inflation to be 2.25 per cent over 2022 and 2.5 per cent over 2023.

Wages growth will also be a factor and Mr Lowe believes it would need to be growing at 3 per cent to sustain the target inflation range.

So far the RBA is forecasting the Wage Price Index to increase by 2.5 per cent over 2022 and 3 per cent over 2023.