Banks raising fixed mortgages despite RBA not lifting interest rates

The RBA still hasn’t raised interest rates but that won’t stop the banks doing something that will cause a world of pain for Aussie home buyers.

Even though the RBA hasn’t lifted the official interest rate yet, banks are raising their fixed mortgage rates. Banks are sniffing the wind. They sense rate rises on the horizon. They don’t want to be stuck lending to homeowners at a fixed low rate in several years time if interest rates are going to be high by then.

ANZ Bank expects fixed interest rates to rise “substantially” in the next few months, said senior economist Felicity Emmet in a note to clients this week. That will cause house prices to rise more slowly, she said.

“The lowest mortgage rate available to new borrowers has already lifted from the historic lows seen earlier this year and is likely to rise substantially in coming months, which will lower borrowing capacity and slow house price gains,” said Emmett.

Fixed mortgage rates are interest rates that don’t change. They are “fixed” for a set period of time, usually two or three years. They’re a good deal for borrowers if you can snag one just before interest rates go up.

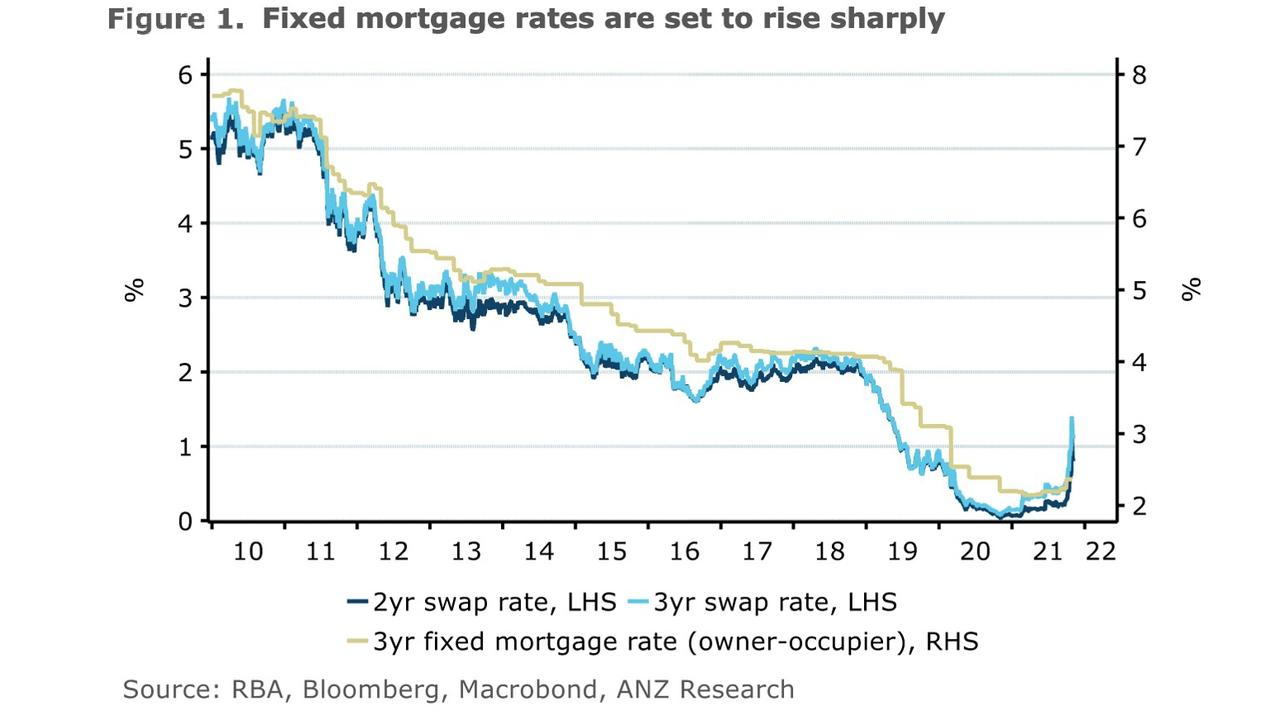

This next graph shows fixed mortgage rates compared to “swap rates” – a type of interest rate that depends on future interest rates. As you can see, the fixed interest rate usually follows the swap rates. And now the swap rates have shot up. We can expect fixed interest rates to rise. (But only for new loans, the rates on loans that have already been made are set! That’s why they call them fixed.)

The fix is in

Australia has historically been a nation in love with the variable rate mortgage. But in the last few years, the fixed rate mortgage became seriously popular. It was by far the cheapest rate you could get and Aussies borrowed loads on it. In fact, almost half of all new mortgages are on fixed rates. That means that a rise in fixed interest rates matters.

The RBA has several different ways of affecting mortgage interest rates. The big one is the official interest rate. They’ve cut that to 0.1 per cent and pledged to leave it there for the foreseeable future.

But they have also been fiddling with other interest rates, trying to keep them low. One was the interest rate on a bond due to expire in April 2024. Last week they decided to stop fiddling with that bond, and lo and behold, its interest rate (technically known as the yield) shot up.

So now everyone is expecting interest rates to be higher in a few years time. The important thing to know is this: the RBA’s decision to stop intervening in that market is what caused interest rates to rise. This is monetary policy in action.

The young person’s awful dilemma

Higher interest rates should stop house prices rising so fast. Which is a relief, given that CoreLogic data shows they’ve risen over 21 per cent in just the last year.

But of course higher interest rates do not make buying a house cheaper. They actually increase the repayments. When you borrow $500,000 at 2 per cent on a 30-year loan, your lifetime interest repayments are $165,000. But if rates rise to 3 per cent your lifetime interest repayments rise to $260,000.

The truth is that in the lifetime of a 30-year loan, rates could rise to much more than 3 per cent. Fixed interest rates could hit 3 per cent as soon as later this year, even, and keep rising.

The crappy thing about this moment in history is that because of outrageously high house prices, young people have had to save for years – decades in some cases – to gather together a deposit for a place. That same generation of house buyers is also likely to face rising interest rates during the life of their loan. It’s a double whammy. People who bought 15 years ago, of course, had the exact opposite experience.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.