RBA’s surprising interest rate prediction

The head of the Reserve Bank has given a remarkable prediction for interest rates in the next few years, making home owners very happy.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

The head of the Reserve Bank has given a remarkable prediction for interest rates in the next few years, making home owners very happy.

The central bank has revealed its latest stance on interest rates and set out its economic predictions for the coming year.

Heightened borrower confidence in record low interest rates could push property prices sky-high, according to analysis by the Reserve Bank of Australia.

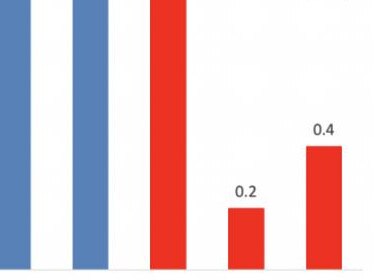

Australia’s largest bank has dealt a blow to savers, implementing further rate cuts that are more than the recent interest carving by the central bank.

Buy now, pay later providers have been given regulatory breathing space, while Australians continue to take scissors to their credit cards.

Three things have combined to create a housing market that’s unpredictable and potentially volatile. The ripple effect could impact us all.

Australia’s economy has turned a corner and is out of recession, but a bumpy ride lies ahead, the Reserve Bank chief warns.

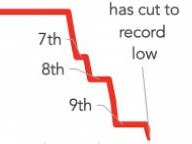

The Reserve Bank of Australia has retained the official interest rate at a historic low, saying the road to recovery won’t be easy.

A huge $56 billion was spent to save jobs when the pandemic hit. And a huge amount of it was seemingly wasted. But that wasn’t the case.

ANZ savers have been dealt a major blow, with the big-four bank slashing savings rates in a move described as a ‘hard pill to swallow’.

Australia’s population growth is forecast to shrink to the lowest rate since 1916 – and an influx of skilled migrant workers is the key to fixing the economy.

The RBA’s historic recent rate cut could force the hand of many potential buyers, with early signs already showing an uptake in demand for property.

Historically low home loan rates? Might be time for a check in on your home loan and the sharp deals that are available.

Three of Australia’s major banks have acted swiftly after the Reserve Bank slashed interest rates to a historic low on Tuesday.

Not all the big banks are responding to the interest rate cut, as Aussies are urged to shop around to find the best deal to save on their mortgage.

People who have borrowed high will breathe a sigh of relief at an announcement that should see them sitting pretty for at least three years.

The Reserve Bank has slashed interest rates to a record low of 0.1 per cent — but many banks have form for not passing it on to customers.

While the Reserve Bank’s decision to cut interest rates will be good news if you’ve got a mortgage, it’s not so welcome for some Aussies.

On the eve of the RBA’s interest rate, a mortgage lender has jumped the gun and is advertising the lowest home loan rate on record.

The Reserve Bank has released the new $100 note, the final design change in an overhaul of our currency. But it might be a while before you see one.

The RBA has declared our first recession in 30 years is over already – but there’s a big problem with that exciting claim.

Banks are chasing mortgage payments and economists say we’re “pretending” if we think everything’s OK. What’s next for our crumbling economy?

The Reserve Bank of Australia says its “best guess” is Australia’s economy grew in the September quarter, spelling an end to the recession.

The Australian sharemarket fell after the RBA gave no clear signal of a Melbourne Cup Day rate cut, with banks and miners losing ground.

Economists have warned Josh Frydenberg’s plan could leave Australia vulnerable to a “double dip” recession that would make us all worse off.

We’ve been riding on a wave that’s seen us boom for decades – but now it could all come crashing down, new research shows.

It will be happy days for Aussie homeowners for the next three years according to PM Scott Morrison – if you’re lucky enough to own one that is.

Aussies have been told to expect low rates for years to come, and the RBA today stuck to its guns by leaving the cash rate at a record low.

Shocking new research has revealed that Australia’s banks have “effectively stolen” billions of dollars from customers over the past decade.

Australia’s Reserve Bank Governor has warned that ending the $1500 JobKeeper package too early would be a “mistake” for the economy.

Original URL: https://www.news.com.au/topics/reserve-bank/page/27