Why mortgage deferrals are a ticking time bomb

Banks are chasing mortgage payments and economists say we’re “pretending” if we think everything’s OK. What’s next for our crumbling economy?

In the classic fairytale Cinderella, the fairy godmother turns Cinderella into a princess with her magic wand – but only until the clock strikes midnight.

In many ways Prime Minister Scott Morrison and the banking regulator APRA have acted like a fairy godmother for the nation’s mortgage and SME (small and medium enterprise) borrowers.

They’ve used their magical abilities to change otherwise concrete rules surrounding financial regulation and loan repayments, to make bad loans good and offer an unprecedented number of loan deferrals.

But like the story of Cinderella, the magical illusion of low mortgage arrears and good times underpinned by government support will fade when the clock strikes midnight.

RELATED: Full coverage of the economic impact of COVID-19

RELATED: Savage change in Aussie housing market

However, unlike the fairy godmother, APRA and the Morrison Government have already waved their magic wand again to extend mortgage deferrals, from their initial conclusion in September and October, to March next year.

This has been dubbed by some economists and finance experts as a strategy of ‘Extend and Pretend’. Effectively ignoring what would otherwise be a US subprime crisis level of mortgage arrears and hoping that someway, somehow, things would improve.

According to the latest data from APRA, around one in 11 mortgages and one in six small/medium business loans are currently being deferred.

Of those 393,000 mortgage holders with their loans currently in deferral, the Reserve Bank (RBA) has estimated that around 15 per cent are at the greatest risk of not being able to resume payments when their deferral period ends.

However, the household survey data from research firm Digital Finance Analytics (DFA) paints a much more concerning picture. It suggests the proportion of mortgage holders who will not be able to resume repayments may be significantly higher.

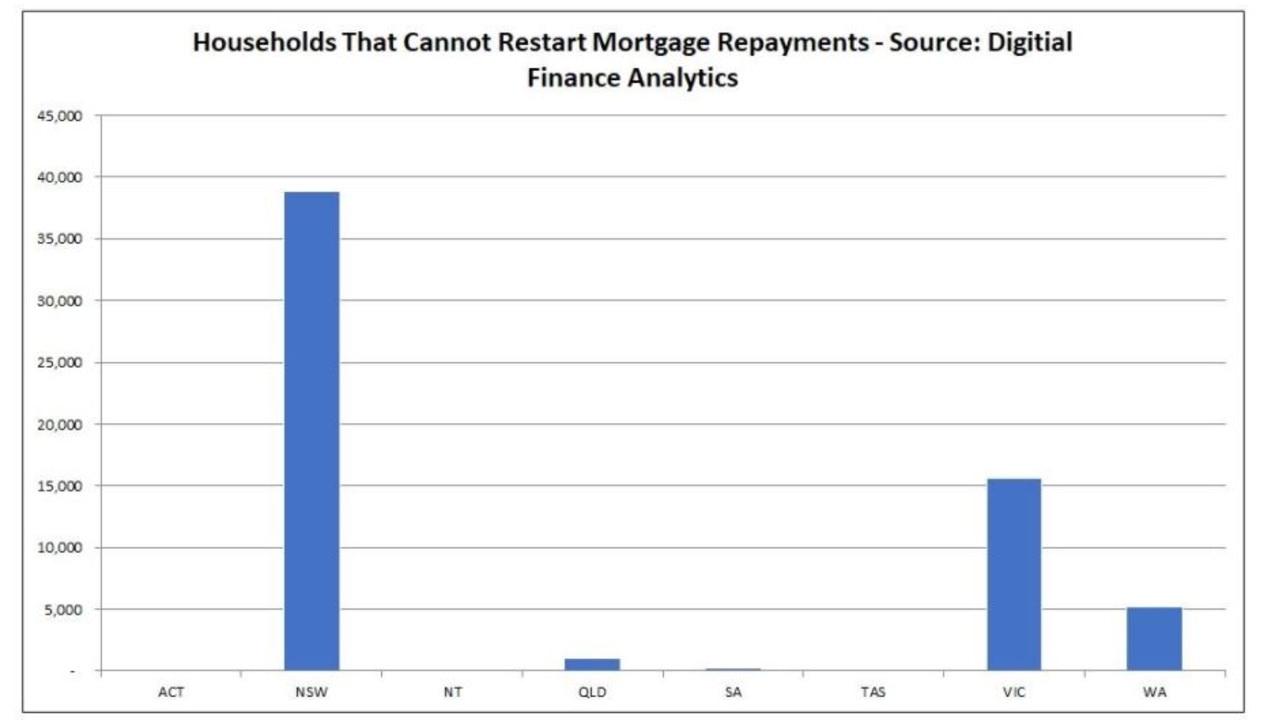

According to DFA’s surveys, 60,880 households will not be able to restart their mortgage repayments. With NSW leading the nation with 38,844 households who will not be resume their repayments, followed by Victoria with 15,627 and Western Australia with 5197.

RELATED: 660,000 Aussies could lose their job soon

RELATED: Date your income will plummet

In recent months, a sizeable number of borrowers have resumed their repayments according to the Australian Banking Association.

However, hundreds of thousands more borrowers still face a nervous wait. The state of the economy in the coming months will be key to how many can come to alternative payment terms with their banks, such as interest only or other hardship provisions.

Otherwise some of these borrowers may end up joining the almost 61,000 households which DFA has concluded will not be able to resume paying their mortgages.

There is speculation that APRA and the banks may choose to further extend loan deferrals beyond their current March 2021 end date. However, eventually struggling borrowers may need to come to alternative terms with their banks or consider selling their property.

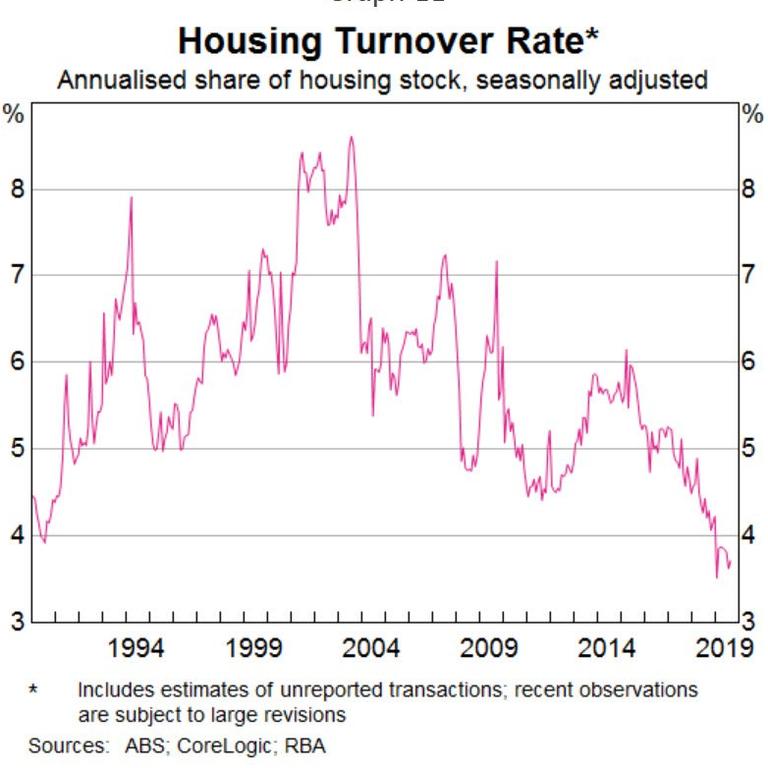

With turnover in the housing market near its lowest level in over 30 years, a significant increase in levels of stock on the market driven by forced sales could place downward pressure on housing prices.

RELATED: Virus’s long-lasting impact on migration

RELATED: Tax cuts that ‘may never happen’

But if we were to stop the story here, that would only be half the tale.

At the end of March next year, JobKeeper and the mortgage deferrals are slated to conclude. When that day comes and the clock strikes midnight, we will finally be able to see what damage has truly been done to our economy and household budgets.

With figures from Treasury indicating that over 3.5 million workers are currently being supported by JobKeeper and around 1300 businesses are newly applying for JobKeeper every day, it’s clear that what we find when the dust finally settles will not be good.

Figures from Roy Morgan’s recent unemployment report are already painting an alarming picture of what may lay ahead.

During September, 56,000 people lost their jobs and 152,000 chose to give up looking for a job and left the workforce.

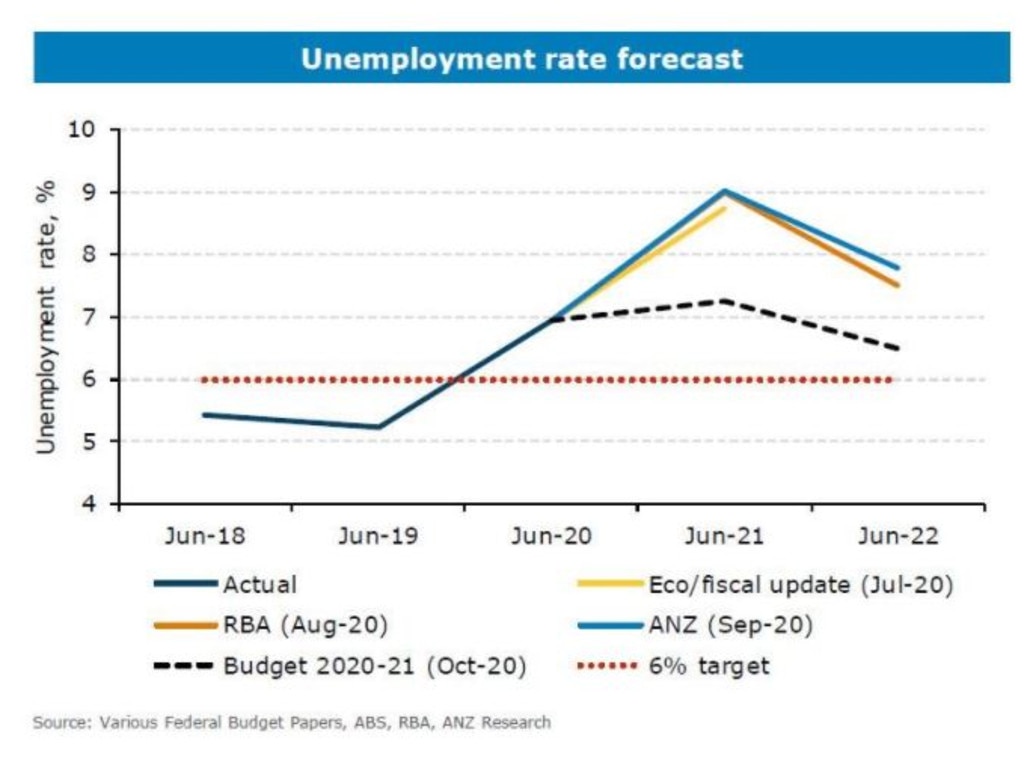

Meanwhile, ANZ is forecasting headline unemployment to rise to 9 per cent by mid next year and remain at almost 8 per cent until after mid-2022.

With so many workers potentially facing unemployment in the coming months, it’s possible we may see a second wave of struggling borrowers seeking to defer their loans.

When this time comes, the property market may face a perfect storm as struggling borrowers stare down the possibility of being forced to sell their homes or investment properties at the same time.

While we can assume the banks, APRA and the Morrison Government will do everything they can to spread out any forced sales over the longest possible time period, the scale of transactions may prove too large for the property market to absorb without prices falling.

But like every other market, housing is defined by supply and demand. If the Government was able to engineer sufficient demand for property through HomeBuilder, the First Home Deposit Lending Scheme and other policies, it’s possible that the impact of the inevitable forced sales could be quite limited.

Predicting how this will play out in the coming months ranges from problematic to near impossible.

The Government and APRA may follow the lead of other nations and continue to ‘extend and pretend’, potentially kicking the can down the road for an additional six months or a year. The RBA could step in to provide support to the banks to keep borrowers in their homes even after they have defaulted on their debts, as was seen in the US after the GFC.

Ultimately, the coming year will prove pivotal for the nation’s housing market and our banks.

Perhaps Australia’s property market will be protected by the magic wand of APRA and the Morrison Government, emerging relatively unscathed. Or maybe this time, the storm is simply too powerful for even the magic of government and banking regulator intervention to overcome.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator