Sydney, Melbourne, Brisbane rent prices plummeted amid pandemic, RBA reveals

A certain section of the housing market is in free fall and it means everyone – from buyers to renters, investors and tradies – is in for a shock. Here’s why.

A massive change is sweeping Australia’s housing market, and whether you rent, own or invest, it’s going to affect you.

House prices are the flashy part of the housing market, but the Reserve Bank of Australia pays very close attention to rents.

Rents are the ticking heartbeat of our housing market because they determine how much investors will earn from their portfolios. They are especially worth watching in difficult times because even when the buying market slows down dramatically, people keep renting.

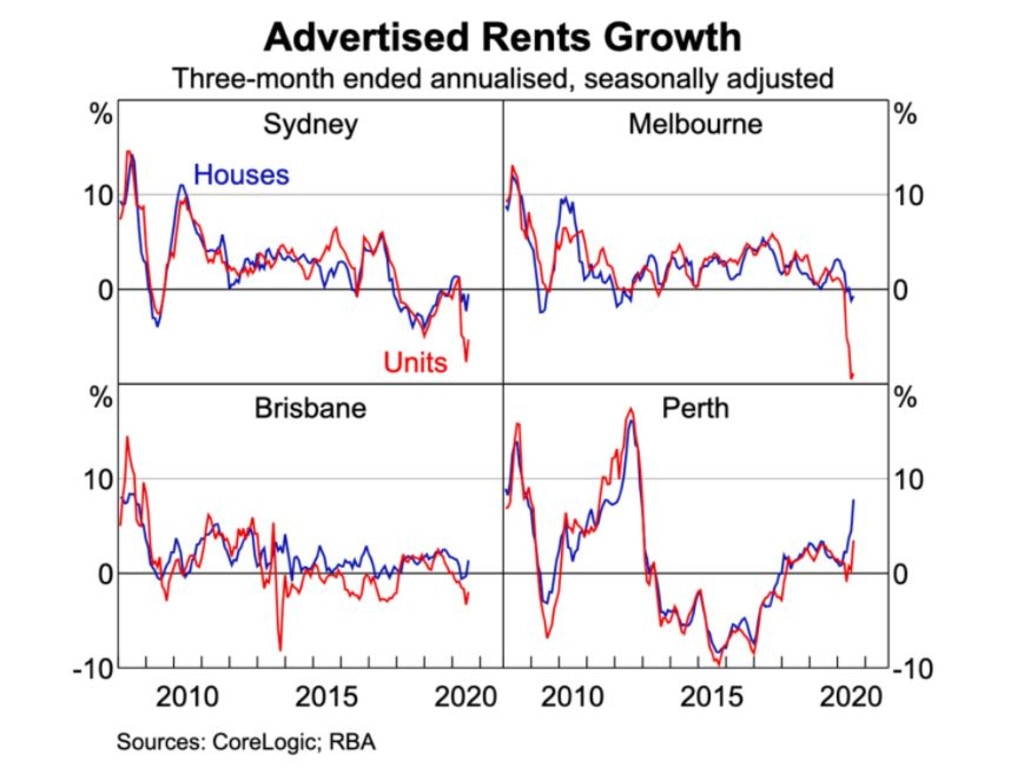

The RBA released a huge new piece of research on the rental market during the pandemic and it is essential reading. As the next graph shows, rents have turned negative in some of Australia’s biggest markets, and rents for units – i.e. mostly apartments – are suddenly in free fall. (Except for Perth, which has been a contrarian on property for years).

RELATED: Ticking time bomb that will affect us all

But Perth is a unique part of Australia’s housing market. Sydney, Melbourne and Brisbane represent a much higher number of homes and in those cities it is hard to ask for higher rent, because vacancies are high. A willing renter is suddenly hard to find.

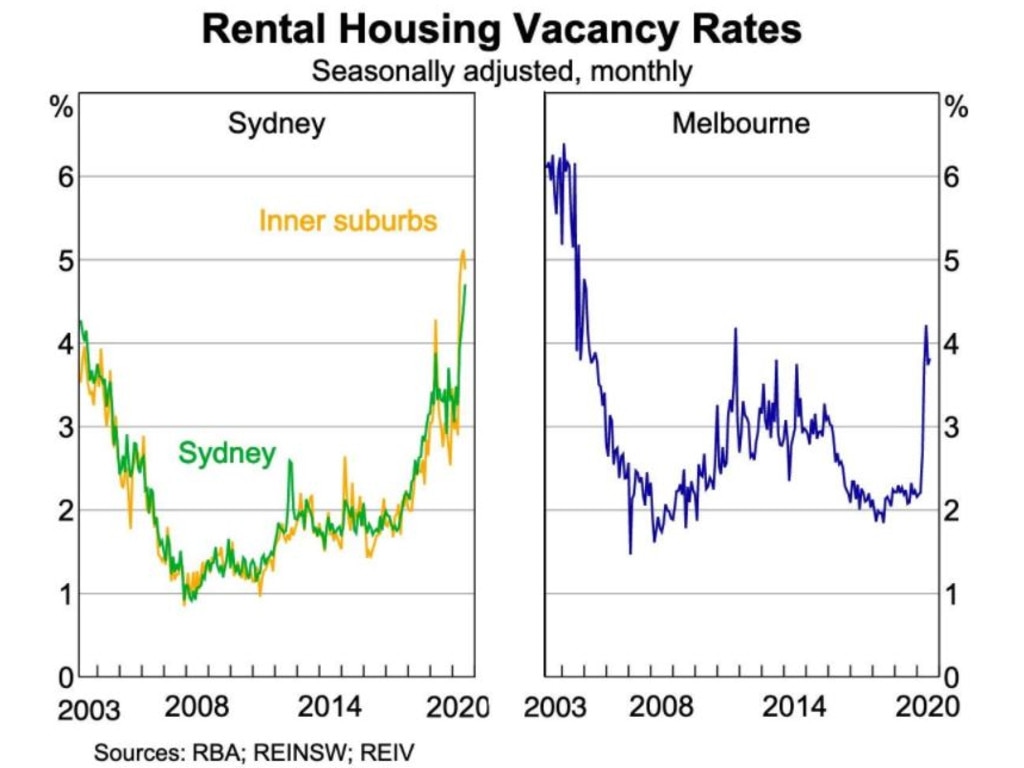

Young hospitality workers have moved back in with mum and dad as their income dried up, overseas students are completely missing, and at the same time, the market has been flooded with thousands of Airbnb properties that would once have been full of tourists.

Around 40,000 properties that were on Airbnb in February had gone by May. And that’s just one of the many short-term rental websites in Australia.

In Sydney, vacancies are the highest they’ve been since 2003, while in Melbourne, they’ve immediately doubled. That’s not going to snap back all at once, because the RBA estimates Australia will have 400,000 fewer people in it by June 2021 than expected.

RELATED: How much the recession will cost you

PROPERTY PRICES

Property investors are used to losing money – that’s what negative gearing is – but they have their limits.

If even a fraction of investors offload their properties in 2021, it could create a wave of supply that will suppress property prices. This is especially likely for apartments, because around Australia, approximately half of all apartments are rented out.

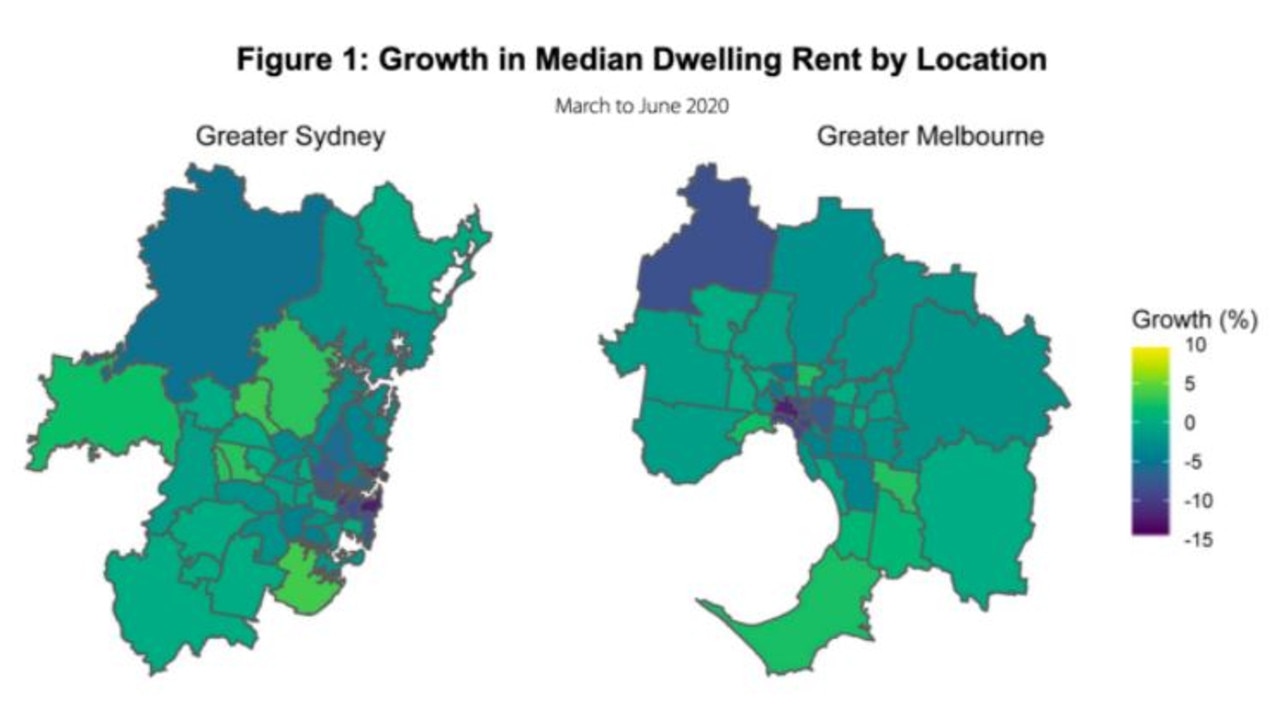

2021 could be a banner year for anyone keen to buy an apartment to live in. Apartments will be where the bargains will be found at first. Especially in the inner cities.

As the next graph shows, the fall in rents has been savage in the inner cities of Melbourne and Sydney. Those dark blue areas in the centre of both cities might look small but they represent tens of thousands of properties, and the rents there have tumbled.

RELATED: The date your income will plummet

Even if you own a house out in one of the lime green areas you need to pay attention to the city housing markets. Apartment prices are connected to the price of freestanding homes. Not immediately, but eventually.

Here’s how it works – if young singles rent apartments a few years longer while they become young couples and even as they become young couples with a kid, they lessen pressure on the market for houses. Share houses are also becoming a vanishing concept as suburban homes become the domain of families and renters take apartments.

This is stating the obvious, but apartments and houses are substitutes for each other. If demand for one goes down, it eventually flows through to the other.

THE PIPELINE

The second big way a rental market collapse hits the Australian economy is via tradies. At the moment, tradies are hard at work finishing off big apartment projects that were started in 2019, 2018 and even 2017, when times were good. If you go on the real estate websites you can find lots of ads for brand new developments. Those apartments will leak out into the market in the next year or so, suppressing rents and apartment prices even more.

Developers know what will happen. Some projects they have in the early stages are getting put on ice. This hasn’t shown up in the building approvals data yet – building approvals are actually up in July, reflecting projects put in for approval earlier. But approved developments don’t have to get built. It is likely a lot of apartment buildings will remain just plans for a few years.

That will be bad news for the construction sector, which employs around 10 per cent of Australians, directly and indirectly. So far construction workers have seen limited effects of the pandemic. Some were stood down, working just a few hours or zero hours, but job losses have been limited. As the building supply chain dries up all the businesses that sell to tradies will suffer too.

Like the end of Jobseeker, a lot of this is still coming down the pipe. We all saw last week’s unemployment numbers and they were extremely promising – a fall in unemployment when experts anticipated a rise.

But the risk is we forget the economy is still propped up by JobSeeker and JobKeeper. We still need to navigate their removal. We’ve done brilliantly at protecting the economy from the worst of the impacts but if we dust off our hands and think, job done, that’s when the tidal wave will hit. The fall in rents is just the earliest sign of what could be heading our way.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.