Why personal, home loan deferral repayments could start economic crisis

In the next few weeks 450,000 Aussies will be getting a call asking them for money they may not have. The knock on effect will be devastating.

Revenge of the loan. The next few weeks are going to be very stressful for hundreds of thousands of Aussies, as they get a call they’ve been dreading from the bank. The consequences of those phone calls will affect all of us.

Half a million Aussies will have a difficult conversation with a bank employee about the fact they have not been paying their loans. Six months ago banks handed out loan deferrals like lollies. Now they’re coming to take the deferrals away.

The boss of the Australian banking association calls it the “largest ever customer contact process in the industry’s history.”

Hundreds of thousands of mortgage customers and around 100,000 small business loans are up for reassessment, and banks will be keen to get people paying again.

RELATED: Date your income will plummet

It’s not just payback time, it’s also back pay time.

The missed payments need to be made up, and the extra interest is added on top. Of course, not everyone will be able to do so. People have lost their jobs. Australia’s unemployment rate is 7.5 per cent and rising. The total amount of wages paid is down by 5 per cent.

Westpac CEO Peter King confirmed on Friday that some customers are now in strife.

“There will be people who do not have enough income to service their loans,” he told a parliamentary committee. “We are going to have to work with customers about options.”

Some of those “options” are ugly. Yes, banks will give some people extra time to find a new job. But not everyone. People will, in some cases, be forced to make the horrible decision to sell their homes to repay the loans.

Indeed, the Commonwealth Bank CEO Matt Comyn has suggested to some house investors they should consider selling now.

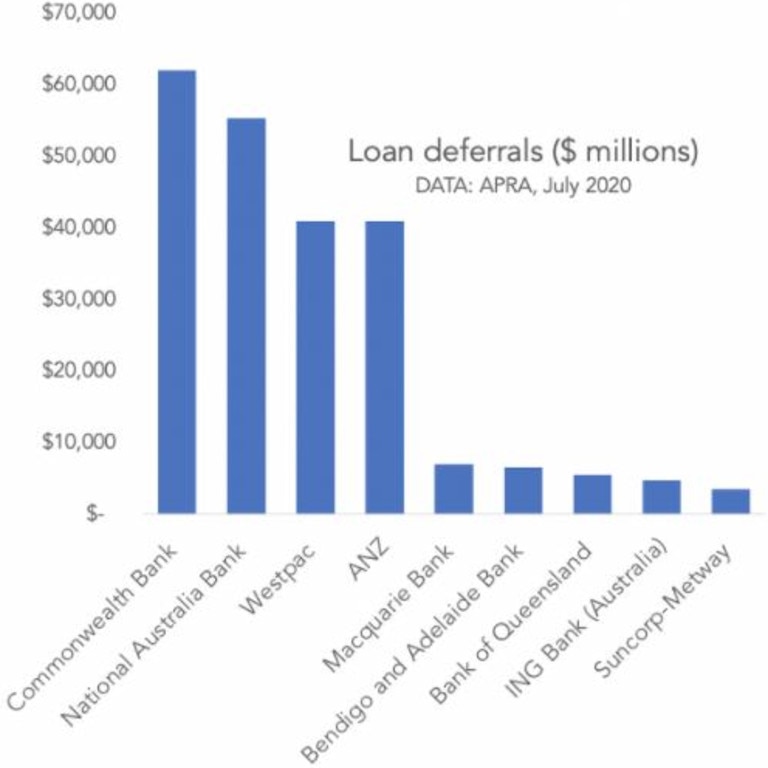

As the next graph shows (using the latest data from APRA) the big banks have different amounts on deferral.

RELATED: Australia’s big weakness exposed

Commonwealth Bank has the most in raw dollar terms at more than $60 billion, but NAB is a close second. That’s more than $120 million between the two of them. Bank of Queensland is well down the list but because it is a smaller bank, it has the highest proportion of loans on deferral, at 13.3 per cent.

As the tidal wave of loan deferral phone calls happens around Australia, the after effects will spill out and affect the rest of us. This will happen in two ways.

OUTCOME ONE

In the best case scenario, people who were worried they were going to lose their job actually didn’t. They simply start repaying their loan. That’s great news for the banks but it is not always best for other businesses. They might have been enjoying a bit of extra spending while people were freed from grinding away at their home loan.

The amazing results we’ve seen in the retail sector recently (including profits at Harvey Norman, Kogan and JB Hi-Fi) may owe a little to the fact some people have been temporarily freed from their home loan repayments. If this effect is large it could hurt sectors of the economy that depend on consumer spending. But the money does go somewhere, and that’s to banks.

Of course if you own bank shares you want them to get borrowers repaying again. Banks have paid much lower dividends this year and that harms people who rely on dividends for their income, as well as Australians whose superannuation funds invest in banks (i.e. most of us!).

OUTCOME TWO

The hardest conversations banks will have with deferred customers are ones where they can’t start to repay again.

Houses will get sold. It’s important to distinguish this from a mortgage default. A default is where the bank takes the house because you can’t pay. A forced sale is different. It might happen where the owner owes $500,000 on a house they can sell for $600,000. It allows the owner to pull out their equity and pay off the mortgage.

Selling a house to clear your mortgage doesn’t count as a default. Defaults in Australia are rare, except where the house is worth much less than the owner owes the bank.

The impact of any forced sales will be felt in the housing market. If a lot of people are forced to sell their properties at once, there could be a rush of supply. Obviously the banks do not want this – they are invested in higher house prices! But it could happen.

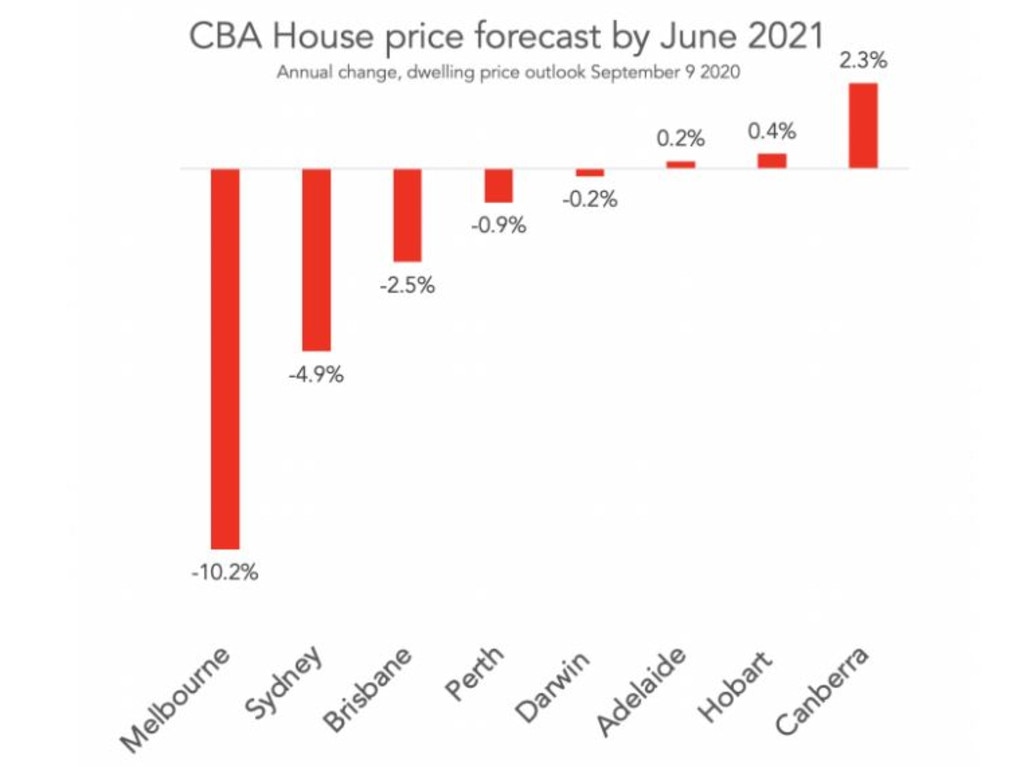

Commonwealth Bank recently put out updated house price forecasts. They see the national average house price falling by 6 per cent.

RELATED: How much the recession will cost you

Commonwealth Bank expects Canberra to actually have house price growth, of 3.3 per cent between June 2020 and June 2021. Sydney will fall 4.9 per cent over that same period, they predict, and Melbourne will be the worst, with falls of 10.2 per cent.

One thing is clear – the economic effect of this pandemic is far from over. Not on banks, not on business, not on jobs. And definitely not on house prices.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.