How much will Australia’s recession cost you?

From job losses to mortgage payments and rent, this is how the recession will play out for you and most importantly, here’s how to survive it.

The recession is here and it’s a huge one. We just saw the biggest fall on record in the national accounts. But what does it mean? What will actually happen to us? And how can we dodge the most damaging fallout?

Recessions hurt. That’s the truth. I’m an economist and the reason I became one is the economy matters to people. It’s not about money. It’s about people’s lives. Recessions hurt families and harm people’s wellbeing.

The biggest effect is by making it harder to earn a living. When the economy shrinks, there are fewer jobs and the pay is not as good.

Some Australians are already out of work. We have all seen the unemployment rate shoot up, and it will go up more as JobKeeper is removed.

RELATED: How much money you should have in savings to survive a recession

RELATED: Secret truth behind Aussie recession

Unemployment doesn’t just mean having less money. It is really bad for your health. There’s a lot of data on it but I think this quote from a social worker in regional NSW provided to a parliamentary inquiry, sums it up: “I have seen, heard and felt the human misery and suffering that unemployment has inflicted upon people … I have seen how this savage impact can foster suicidal tendencies, marriage breakdowns, drug and alcohol abuse and much more that will never be disclosed.”

The longer you are unemployed, the worse the effects.

The scary thing about a recession is it can take a very long time to find a job. There are already six unemployed people for every job vacancy and that ratio could get worse.

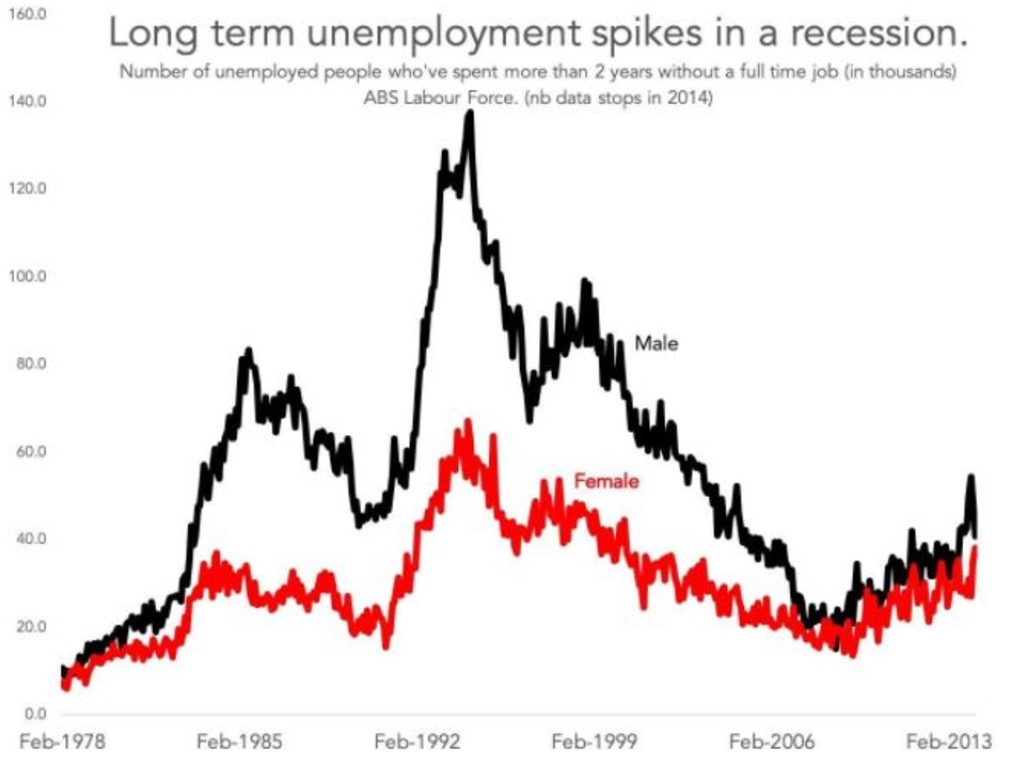

If you do fall into unemployment you can be stuck there for a long time. As the next graph shows, long-term unemployment went up enormously in the 1990s recession.

RELATED: Australia’s big weakness exposed

Some people get back into work eventually. But not everyone. Older people and people who can’t learn new skills often get stuck.

Notice in the graph above, the number of long-term unemployed people goes down again. That doesn’t mean they all got a job again. Some people just transition to retirement. They do so earlier than planned and with less money saved up than expected. After a recession a lot of people spend decades surviving on the pension.

PAY

Wages usually stop growing in a recession and pay rises are hard to come by. That might be pretty uncomfortable if you have a lot of debt.

Luckily Australians are paying off their credit cards fast. We’ve wiped off $2 billion in balances since the start of the pandemic. Mortgages are also being wiped off quickly. But property investors with big portfolios who face falling rents and falling wages could rapidly find themselves in difficulty.

WHAT TO DO ABOUT IT?

There’s ways to survive a recession.

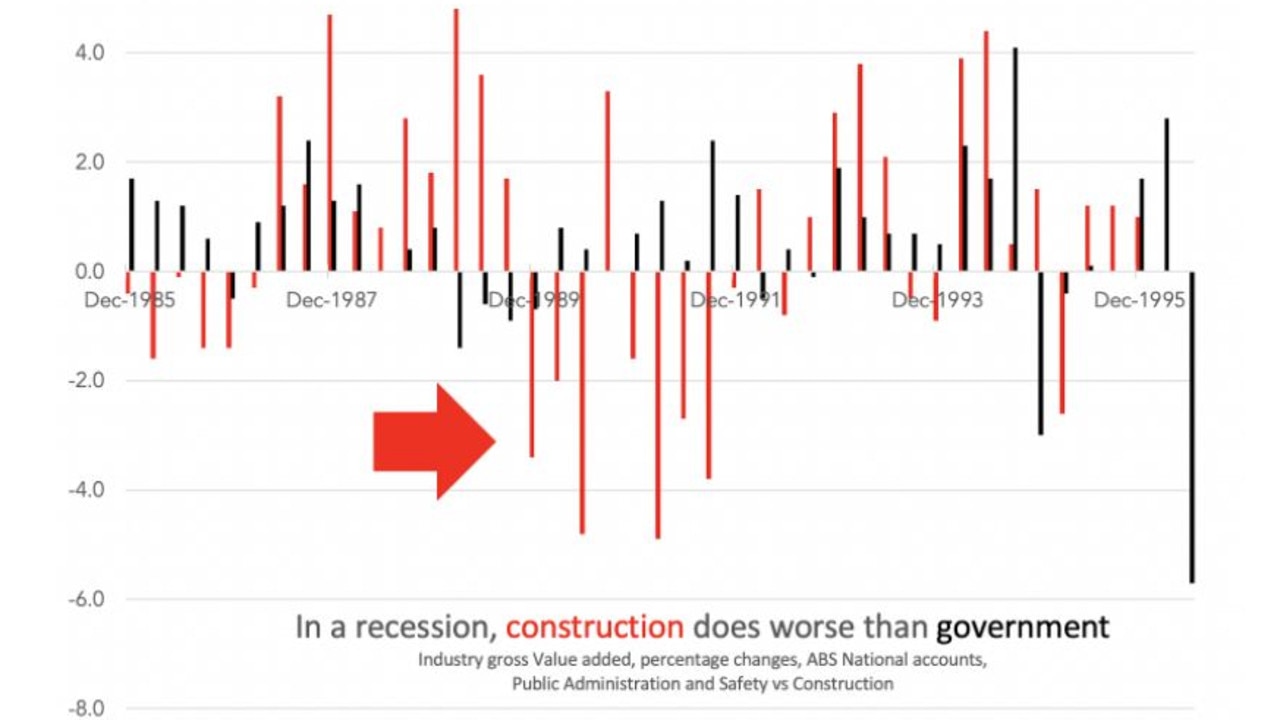

A good approach is to find an industry that goes the same through thick and thin. Government is a good option here. The next graph shows how government went in the 1990s recession, compared to construction.

While the construction sector started shrinking and continued to get smaller in multiple successive periods, government barely blinked. Public servants enjoy excellent job security.

Electricity companies, water companies, gas companies. All of these are good examples of “recession-proof” industries. If you work for Louis Vuitton, maybe consider a career-shift?

An even smarter approach is to work for an industry that does better in the bad times. Education is historically a surprisingly good choice here. Many people who might usually have left school and found a job will instead finish year twelve. Those who might have usually graduated from a degree and found a job will instead pursue another qualification.

The complicating factor in this recession is that we will have far fewer overseas students around.

The other kind of industry that grows in a recession is an industry selling cheaper versions of popular goods. If you work at David Jones it might make sense to seek a job to Kmart. If you work for Mercedes, maybe consider applying to Hyundai. If you sell organic chickpeas, perhaps you could pivot your business to bulk baked beans.

Because for a while, Australia is going to be eating a lot more baked beans and less smashed avo. We are all going to have to adapt to a less abundant economy.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.