RBA predicts a potential 40 per cent drop in house prices

We’ve been riding on a wave that’s seen us boom for decades – but now it could all come crashing down, new research shows.

New research shows what will happen if house prices fall. The news is bad. It turns out Australia is so puffed up on housing wealth that if house prices fall they drag down a huge section of our economy with them.

The Reserve Bank of Australia put out new research on Tuesday with some dire warnings. RBA investigated the effect of a 40 per cent fall in house prices – a fall they described as “extreme but plausible”. That would mean a $500,000 home falls to $300,000 and a $1 million home falls to $600,000.

They chose that figure because such a fall has happened in other countries during the global financial crisis (GFC). They also assume rising unemployment falls and a sharemarket crash.

They then ran a few scenarios to see what will happen. The bank was mostly trying to investigate Australia’s record high household debt. As we know, Australians have borrowed up to their eyeballs. We have some very big mortgages. But what they found is a different weakness.

RELATED: Best state to buy in post-COVID

RELATED: ‘Clever trick’ to JB Hi-Fi’s success

MORTGAGE DEFAULTS

A lot of people worry about mortgage defaults. Here’s how that works in theory: If house prices crash, people end up owing more on their loan than the loan is worth. If they default on the loan, the house then belongs to the bank.

That can be a problem for the bank – it gets a house that’s not worth much and there’s nobody to pay off the loan. If a lot of people do this banks can lose so much money they go broke and the Government needs to save them.

However, in Australia this isn’t going to happen, according to the RBA. Our banks, the lucky buggers, will be fine. Even if house prices fall by 40 per cent, they can handle it. About 2 to 3 per cent of people will default on their loans but that’s not enough to send the banks broke.

A lot of banks in other countries went broke during the global financial crisis and we learned from that. We built up the strength of our banks. They have something tucked away for a rainy day. They also make some riskier borrowers get insurance – called Lenders Mortgage Insurance – that will pay out if they stop paying their loan.

So – if the RBA calculations are right – we don’t need to worry about our banks collapsing. What we need to worry about is something else.

ONE PERSON’S SPENDING IS ANOTHER PERSON’S INCOME

Household spending is the biggest part of our economy. Household spending means spending by people, (not businesses or government) on everyday things like food and education, health insurance and cars, house repairs and renovations. That’s the biggest part of our economy – it accounts for 56 per cent of everything that goes on. And it will fall down hard if house prices collapse.

They call this the wealth effect. The wealth effect has, for the last 20 years, pushed spending up as the price of houses went up. People whose houses are suddenly worth two or three times more feel very comfortable splashing cash around. In particular they like to buy nice cars.

RELATED: Everyday Aussie item to disappear

But the wealth effect also works in reverse. In an economic crash where house prices fall 40 per cent and the number of people employed falls by 8 per cent, people stop splashing cash around. In fact, people cut their spending to the bare bones.

If you’re imagining people eating rice with Black & Gold margarine for dinner, you’re on the right track. The RBA calculates that almost a quarter of households end up at the “subsistence level”.

“The share of households consuming at the subsistence level increases from 13 per cent to 24 per cent,” they say.

That’s a frightening image. You don’t want people in a first-world country to be stuck at “subsistence level”. It would mean one house in four has cut their spending as far as they can.

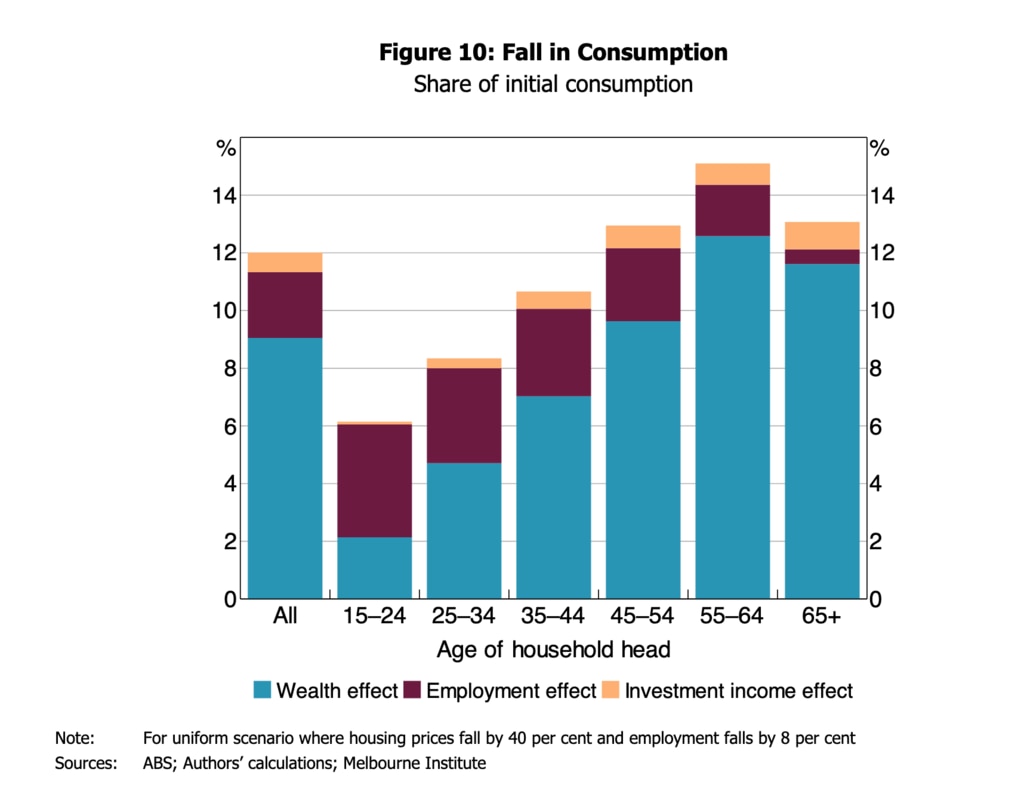

As the next graph shows, the fall in consumption is big and it hits older people hardest, because they are the ones with the most housing wealth to lose. The average fall in consumption is 12 per cent.

Why is this a surprise? Economists had previously not realised consumption could crash so hard. Even when Australia’s banking regulator APRA and the International Monetary Fund (IMF) had done “stress tests” to see how Australia copes with a crash, they hadn’t foreseen such a large fall.

The RBA puts it like this: “The fall in consumption is much larger than those embodied in previous stress tests by APRA and the IMF in Australia which also involved severe recessions.”

The issue is if we have a big economic event (like, I don’t know, a pandemic) that causes unemployment to rise and house prices to fall, that’s not the end of the story. The economic decline itself creates a big second wave of effects that makes the economy even worse. One person’s spending is another person’s income.

INVESTMENT PROPERTY MAKES US EVEN WEAKER

Australian households are extra vulnerable to a fall in housing prices because of all the investment properties.

In places like Germany, investment properties are often owned by co-operatives, the government or companies. Not here. Here your landlord is just another family. That means that when house prices fall, the hit to families is even bigger.

It’s important to remember that this scenario only exists on paper, so far. At the moment, Australia’s employment has fallen by 3.2 per cent. That’s under half the 8 per cent fall the RBA looked at in its research.

And house prices are only down around 2.3 per cent (average across the five capital cities across the last three months, according to CoreLogic), not 40 per cent. The house price fall would have to get a lot more intense to be anything like the what the RBA is looking at. And I’m sure the Government would step in to try to prevent things getting so bad.

That’s the final thing I’d like you to take away from this story. Be aware that a crash in house prices would be very bad for the economy. Be aware that we’ve probably made some bad decisions in making our economy so vulnerable to changes in house prices and that one day maybe we should reverse some of those bad decisions. But also be aware that the Government controls a bunch of economic policies that it might use to help prop up house prices to prevent them falling so far.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.