How RBA rate cuts to ‘help economy’ could instead just boost housing market

People who have borrowed high will breathe a sigh of relief at an announcement that should see them sitting pretty for at least three years.

It’s Christmas for borrowers and a horrible time for savers as Australia’s central bank cuts interest rates to a record low, with the RBA promising not to hike rates for “at least” three years.

I know what you’re thinking: Hang on? Another story about how the RBA has cut rates to a record low? Didn’t I just read one like this?

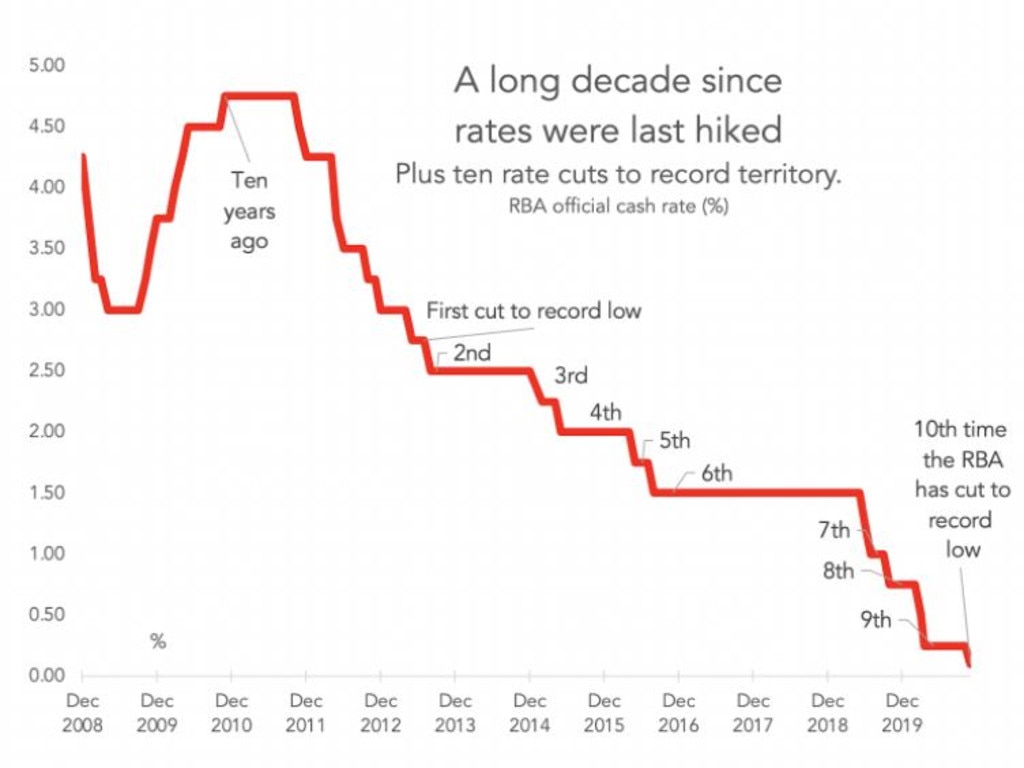

Yes, you probably did, dear reader. This is the 10th time the RBA cut official interest rates to record lows. This time they took rates down to 0.1 per cent. It has been over 10 years since they last put official interest rates up, as the next graph shows.

RELATED: 100 days to decide Australia’s fate

The point of lower rates – the point of the whole RBA – is to stimulate the economy. That is, to try to get business booming so we can all have jobs, and maybe one day even a pay rise. The fact we just had a decade with only rate cuts and no rate rises tells you how successful that has been.

BUT WAIT, THERE’S MORE!

The RBA cut rates, but that’s not all it did. It knows rates were already low. So it is promising to do more on top. For example, the bank pledged to leave interest rates where they are for three years “at least”. Maybe more. That’s helpful for borrowers – they can get a loan and not have to worry rates will go up in January.

But the biggest news was that the RBA would buy $100 billion dollars worth of government bonds. This is what they call a quantitative easing program.

“These bond purchases mean that the RBA is now conducting quantitative easing, or QE, similar to that of many other central banks,” RBA Governor Philip Lowe said.

“How is that supposed to help me find a job or get a pay rise?” I hear you ask. The answer is it’s a two-step process, and it depends on bonds.

YEAH, WHAT ARE BONDS?

A government bond is a piece of paper that usually promises to pay whoever owns it a fixed amount of money. Bonds are bought and sold in financial markets like shares, but they work a bit like a bank account: Instead of putting your money in the bank and getting interest, you could buy a government bond and get the payment.

If the price of the bond is low and the payment is high, you are getting a good return, like a bank account with a high interest rate. If the price of the bond is high though, the payout is like a low interest rate. You put money in and you don’t get much return.

The RBA is trying to reduce the “interest rate” on government bonds to make them more like savings accounts with low interest rates.

It does this by buying government bonds. Bidding at auction for bonds makes their price go up. (Like any product, the more demand there is the more the price goes up.) Higher bond prices make the “interest rate” go down. Basically it’s an elaborate way of cutting other types of interest rates in the economy as well as the official interest rate they usually focus on. This is step one.

RELATED: Shock swing in Aussie house prices

RELATED: Disaster as Aussie jobs ‘evaporate’

Bond “interest rates” affect other interest rates, hopefully dragging them down. The point of lower interest rates is it is supposed to make businesses willing to borrow to buy new trucks, build new factories etc. This is step two. Or it would be. But of course it doesn’t seem to really work in practice like it does in theory. In practice, when the RBA cuts interest rates it mostly just jazzes up the housing market.

HOUSING

Everyone knows that a large impact of cutting interest rates goes to the housing market. House buyers will enjoy lower mortgage rates and therefore be able to borrow more and pay more for homes. The RBA has said so itself, and acknowledged there are risks that come with that.

On Tuesday, Mr Lowe made specific mention of the housing market only to say it wouldn’t be an issue.

“In the past I would have worried about the effect on the housing market. But I am not particularly concerned about that at the moment.”

He said falling population growth and falling rents mean the market was unlikely to get frothy. Time will tell if that is true. It would be a terrible shame if all this effort from the RBA served only to prop up the housing market and not actually improve the economy.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.